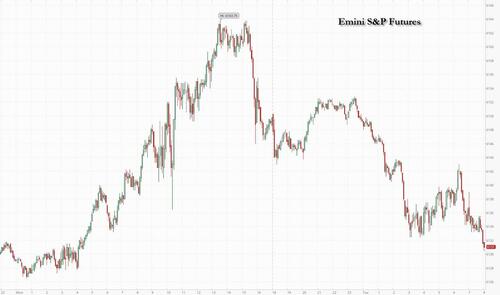

Futures Drop As Global Selloff Reaches The US

There is only so much the US can “exceptionally” decouple from the rest of the world, and on Tuesday US futures finally succumbed to the persistent selling in markets around the world, as traders awaited the Federal Reserve’s final interest-rate decision for 2024 and its monetary policy forecasts. As of 8:00am, S&P futures dropped 0.3%, while Nasdaq 100 futs eased back 0.2% after the relentless rally in tech stocks pushed the gauge to a fresh all-time high on Monday as AAPL/GOOGL/AMZN/TSLA/AVGO all reached new ATHs. TSLA (+3% pre-mkt) on an u/g away while NVDA (-1.5% pre mkt) continues to be under pressure. Europe’s Stoxx 600 fell 0.4% as weaker crude prices weighed on oil-related stocks (FTSE -70bps/DAX +15bps/CAC +30bps). A key Asian gauge dropped 0.5% after erasing gains as concerns over China’s economy persist (Shanghai -73bps/Hang Seng -48bps/Nikkei -24bps). US rates rose with 10Y TSY yields rising +4bps @ 4.43%. The Bloomberg Dollar Spot Index adds 0.1%. The Aussie dollar is the weakest of the G-10 currencies, losing 0.5%. The yen outperforms with a 0.2% gain. Crude oil extended its drop as WTI dropped 0.8% to $70.15. Meanwhile, Bitcoin adds another +90bps to $107,040 as global equities chop around ahead of a slew of central bank rate decisions the next few days (FOMC tomorrow). There is a busy macro calendar today with retail sales, industrial/mfg production, business inventories and the NAHB housing index all on deck.

In premarket trading, Pfizer rose 2% after the company forecast 2025 sales and earnings in line with analysts’ projections, a step toward fending off an activist investor’s claims that the drugmaker is being mismanaged. Here are some other notable premarket movers:

- Mitek (MITK) rallies 15% after the identity verification software company reported fourth quarter revenue and earnings that beat the average analyst estimate.

- Pacs Group (PACS) slips 3% as JPMorgan issued a downgrade after nursing home operator said it received investigative demands over its reimbursement and referral practices.

- Rockwell Medical (RMTI) climbs 14% after the manufacturer of hemodialysis products entered into a supply pact with a provider of dialysis products and services.

- Shoals Technologies (SHLS) climbs 8% as Morgan Stanley upgraded the renewable energy equipment company to overweight citing increased confidence in the earnings outlook heading into 2025.

- Tesla shares rise as much as 3.4% in premarket trading on Tuesday as Mizuho Securities upgrades to outperform from neutral citing an improved outlook under the new administration.

- Shares in electric-vehicle and charging station companies may be active on Tuesday after Reuters reported that Donald Trump’s transition team plans changes that would redirect funding from EV and charging stations markers to national-defense priorities.

As equity markets head into the final weeks of 2024, US stocks have significantly outperformed their peers for the year as optimism about artificial intelligence and falling rates fuel investor confidence. Traders are now focusing on Wednesday’s Fed announcement, with Chair Jerome Powell widely expected to deliver a quarter-point of easing.

What happens in the following months remains less clear. While the US economy is resilient, the prospect of inflationary import tariffs threatened by the incoming administration of Donald Trump may give Fed officials pause about the pace of further moves. Money markets are seeing an 80% chance of three cuts next year, compared to the small probability of a fourth reduction seen at the start of the month. “There is also the Fed, which stirs some uncertainty,” said Alexandre Baradez, chief market analyst at IG in Paris. “My scenario is for a hawkish cut with a much more cautious narrative.”

Bank of America strategists cautioned that fund managers have been reducing cash holdings to a record low and pouring money into US stocks, triggering a metric that could be a signal to sell global equities. Cash as a percentage of total assets under management fell below 4%, a move that in the past has been followed by stock market losses.

In Europe, the Stoxx 600 fell for a fourth consecutive session, as political upheaval in the region weighs on sentiment, with traders also bracing for Eurozone inflation data and a US rate decision due tomorrow. Technology and automakers are among gainers while energy and telecom sectors lead declines. Here are some of the biggest movers on Tuesday:

- Airbus shares rise as much as 1.9% after Deutsche Bank upgraded the planemaker to buy from hold, saying it is better positioned for 2025 and is trading at a relatively affordable valuation.

- Jungheinrich gains as much as 4.9% after Citi upgrades the intralogistics solutions provider to buy from neutral, saying the stock is too cheap to ignore after prolonged underperformance.

- Goodwin shares rise as much as 18% after the UK mechanical and refractory engineering company reports what Shore Capital describes as “excellent” interim results.

- Thyssenkrupp Nucera shares gain as much as 9.3% after full-year earnings from the German green hydrogen technology firm revealed encouraging developments in the pipeline and funding potential, according to Citi.

- Hollywood Bowl shares drop as much as 11%, their worst day in over four years, after the bowling center operator reported a slide in pretax profit as well as flagging an impact of £1.2 million when UK National Insurance changes are implemented next year.

- Bunzl drops as much as 5.7% after the year-end trading update reports revenue that fell below consensus as Jefferies analyst says the update flags “continued top-line weakness.”

- Capita drops as much as 11% after the outsourcing specialist issued a trading update that showed an 8% adjusted-revenue decline and flagged a further slide in revenue growth next year.

- Chemring shares fall as much as 11% as the British defense firm decided not to renew its share buyback program and said its margin has fallen due to operational challenges.

- JDE Peet’s falls as much as 5% to hit a record low, after Goldman Sachs re-initiated coverage of the Dutch coffee and tea company with a sell rating, noting that a sharp uptick in coffee prices could hit sales, potentially putting at risk its presence in equity indexes.

- UCB shares slip as much as 3.6% after a proof-of-concept study for its experimental drug minzasolmin developed in partnership with Novartis for Parkinson’s disease didn’t meet primary and secondary clinical endpoints.

Earlier in the session, HK/China closed lower despite a midday spike following a Reuters headline that placed China’s 2025 GDP growth and fiscal deficit targets at the upper bound of investor expectations. Small caps caught the most weakness today, suggesting that retail investors are taking a breather after being better buyers over the past few sessions. Meanwhile, Samsung Electronics 00597230 KS caught selling after GIR cut its price targets, while ASIC names in Taiwan were well bid after Broadcom AVGO US rallied again overnight.

- Australia: S&P/ASX 200 +0.78%, snapping a five-day losing streak. The index took cues from Wall Street, where Tech shares delivered strong performance, bolstering sentiment. Investors are bracing for an expected interest rate cut from the US Fed Reserve later this week, with much of the focus shifting to the Fed’s outlook for 2025. Notable performers were Commonwealth Bank CBA AU +1.6%, NA Bank NAB +1.5%.

- Taiwan: TAIEX -0.09%. Market opened higher but gradually lost steam over the day. TSMC 2330 TT retreated 0.9% and is just 3 ticks short of another A-T-H. United Microelectronics Corp UMC + 2.7% after the biggest morning headlines were focused on their reported securing advanced packaging orders from Qualcomm. The ASIC theme was also very strong again, as Broadcom gained another 11% overnight with the local ASIC names benefiting again, including Alchip limit up, GUC 3443 TT +8.8%, and Faraday 3035 TT +5.2%.

- Korea: KOSPI -1.29%. It opened weak and dipped lower further into the afternoon on accelerated foreign outflows with the bulk of the selling coming from program trades which indicated passive, systematic driven selling while locals (institutios, retail) were on the receiving end of the supply. Tech was an underperformer today whereas within semis – Samsung and Hynix saw divergence again while the EV names were notably weaker following potential tariff headwinds.

- Japan: Nikkei 225 -0.23%. Market opened with risk on mode led by momentum trades. Investors preferred popular themes like defense names, AI related names. Investors shifted their positions from cyclicals to defensives, from high vol names to low vol names, value names to growth names. Shares of Advantest 6857 JP tumbled 9.1% as the unveiling of its latest testing solutions for advanced applications. Meanwhile, SoftBank Group 9984 JP +4.3% after CEO Masayoshi Son announced plans to invest $100 bn in the US.

- China: SHSZ300 +0.26% but A-shares in other indices took another leg lower weighed weighed by small and micro cap names. Headlines from Reuters that China GDP growth target set at 5% for next year, and budgeted fiscal deficit 4% hit the tape at noon. Growth target is in line (and deemed aggressive by many; GSe: 4.5%), and fiscal target to the upper bound of expectation. The news spurred a quick spike in the PM session, but tapered soon.

- Hong Kong: HSI -0.22%. Markets saw a sharp spike in PM inline with onshore, but soon faded marking the 3rd straight session of losses as most sectors retreated – particularly property, consumers, and tech. Sluggish activity data for Nov in China continued to weigh on sentiment, with retail sales growth unexpectedly slowing while industrial output rose at a relatively similar pace to October. Notable decliners include Techtronic Inds. 669 HK -2.4%, JD Logistics 2618 HK -1.58%, Wuxi Biologics 2269 HK -2.66%.

In FX, Bloomberg’s dollar gauge was little changed. An index of Asian currencies fell to the lowest in more than two years amid pessimism over China’s economic outlook and expectations that Trump policies will drive gains in the greenback. The yen snapped a six-day losing streak after weakening beyond the 154 level versus the dollar overnight. The yen’s rapid decline in the past week had strategists warning that further weakness may trigger verbal intervention from authorities and add pressure on the Bank of Japan to hike rates. Traders are pricing in a less than 20% chance of a rate hike in December, according to swaps market pricing. The pound erased a small loss while gilt yields rose as traders scaled back bets on Bank of England rate cuts after UK wage growth accelerated for the first time in more than year. The implied chance of three quarter-point cuts in 2025 fell to around 55%, down from 90% before the report. The yuan was little changed in both onshore and overseas trading, as markets shrugged off news that Chinese leaders were planning to set an annual growth goal of about 5% for next year and raise the budget deficit.

In rates, yields on US Treasuries advanced across the curve, with the US 10-year yield rising 3bps to 4.432%, cheapest since Nov. 21. UK government bonds fall as traders pare bets on interest-rate cuts by the Bank of England after UK wage growth accelerated for the first time in more than a year. UK 10-year yields rise 6 bps to 4.50% although the pound has given back its earlier advance versus the dollar. OIS swaps price in about 60bps of easing through December 2025 vs around 75bp at Monday’s close. The US Treasury sells $13 billion of 20-year bonds in a reopening at 1pm New York time; WI yield near 4.72% is ~4bp cheaper than November’s new-issue sale, which tailed by 1.5bp.

The 10Y yield may climb to 6% as US fiscal woes worsen and Trump’s policies help keep inflation elevated, according to T. Rowe Price. “Is a 6% 10‑year Treasury yield possible? Why not? But we can consider that when we move through 5%,” Arif Husain, chief investment officer of fixed-income, wrote in a report. “The transition period in US politics is an opportunity to position for increasing longer‑term Treasury yields and a steeper yield curve.”

In commodities, oil prices dropped with WTI falling 1% to $70 a barrel. Spot gold drops $11 to around $2,641/oz.

The US economic data calendar includes November retail sales and December New York Fed services business activity (8:30am), November industrial production (9:15am), and October business inventories and December NAHB housing market index (10am)

Market Snapshot

- S&P 500 futures down 0.3% to 6,062.00

- STOXX Europe 600 down 0.4% to 513.83

- MXAP down 0.5% to 183.86

- MXAPJ down 0.6% to 579.67

- Nikkei down 0.2% to 39,364.68

- Topix down 0.4% to 2,728.20

- Hang Seng Index down 0.5% to 19,700.48

- Shanghai Composite down 0.7% to 3,361.49

- Sensex down 1.2% to 80,747.70

- Australia S&P/ASX 200 up 0.8% to 8,314.00

- Kospi down 1.3% to 2,456.81

- German 10Y yield down 2 bps at 2.23%

- Euro down 0.3% to $1.0482

- Brent Futures down 0.6% to $73.47/bbl

- Brent Futures down 0.6% to $73.47/bbl

- Gold spot down 0.4% to $2,641.97

- US Dollar Index up 0.18% to 107.05

Top Overnight News

- China suffered the biggest outflow on record from its financial markets last month as the prospect of higher US tariffs posed more risks for the world’s second-largest economy. Domestic banks wired a net $45.7 billion of funds overseas on behalf of their clients for securities investment. BBG

- China will keep its growth target of about 5% next year and agreed to increase its fiscal deficit target to 4% of GDP in 2025, up 1% from 2024’s 3% goal and consistent with the recent pledge to adopt a more proactive fiscal policy. RTRS

- BABA (Alibaba) to book a $1B loss on the sale of its department-store chain Intime. WSJ

- Ukraine said it killed a senior Russian general in a Moscow bombing after a device planted in a scooter exploded early Tuesday, a rare targeted assassination of a high-profile military official in the capital. Ukraine accuses the general of committing chemical weapons crimes. WSJ

- The White House reiterated its position that it’s up to Volodymyr Zelenskiy to choose the timing and terms of talks with Russia, after Trump said Kyiv must make a deal to end the war. BBG

- Senior U.S. officials say Turkey and its militia allies are building up forces along the border with Syria, raising alarm that Ankara is preparing for a large-scale incursion into territory held by American-backed Syrian Kurds

- US retail sales are expected to rise 0.6% in November, compared with 0.4% the prior month, as companies lured bargain-hunters with discounts and tariff-wary shoppers pulled forward big-ticket purchases. BBG

- Fund managers have been reducing cash holdings to a record low and pouring money into US stocks. Cash as a percentage of total AUM fell below 4%, a move that in the past has been followed by losses. BBG

- Ten-year Treasury yields may climb to 6% for the first time since 2000 on Donald Trump’s inflationary policies. The benchmark may reach 5% in the first quarter. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mixed after the region initially showed a positive bias, taking cues from Wall Street, and in the absence of macro newsflow with looming risk events. ASX 200 firmed with banks underpinning the index, with Westpac among the gainers while its CFO announced plans to retire. Nikkei 225 trimmed earlier upside as traders were cautious ahead of the BoJ, with the decision contingent on the FOMC’s announcement hours beforehand. Hang Seng and Shanghai Comp traded within narrow parameters in uneventful trade amid quiet newsflow, with participants remaining non-committal ahead of major risk events.

Top Asian News

- China is to maintain a growth target of “around 5%” for 2025, according to Reuters sources. China is to target a budget deficit of 4% in 2025 (vs 3% initially). More stimulus will be funded through issuing off-budget special bonds, sources added.

- New Zealand sees 2024/25 operating balance before gains, losses at NZD -17.32 bln (budget NZD -13.37 bln), according to Reuters.

- New Zealand Debt Management Office says 2024/25 gross bond issuance increases to NZD 40 bln from NZD 38 bln in May, according to Reuters.

- Alibaba Group (9988 HK/ BABA) sells Intime; Expected gross proceeds to Alibaba from Intime sale is approximately RMB 7.4bln; Alibaba expects to record losses of approximately RMB 9.3bln as a result of the sale of Intime.

- PBoC injected CNY 355.4 bln via 7-day reverse repos with the rate maintained at 1.50%, according to Reuters.

- South Korean acting President Han says South Korea is to implement the budget on Jan 1st; South Korea to allocate budget promptly for economic revitalisation, according to Reuters.

- Magnitude 7.4 quake has struck Port-Vila in the Vanuatu region, according to USGS.

European bourses began the session entirely in the red and have mostly resided in negative territory throughout the European morning, but have attempted to edge a little higher in recent trade, with some indices managing to climb incrementally into the green. German Ifo data confirmed the dire situation in the region, whilst ZEW surprised to the upside; metrics which sparked little price action. European sectors are almost entirely in the red, given the slip in risk sentiment in today’s session thus far. Tech is marginally in positive territory, alongside Consumer Products and Services. Energy is the clear underperformer joined by Basic Resources, attributed to the losses seen in underlying commodity prices today. US equity futures are modestly in negative territory, in-fitting with the losses seen in Europe and the general risk tone; a slight turn in fortunes in comparison to the gains seen in the prior session.

Top European News

- French Central Bank Forecasts: 2024 Growth seen at 1.1% (unchanged), 2025 seen at 0.9% (prev. 1.2% in Sept.); 2026 at 1.3% (prev. 1.5%), 2027% at 1.3%. HICP inflation 1.6% in 2025, 1.7% in 2026 and 1.9% in 2027.

- ECB’s Rehn says data to decide speed and scale of rate cuts; scale and speed of rate cuts will be determined in each meeting on the basis of incoming data and comprehensive analysis; Euro area inflation starting to stabilise at ECB’s 2% target. Monetary policy will cease to be restrictive in the later winter, early spring period (i.e. between January and June 2025)

- ECB’s Kazimir says inflation risks are well balanced, via Bloomberg. Will discuss the neutral rate when they approach 2.5%.

- ECB keeps capital requirements broadly steady for 2025, reflecting strong bank performance amid heightened geopolitical risks

FX

- DXY is on a firmer footing and topped 107.00 in early European trade, to currently trade at the top-end of a 107.05-106.69 range. Should the upside continue, the Dollar index could see a potential test of the prior day’s best at 107.16, and then 107.18 from Friday 13th December. The North American day sees the release of US retail sales, which are expected to rise +0.5% M/M in November.

- EUR is on the backfoot vs the Dollar, after posting modest gains in the prior session. German Ifo figures were mixed, with the Business Climate and Expectations components printed below expectations whilst the Current conditions improved a touch. Overall the figures only further confirmed the dire situation in the region. German ZEW was a little more optimistic, which helped to lift the Single-Currency a touch, but ultimately proved fleeting. Currently trading near session troughs at 1.0480.

- GBP is on a firmer footing and one of the better G10 performers today, as traders trim their bets for more cuts in the coming year following today’s hot jobs reports, with particular focus in the wages components which surpassed the top end analyst expectations. Cable briefly topped 1.27 before then paring the upside to a current 1.2687.

- The JPY is the best G10 performer thus far, in contrast to the losses seen in the prior day. USD/JPY currently trades in a 153.76-154.34 range, and just within the confines made on Monday.

- Antipodeans are on the backfoot and in-fact the worst G10 performers, given the subdued risk sentiment and losses in commodity prices.

- PBoC sets USD/CNY mid-point at 7.1891 vs exp. 7.2842 (prev. 7.1882)

- RBI likely sold USD via state-run banks at 84.92-84.93, according to Reuters citing traders.

- Barclays Month- & Quarter-end Rebalancing: USD neutral.

Fixed Income

- USTs are in the red but only modestly so, moving in tandem with the morning’s data release out of the UK and Germany but in relatively thin 109-21 to 109-29+ parameters. US Retail Sales precedes a 20yr auction later today.

- Bunds came under pressure on the morning’s UK wage data (see Gilts for details) with leads bearish in-fitting with contained/softer UST action overnight. However, this proved relatively short-lived as Bunds were sent back into positive territory to a 134.94 session high on Germany’s 13% Y/Y lower 2025 issuance intentions, and the mixed but ultimately softer German Ifo release. On the data front, Ifo figures were poor whilst the ZEW was a little more optimistic on the economy and helped to spark some short-lived upside.

- Gilts are underperforming after the day’s jobs data, with the wages components have taken centre stage with the hot metrics essentially removing any chance of easing on Thursday with just 1bps implied (c. 4bps pre-release. Though, we await CPI on Wednesday. A release which caused Gilts to gap lower by 47 ticks at the open and then slip further to an initial 93.27 trough. The 2029 outing saw a softer cover than the prior, which led Gilts down to a new 93.23 trough.

- German Finance Agency intends to issue around EUR 380bln via Federal debt sales in 2025, -13% Y/Y. Plus two syndications.

- Italy PM calls for discussions on common EU bonds to fund defence spending.

- UK sells GBP 3.75bln 4.125% 2029 Gilt: 2.9x (prev. 3.05x), avg yield 4.348% (prev. 4.148%) & tail 0.8bps (prev. 0.8bps)

Commodities

- WTI and Brent came under pressure early-doors despite a lack of fresh fundamental drivers at the time. Pressure which took the benchmarks to fresh lows for the week and back towards the troughs from Friday; though, well within last week’s circa. USD 5/bbl parameters. Brent’Feb 25 currently sits near session lows at USD 73.35/bbl.

- Gold is softer, pressured by continued USD advances which has taken the DXY above the 107.00 mark. Yellow metal has been waning gradually in European hours, as the region’s risk tone meanders higher. Thus far, down to a USD 2641/oz base.

- Base metals spent APAC trade in very thin ranges but have since slipped to the lower-end of those and modestly into the red. Pressure which comes despite the modest inch higher in the European risk tone.

Geopolitics: Middle East

- “The IDF has approved plans for major strikes in Yemen, and is prepared to act pending government approval”, via Open Source Intel citing N12 News

- US military said it conducted an airstrike against Houthis in Yemen, according to Reuters.

- Syria’s rebel leader said factions would be ‘disbanded’ and fighters would join the army, according to AFP.

Geopolitics: Other

- Russia may increase the frequency of missile testing as external threats grow, according to Russian state news agencies citing the commander of Russian strategic missile forces. Russia may also increase the number of nuclear warheads on deployed carriers in response to similar actions by the US. Mobile-based missile systems, the commander noted, will be decisive means of inflicting devastating enemy damage in a potential retaliatory nuclear attack. Russia’s strategic missile forces plan maximum-range launches as part of state testing of prospective new systems. Additionally, Russia and the US give each other at least a day’s warning about planned launches of intercontinental ballistic missiles.

- Russian lieutenant general Kirillov and his associate killed in explosion in Moscow, according to RT sources; Kirillov is listed as Chief of Radiological, Chemical and Biological Defence of Russian Armed Forces.

- Senior US officials say Turkey and its militia allies are building up forces along the border with Syria, raising alarm that Ankara is preparing for a large-scale incursion into territory held by American-backed Syrian Kurds, according to WSJ.

US Event Calendar

- 08:30: Nov. Retail Sales Advance MoM, est. 0.6%, prior 0.4%

- Nov. Retail Sales Ex Auto MoM, est. 0.4%, prior 0.1%

- Nov. Retail Sales Control Group, est. 0.4%, prior -0.1%

- 08:30: Dec. New York Fed Services Business, prior -0.5

- 09:15: Nov. Industrial Production MoM, est. 0.3%, prior -0.3%

- Nov. Manufacturing (SIC) Production, est. 0.5%, prior -0.5%

- Nov. Capacity Utilization, est. 77.3%, prior 77.1%

- 10:00: Oct. Business Inventories, est. 0.1%, prior 0.1%

- 10:00: Dec. NAHB Housing Market Index, est. 47, prior 46

DB’s Jim Reid concludes the overnight wrap

In what should be a quiet week given the time of year there is still a lot going on in markets as we build up to the FOMC that concludes tomorrow. The S&P 500 (+0.38%) ended the session just beneath its all-time high from earlier in the month but with the number of decliners (321) in the index exceeding advancers (182) for a remarkable 11th session in a row. On my calculations this is the longest such run for 40 years. Elsewhere French assets under-performed a touch after the Moody’s downgrade on Friday night, whilst the Canadian Dollar hit its weakest intraday level in four-and-a-half years after the country’s finance minister resigned heaping pressure on Trudeau as the political instability in several G7 countries seen over the last few months continues.

Talking of which, the other main story of the day centred around Germany as the government lost a no-confidence vote as expected that paves the way for an early election to happen. By way of background, Chancellor Scholz had led a three-party coalition of his own SPD, the Greens and the FDP. But the coalition collapsed after Scholz fired the FDP leader and finance minister Christian Lindner because of a budget dispute. Under the German system, the Chancellor can’t simply call an early election at the time of their own choosing. However, they can ask the President for an early election if they lose a vote of no confidence, so this one was tabled deliberately by the government in order to bring forward the election date. The election is expected to take place in February, and the conservative CDU/CSU bloc currently have a clear lead in opinion polls. Today they will release their manifesto with the leaks suggesting no plans to reform the debt brake. However part of this is likely to help ensure they have a stronger negotiating position in coalition talks. See Robin Winkler’s latest piece yesterday looking at DB’s latest thoughts.

In the meantime, there were also big developments in Canadian politics yesterday, as Finance Minister and Deputy PM Chrystia Freeland resigned from the cabinet. In her resignation letter, she said that the threat of US tariffs meant Canada should be “keeping our fiscal powder dry today, so we have the reserves we may need for a coming tariff war.” The move came just hours before Freeland was set to deliver an economic update, and Canadian assets struggled following the resignation, with equities around half a percent lower and the Canadian Dollar weakening. Canada’s next election is due by October 2025, but the governing Liberal Party under Justin Trudeau are lagging well behind the opposition Conservatives, and CBC News’ poll tracker points to a high chance of a Conservative majority based on current polls. The question after this is whether Trudeau can ride this out until next October or will have to go to the polls earlier.

Moving on to France, there was an underperformance in the country’s markets following the credit rating downgrade from Moody’s on Friday. For instance, the CAC 40 (-0.71%) was the worst performer among the big European indices, well beneath the Europe-wide STOXX 600 (-0.12%). In addition, the Franco-German 10yr spread widened by +1.4bps to 79.9bps, which is its 5th consecutive move wider. Remember the downgrade only bring Moody’s into line with S&P and Fitch so it aligns the main agencies rather than creates an incremental move away from the pack. Otherwise, there wasn’t much in the way of concrete political news, but the new PM François Bayrou met with Marine Le Pen, who said after the meeting that “It’s perhaps a little early to say if we were heard, but we were listened to.”

Elsewhere in Europe, there was a bit more optimism yesterday as the December flash PMIs were slightly better than expected. Now admittedly, the Euro Area composite PMI was still in contractionary territory at 49.5, so it was hardly a stellar performance. But that was stronger than the 48.2 print expected, and the services PMI was back in expansionary territory at 51.4 (vs. 49.5 expected). From a market perspective however, there wasn’t much to shift the dial for the ECB, who are still widely expected to keep cutting rates in 2025. And sovereign bonds were broadly steady yesterday, with 10yr bund yields (-1.0bps) coming down slightly to 2.24%.

The modest rally in European bonds also came as ECB President Lagarde followed through on some of the more dovish signals seen at last week’s press conference, saying that the ECB is looking to deliver an “appropriate” policy stance and that “If the incoming data continue to confirm our baseline, the direction of travel is clear and we expect to lower interest rates further”. Meanwhile, Schnabel, one of more hawkish ECB voices, noted that “lowering policy rates gradually towards a neutral level is the most appropriate course of action”, so some implicit pushback against the possibility of the ECB having to move rates below neutral.

Over in the US, the theme of American exceptionalism continued as the flash PMIs were notably stronger than expected. Indeed, the composite PMI was up to 56.6, which is its highest since March 2022 when the Fed started to hike rates again. In turn, that contributed to a selloff among US Treasuries, which pared back their initial gains to leave the 10yr yield little changed (+0.1bps) at 4.40%. At the same time, there was a notable outperformance from US equities, with the S&P 500 (+0.38%) ending the session just -0.27% beneath its all-time high. As mentioned at the top the breadth was again a negative as more stocks fell than rose for an eleventh day with the equal weight index down -0.36%. So the advance was driven by the Magnificent 7 (+2.07%), which hit another all-time high. Health care stocks (-1.24%) were among the underperformers as Trump commented that he plans to “knock out the middleman” in the sector during a wide-ranging press Q&A.

In Asia the main headline just coming through is Reuters reporting that China is set to announce a 5% growth target for 2025 along with a 4% budget deficit. There has been talk of such an expanded deficit number in the last couple of weeks but if that is the growth target the market will likely conclude that the authorities will have to be serious about stimulus. After the story’s release Chinese equities have rallied several tenths of a percent with the Shanghai Comp now “only” -0.16% lower on the day. The Hang Seng is +0.2% higher having spent most of the session notably lower. The Nikkei (+0.20%) and the ASX (+0.78%) are higher but the KOSPI (-1.0%) is the biggest underperformer as the country continues to digest the weekend impeachment news. US futures are flat.

Bitcoin (+0.41%) is advancing for the third straight session, hitting a record high of $106,511 as the incoming Trump administration is seen as being far more friendly towards cryptocurrencies.

To the day ahead now, and data releases in the US include retail sales and industrial production for November, in Canada there’s the November CPI print, in Germany there’s the Ifo’s business climate indicator and the ZEW survey for December, and in the UK we’ll get unemployment for October. Central bank speakers include the ECB’s Kazimir and Rehn.

Tyler Durden

Tue, 12/17/2024 – 08:26

via ZeroHedge News https://ift.tt/UXoCabJ Tyler Durden