Cruising Into Year End?

By Peter Tchir, chief strategist of Academy Securities

For the record, I am not advocating cruising into year-end. I think there will be potential opportunities to be captured by diligent asset managers and corporations. We will focus on yields and credit spreads today. But let’s start by hoping that you all had a great Thanksgiving! Last weekend’s An Amazing Country (with some questions) hopefully helped you navigate through some holiday meal discussions (or more likely, work discussions), and it remains relevant today, as does 3D Chess or 52-Card Pickup.

In fact, now that “consensus” has become that everything President-elect Trump does is “just a start” to his bargaining, I’m a little concerned that the market has become a little too complacent. Yes, we were arguing for this view, but it is surprising how quickly it seems to have morphed into a consensus trade.

Around the World with Academy Securities

In case you missed our Around The World report on Wednesday, it covers the usual suspects, but with some different twists and turns.

Sierpinski Triangle

As there is a lot of chatter about “chaos” (along with our analysis of 3D Chess versus 52-Card Pickup), I’ve been thinking a lot about the Sierpinski Triangle. You start with any type of triangle. Then, you start rolling the dice and moving from your current position in the triangle to one halfway to the corner “selected” by the die. Once you’ve gone a couple of turns to “seed” the solution, you mark the points and repeat ad infinitum. What seems random, creates, with 100% certainty, an elaborate pattern that I cannot believe many people would have guessed to be the output of this exercise (it is often one of the early chapters on anything about chaos theory).

So, as we watch the machinations coming out of D.C., we are still left wondering whether an elaborate pattern will emerge from the current selection process.

It does seem that the market went from doubting all the moves out of D.C. (which seemed too pessimistic) to suddenly seeing order (or at least no major stumbling blocks) from D.C. – which might be too optimistic.

Expect Some Chaos

Okay, chaos is probably too strong of a word, but I do think that the market should be prepared for some setbacks, as not every negotiation or appointment will go smoothly. It is the nature of President-elect Trump’s style – from his old real estate days to his first term as president – he will push, he will be aggressive, and there will be some confusion.

Inflation

Inflation might be the trickiest variable to estimate right now. Over time, we could see the economy turn one way or the other, and we could see the jobs situation change, but inflation, in my view, has the widest range of possible outcomes in the coming months.

-

Tariffs, as discussed last week, could push inflation higher. That is not our base case (and is not consensus), but there is some risk here.

-

Immigration issues could impact inflation quite dramatically. Again, we covered this last week, and our base case is that Trump will go after some high profile wins and listen to some of his constituents, who don’t want wholesale deportations that would disrupt the labor force. Again, consensus seems to have moved in this direction as well, but our conviction on this base case is medium (at best) and there could be risks that are not being priced in appropriately.

-

The natural ebbs and flows of supply and demand. We were in the camp that believed inflation was under control, but not tamed (call it, settling into a 1.75% to 2.75% range). As businesses are allegedly pulling forward purchases to avoid potential tariffs, as China continues to try to stimulate its economy, and as we see policy to promote “onshoring,” there are some risks of inflation moving back to the high end of our range, which would likely make the Fed (and bond markets) uncomfortable.

-

Commodity prices should help the inflation story if we really are going to see a “Drill Baby Drill” mentality. Or, as discussed in detail last weekend (yes, I’m referring to that fairly often, but it forms the building blocks for much of our current work), we could see a pushback against “Not In My Backyard”, but commodity prices should remain under control (while commodity related companies can do very well with increased production).

Rates

Positioning has been and will continue to be a factor.

I’ve been pointed to the “Commitment of Traders” report: there is a lot of short interest by speculators, especially in the 10-year part of the curve. It apparently has been coming down, but if traders remain short, it will continue to help support bond prices. TLT, a 20+ year ETF, has been seeing outflows even as yields went higher – another potential indicator that positioning remains “underweight” bonds.

The negative buzz around the deficit and bond yields seems to have dissipated. In a quick note on Friday to our capital markets team and via Bloomberg to the clients I’m in IB chats with, we reduced our bullish outlook on bonds at 4.19% on 10s.

We actually saw buying right up to the last minute on Friday’s trading, but I think with the “index extension” trade over and back to full days to trade bonds, it will be difficult for the rally to continue Our target was 4.1% to 4.2%, and while we are at the high end of our range, the rally has been almost too ferocious of late to be truly believable. The fears around tariffs, immigration, and the deficit (which were overdone), have now been replaced with a degree of complacency that doesn’t seem deserved.

China TIC data showed China holding $772 billion of Treasuries at the end of September. That number has been between $780 billion and $767 billion (a very narrow range) since February. There is no obvious reason for China to grow their holdings, and if anything, as they continue their efforts to stimulate their economy and gird for potential tough negotiations with Trump, we could see them lowering the amount held in the coming months. Not a big problem for markets, but not helpful as we have a lot of bonds to auction in the coming months.

The Fed:

-

1 cut in the next two meetings, probably this one.

-

A terminal rate of 3.875% next year, a bit above the 3.45% priced in for December 2025 (according to the Bloomberg WIRP function).

Bond Yields:

-

Expect the 10-year to inch a touch higher, pushing back towards 4.3%, with a lot of difficulty getting back to 4%.

Should be a good “range trading” environment, with a much greater risk of 50 bps higher than 50 bps lower from here, for the long end.

Credit

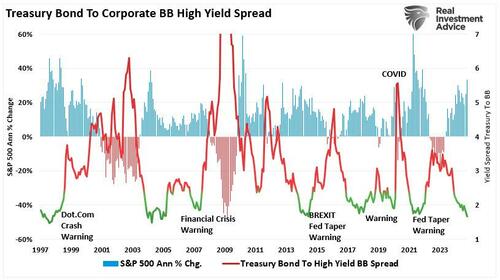

It has been almost six months since we devoted serious attention to the credit markets.

Back in June, we published How Tight Can Credit Spreads Go?, and were unequivocally and unapologetically bullish on credit. We listed trends like private credit, banks competing for lending (to grow their net interest margin), and how much the high yield bond market has changed as reasons why fretting over old charts makes little sense. We dragged out our old standbys – Maslow’s Hierarchy of a Credit Bubble, The 5 Circles of Bond Investor Hell, and a picture of one of the remaining IG 200 hats! If you lived through the GFC and traded CDX indices, you likely remember the hats.

While CDX didn’t get to 20 bps, it has traded very well, as has any measure of corporate bond spreads.

While I remain very comfortable with credit, it is more difficult to sit here near the lows and continue to add to credit. It might not take much to “upset” the apple cart here, at least a little. While the arguments for liking credit so much (at what already seemed like tight levels back in June) largely remain in place, they are all a bit worn here. Just like that favorite shirt that is still up there on your list, but you can tell that it is getting dated.

If you go back two years, we are still at, or near, the lowest average yield for the corporate bond index (it varies with time, depending on the type of issuance, maturity, rating, etc.). We’ve seen a brief reprieve on the rates side, but even though I’m bullish credit (kind of) and bullish rates (but not really at this moment), the Bloomberg League Tables show $1.58 trillion issued this year and $1.2 trillion issued last year.

The number of scenarios that are likely to play out, ending with higher average yields on this index, are more numerous and plausible than those scenarios that drive this average yield lower.

-

Much lower Treasury yields. I don’t see how we get to much lower Treasury yields from here, without some sort of a problem facing the economy. Something that we’re trying to do could backfire, but I find it difficult to believe that credit spreads will remain tight if we see Treasuries rally significantly from here. Sure, we can get back to 4%, but the scenario for a “benign” move back to 3.7% doesn’t seem plausible to me. I’m recalling a longtime client once telling me that the best interest rate hedge, if you own high-yield bonds, is to own Treasuries. It sounds backwards, but works surprising well in times of stress – which is what would have to be occurring to push yields lower now.

-

Much higher Treasury yields. This risk seems much greater than getting much lower yields (especially as the opposite view becomes consensus). It is extremely difficult for spreads to keep up with bond yields. It just becomes difficult for spreads to move even 10 bps tighter from these levels, if bond yields move 25 bps higher. So yes, higher Treasury yields will likely be accompanied by tighter spreads, but all-in yields will be higher.

Sure, Goldilocks could make an appearance and let overall yields go lower, but Goldilocks tends to be a better acquaintance of equity traders than fixed income traders!

Bottom Line

If you are a fixed income asset manager, you can switch to moderately underweight duration here. If you are a corporate bond manager, I think it’s time to get back down to a normal, rather than overweight, position. Maybe even inch towards underweight/short. While it is anathema for hedge funds to think about running IG credit without rate hedges, I think betting on overall yields going higher is the right move, as scenarios with significantly lower overall yields seem unlikely.

If you are an issuer, do the opposite and look for opportunities to sell debt at reasonable yields. While some people will be on vacation, coupon payments, maturing debt, and the pressure to match indices do not take time off in December. There will be cash coming into the market, and in this day and age, even desks that are half-staffed can process a LOT of bonds! I’d rather take advantage of what I think will turn out to be a decent overall yield, relative to what we might see in January.

If you are an equity investor, nothing has really changed – be nimble, trade the ranges, and be overweight sectors that are catching up. Seasonality should still be helpful, but since people have been talking about (and presumably positioning for) seasonality since September, I’m a bit skeptical it will be overwhelmingly strong, at least at the start of the month.

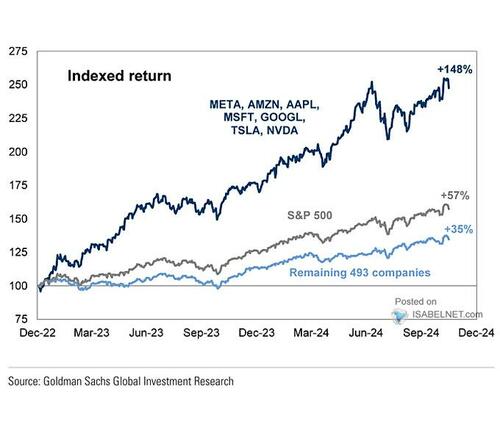

Be long on risks that benefit from a push to extract and refine commodities, if not domestically, much closer to home (and further away from China). Be wary of big tech at these valuations and watch carefully for China’s attempts to push their brands globally, especially into emerging markets – that is a risk that still seems largely dismissed, even as it is occurring.

Everything that comes across my stream in terms of CRE scares me, which the contrarian in me finds even more tempting. The exact opposite is occurring with crypto, but watch out for a rug pull there. Hopefully you all had a great Thanksgiving weekend and a fun holiday season, but I suspect that the market will create multiple opportunities to adjust portfolios as D.C. will remain front and center.

Tyler Durden

Sun, 12/01/2024 – 16:20

via ZeroHedge News https://ift.tt/QU6YaBc Tyler Durden