Treasury Yields Drop After 3Y Auction Tails But Is Otherwise Solid

The year may be drawing to a close but the US needs to feed the government debt monster – which just hit a record $36.17 trillion – with more and more debt come rain, shine, Chritmas, New Years, etc, etc, and this week happens to have three coupon auctions on deck, the first of which just concluded.

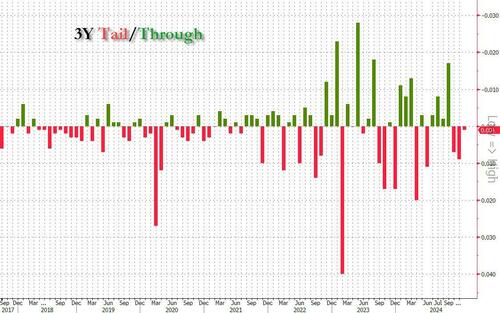

At 1pm, the US Treasury sold $58BN in 3Y paper, at a yield of 4.117%, down from last month’s 4.152% but tailing the When Issued 4.116% by 10.1bps, and the third tail in a row.

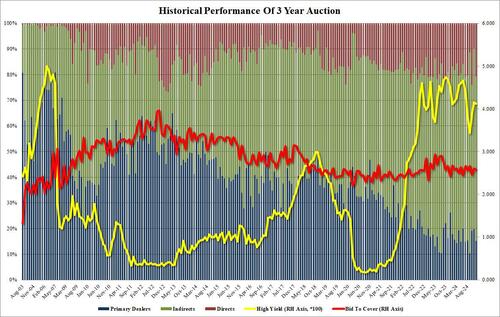

The bid to cover dipped to 2.577 from 2.603 last month, but was just above the 2.56 six-auction average. As shown in the chart below, the BTC on the 3Y has been pretty much fixed for the past 6 years in the 2.4-2.8 range.

The internals were ok. Indirects dropped to 64.2%, from 70.6% in November, and below the recent average of 66.4%. And with Directs surging to 20.7% from 9.6% in November, and above the 17.1% average, Dealers were left with just 15.1%, the lowest since September.

Overall, this was a solid if not stellar auction, and good enough to prevent more selling in the secondary market: the yield on the 10Y was flat after the auction and has since dipped 1bp to 4.22% after earlier rising as high as 4.24%, a one week high.

Tyler Durden

Tue, 12/10/2024 – 14:25

via ZeroHedge News https://ift.tt/foN8eP6 Tyler Durden