Bullish Cattle Bets Soar As US Herd Crisis Sparks Breakout To Record High Price

Institutional investors are increasing bullish bets on live cattle futures, pushing them to their highest levels in five years, as America’s herd size dwindles to its lowest point in more than six decades.

The latest CFTC data via Bloomberg shows money managers boosted bullish live cattle bets by 3,908 net-long positions to 126,308 last week, the most bullish in over five years.

Additional CFTC data (courtesy of Bloomberg):

-

Long-only positions rose 5,781 lots to 140,036 in the week ending Dec. 10

-

The long-only total was the highest in more than five years

-

Short-only positions rose 1,873 lots to 13,728

-

The short-only total was the highest in three weeks

Chicago Mercantile Exchange live cattle futures are reaching new highs, driven by technical trading, anticipation of strong consumer demand heading into holidays, and the alarming decline in overall herd size.

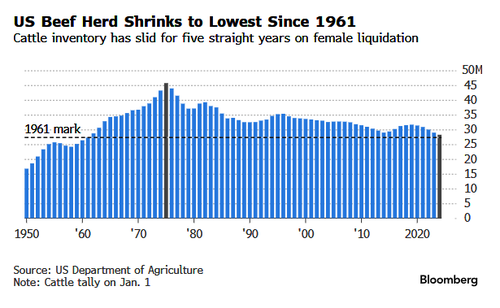

The shrinking beef supply has pushed the nation’s herd size to its smallest level since 1961. With severe droughts, high interest rates, costly feed prices, sliding farm income, surging farm debt, and a shifting consumer preference toward cheaper chicken, struggling ranchers have been culling heifers, preventing any meaningful recovery in the number of calves necessary to expand the nation’s herds.

On top of all this, the nation’s cattle crisis is set to worsen with new pressures: first, President-elect Trump’s anticipated tariff war 2.0, which is expected to tighten domestic beef supplies, and second, immigration reform.

“All of the things he is talking about have potentially negative consequences more so than anything positive,” Derrell Peel, a professor of agricultural economics at Oklahoma State University, told Bloomberg, adding, “Our fate’s pretty well determined in the cattle industry in the US for the next two to four years – and it’s not looking good.”

In February, the United States Department of Agriculture projected that the cattle herd could begin rebuilding by 2025. However, that timeline has since shifted to 2027. The reason is primarily because of high interest rates and poor pasture conditions in the Midwest.

“Even as the beef industry has experienced periods of growth over the past decades, the animal count has dropped almost 40% since a peak in 1975. During the current downcycle, which started in 2020, the herd has been shrinking at the fastest pace since the big farm crisis of the 1980s,” Bloomberg noted.

If Trump introduces new tariffs, it could disrupt the flow of imported beef, further tightening domestic supplies, which will mean supermarket prices of ground beef are set to rise even higher in 2025.

All things point to higher beef prices in 2025.

Tyler Durden

Tue, 12/17/2024 – 04:15

via ZeroHedge News https://ift.tt/qUfn7da Tyler Durden