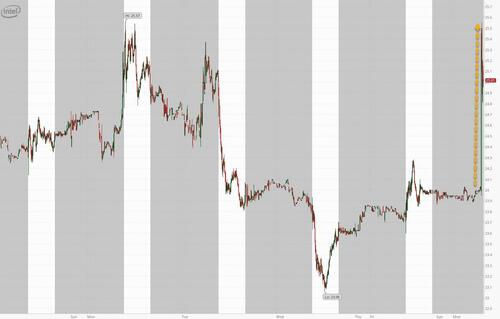

SMCI Soars After Special Committee Finds ‘No Evidence Of Misconduct’; Fires CFO

Super Micro Computer said an external review of its business found no evidence of wrongdoing and that the company will appoint new top financial leadership.

The company is looking for a new chief financial officer, chief compliance officer and general counsel, it said in a statement Monday.

On November 5, 2024, the Company announced that the Special Committee’s investigation preliminarily found that the Audit Committee had acted independently and that there was no evidence of fraud or misconduct on the part of management or the Board of Directors.

The Special Committee’s final findings support those initial findings, and the Company is now disclosing the details of the Review, along with measures recommended by the Special Committee.

The Special Committee’s investigation was intended to assess whether the information brought to the Audit Committee’s attention by EY, and certain other matters identified during the Review, raised substantial concerns about (i) the integrity of the Company’s senior management and Audit Committee, (ii) the commitment of the Company’s senior management and Audit Committee to ensuring that the Company’s financial statements are materially accurate, (iii) the Audit Committee’s independence and ability to provide proper oversight over matters relating to financial reporting, and (iv) the tone at the top of the Company with regard to rehiring certain former employees and financial reporting.

The Special Committee’s key findings are summarized as follows:

Management and Audit Committee integrity: The evidence reviewed by the Special Committee did not raise any substantial concerns about the integrity of Supermicro’s senior management or Audit Committee, or their commitment to ensuring that the Company’s financial statements are materially accurate.

Audit Committee independence: As to the matters investigated by the Special Committee, the Audit Committee demonstrated appropriate independence and generally provided proper oversight over matters relating to financial reporting. The Special Committee also had no reservations about the independence of the Audit Committee and each of its members.

Appropriate tone at the top: With respect to the rehiring of former employees, the tone at the top of the Company was appropriate and fully consistent with a commitment to proper financial reporting and legal compliance.

And due to the lack of problems found, the board says no restatement of reported financials is expected.

As announced on November 18, 2024, in its compliance plan to Nasdaq, the Company believes it will be able to complete its Annual Report on Form 10-K for the year ended June 30, 2024, and its Quarterly Report on 10-Q for the fiscal quarter ended September 30, 2024 and become current with its periodic reports within the discretionary period available to the Nasdaq staff to grant.

As previously disclosed, the Company does not anticipate any restatements of its quarterly reports for the fiscal year 2024 ended June 30, 2024, or for prior fiscal years.

Specifically, with reference to Revenue recognition and sales practices

-

Based on a thorough review of 52 sales transactions from April 1, 2023 to June 30, 2024, including two sales transactions specifically designated by EY, the Special Committee did not disagree with any of the Company’s revenue recognition conclusions for any quarter during this period.

-

The Special Committee reviewed underlying sales transaction information (including sales orders, purchase orders, shipping documents, payment information, and the Company’s revenue recognition determinations), discussed transactions with accounting personnel, and conducted email reviews as appropriate. The sample was focused on sales that included large dollar amounts, involvement of rehires, discussions with now former auditors, customers with high sales concentrations at quarter ends, and/or changes in delivery dates.

-

The Review also examined merchandise returns and warranty practices to assess if there was any pattern or practice of shipping non-working or incomplete products near quarter ends.

-

Based on its investigation, the Special Committee did not disagree with the Company’s revenue recognition conclusions. Additionally, the Special Committee did not find evidence of a pattern or practice of the Company shipping incomplete products at or near quarter ends to recognize revenue.

-

The evidence reviewed by the Special Committee did not give rise to any substantial concerns about the integrity of Supermicro’s senior management or Audit Committee, or their commitment to ensuring that the Company’s financial statements are materially accurate.

-

The Audit Committee demonstrated appropriate independence and generally provided proper oversight over matters relating to financial reporting.

For now the market is happy about this…

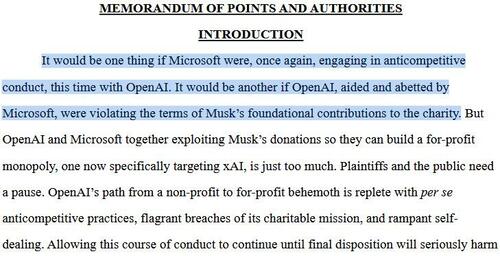

Do we really trust the ‘independent’ investigation after an external auditor abandoned ship?

Among its findings, the independent Special Committee determined that the resignation of the Company’s former registered public accounting firm, Ernst & Young LLP (“EY”) and the conclusions EY stated in its resignation letter were not supported by the facts examined in the Review, the Special Committee’s interim findings reported to EY on October 2, 2024, or the Special Committee’s final findings.

Did EY just make it up?

That’s quite a dive from $122 to $17…

And, having found no evidence of misconduct, why did the company fire CFO David Weigand, and seek a chief compliance officer, chief accounting officer, and general counsel?

Tyler Durden

Mon, 12/02/2024 – 09:17

via ZeroHedge News https://ift.tt/3hX8mJw Tyler Durden