“Dire Situation” – Chinese Bond Yields Hit Record Low On Retail Sales “Big Disappointment”

China’s retail sales increased just 3% in November from a year ago, falling short of forecasts for 5% growth by economists surveyed by Bloomberg.

The weakening in retail sales was surprising following strong sales of home appliances and cars a month ago thanks to government subsidies.

While sales for those two categories remained strong in November, a number of discretionary goods recorded a slump.

Cosmetics led the decline with a 26% plunge in sales from a year ago, while those of clothing, jewelry, beverages and tobacco and alcohol also decreased.

The November retail number “was the big disappointment of the month, as retail sales . . . came in well softer than both consensus and our forecasts”, said Lynn Song, chief economist for greater China at ING in a research note.

The data builds on traders’ disappointment last week when Beijing pledged to boost consumption but failed to offer details on fiscal stimulus.

The retail-sales data “is a reflection of the dire situation there and how the stimulus efforts have prioritized optics over delivering meaningful economic improvements,” said Charu Chanana, chief investment strategist at Saxo Markets in Singapore.

“Even for a tactical recovery, we need more after a series of false starts and the risk of tariffs ahead.”

As The FT reports, Beijing has struggled to boost confidence against the backdrop of a property slowdown, now entering its fourth year, and bouts of deflation.

The government unveiled a series of measures to boost stock markets in late September and to refinance local government debt last month.

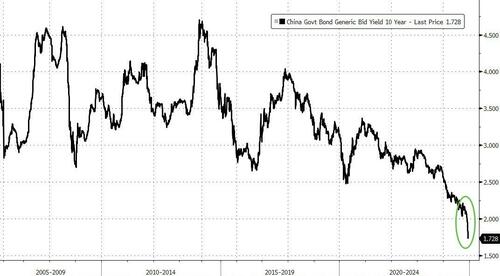

Chinese stocks fell on the report and bond yields tumbled to a new record low…

Source: Bloomberg

“The Japanification of China bonds may be inevitable at some point,” said Stephen Miller, a four-decade markets veteran and consultant at GSFM, calling the recent stimulus a sugar hit.

“China’s issues are deep-seated structural issues. You can’t fully rule out the possibility of yields heading toward zero if these issues aren’t addressed,” he said.

“Bond yields at 0% are a possibility,” said George Boubouras, head of research at hedge fund K2 Asset Management Ltd.

He said the central bank will need to take an ‘anything goes’ approach to stimulus to avoid the economy sliding into a Japan-style balance sheet recession.

Indeed, China is already showing partial signs of a balance-sheet recession, said Yingrui Wang, China economist at AXA Investment Managers.

Households and corporations are curbing spending due to their rising debt burden, which has left the central government as a key source of demand, according to Wang.

China’s recent monetary easing pledges point to a continued decline in bond yields until fundamentals in the economy start to recover. Over recent months, the People’s Bank of China appears to have eased its control on bond yields,

“We forecast the 10-year CGB yield to reach around 1.6% by the end of 2025”, she said.

The damage to consumer confidence is deep-rooted and will require substantial effort to repair; China has yet to act decisively to stabilize its property market, although recent months have seen a shift in focus.

The government’s lack of effective action mirrors Japan’s early missteps, risking a prolonged downturn, and with China’s 30Y yield plunging below that of Japan’s, the market is clearly starting to believe the same…

Source: Bloomberg

Beijing hasn’t fully absorbed Japan’s lessons: The lack of decisive fiscal action despite pressure from the property market, local government debt, and declining confidence among consumers could worsen China’s economic challenges.

“The data show that the recovery in domestic demand has remained sluggish, while the stabilization in industrial production was likely due to some order front-loading ahead of US tariffs and is not sustainable,” said Michelle Lam, Greater China economist at Societe Generale SA.

As Mike Shedlock concludes, via MishTalk, facing debt deflation, China’s best bet would be to allow more bankruptcies, write down debt, and strengthen the yuan. But it is highly unlikely to do so.

US hypocrites led by then Fed Chair Ben Bernanke pleaded with Japan to do that, then failed to do so at our turn in the Great Recession.

Lower for longer will suppress the yuan. It’s one way China has of countering Trump’s tariff threats.

But it’s also counterproductive.

Lower for longer did not help Japan, and negative yields helped neither Japan nor the EU.

Unfortunately, the only thing China seems to understand is growth by exports but that means a weaker yuan.

Even more problematic for Beijing, a huge fight with Donald Trump is about a month away…

Tyler Durden

Mon, 12/16/2024 – 08:37

via ZeroHedge News https://ift.tt/ovNx6MT Tyler Durden