Red Sea Oil Flows Surge As Trump’s ‘Strongman’ Image Signals De-escalation In Maritime Chokepoint Crisis

Yemen’s Houthi rebels have sparked turmoil across the Southern Red Sea and Gulf of Aden for over a year, targeting Western-linked container ships, tankers, and military vessels. The resulting supply chain snarls have had major implications on global trade, causing a surge in container rate prices and shipping diversions around the Cape of Good Hope. However, early indications suggest that President-elect Trump’s strongman image could help de-escalate tensions and alleviate bottlenecks across this critical maritime chokepoint.

The incoming Trump administration urgently needs a fresh strategy to de-escalate tensions in the critical Bab-el-Mandeb maritime chokepoint that caught the Biden-Harris team entirely off guard. The admin’s Yemen policies were marked by inconsistency, leading to dozens of commercial vessels being struck by kamikaze drones and missiles, with several ships sunk as a result of the chaos.

Houthi ballistic missiles impact #Israel-linked Anadolu S Ship in #RedSea | ‘Accurate & direct hit’

Watch pic.twitter.com/FCs2JVAwSS

— The Times Of India (@timesofindia) November 20, 2024

Footage has been released of a Houthi anti-ship ballistic missile striking the MT ZOGRAFIA in the Red Sea on Tuesday. pic.twitter.com/SRAK1azuIa

— GMI (@Global_Mil_Info) January 19, 2024

Trump’s second administration needs a strategy to address the deeper foundation for US interests in the Middle East. This likely means pushing forward with his hardline counter-Houthi policies.

A recent Wall Street Journal report cited officials on Trump’s transition team who say they intend to enforce current sanctions and impose new ones on the group, including redesignating the Iran-backed Houthis in Yemen as a foreign terrorist organization and banning countries from buying Iranian oil.

The mere prospect of Trump returning to the White House next month appears to have already eased tensions in the critical maritime chokepoint.

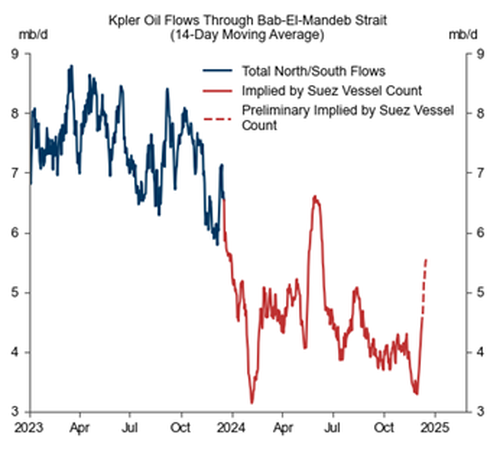

New data from Goldman Sachs, citing global trade intelligence firm Kpler, shows a significant surge in oil flows via tankers over the past few weeks.

“Despite the market’s renewed focus on geopolitical supply risks, actual oil flows through the Red Sea have recovered over the last two weeks amidst continued setbacks to Iran and its proxies,” Goldman’s Ephraim Sutherland and Daan Struyven wrote in a note.

The analysts noted, “We see significant downside to oil tanker freight rates and up to $3/bbl of downside to our refined product margin forecasts from a potential full unwind of the oil tanker Red Sea and Russia redirections.”

“The Houthis may have wound down their Red Sea disruptions for now, but let’s see how long it takes them to come up with more reasons to start back up again – renewed clashes in Gaza, a new “maximum pressure” campaign that targets the Houthis and what’s left of Iran’s stable of proxies, etc. We don’t rule out more targeted attacks against the US and Israeli assets in the region,” said Scott Modell, CEO of Rapidan Energy Advisors, about the Kpler data.

So the question remains: Will de-escalation in the critical maritime chokepoint persist after Jan. 20?

Tyler Durden

Wed, 12/18/2024 – 04:15

via ZeroHedge News https://ift.tt/rubnKAU Tyler Durden