The End Of Economic Growth: Energy Shortages Drive Global Downturn

Authored by Gail Tverberg via Our Finite World,

-

The global economy is expected to enter a recession in 2025 due to a decline in the availability of crude oil, coal, and uranium relative to population.

-

Government attempts to stimulate the economy through debt will lead to inflation rather than growth, as energy supplies are constrained.

-

High interest rates, low energy prices, and a decline in industrial output will characterize the economic landscape in 2025.

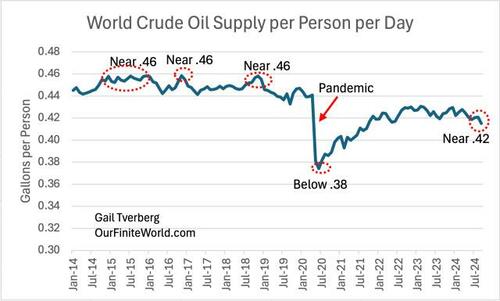

As the world enters 2025, the critical issue we are facing is Peak Crude Oil, relative to population. Crude oil has fallen from as much as .46 gallons per person, which was quite common before the pandemic, to close to .42 gallons per person recently (Figure 1).

Figure 1. World crude oil production per person, based on data of the US EIA. Data through September 2024.

People have a misimpression regarding how world peak oil can be expected to behave. The world economy has continued to grow, but now it is beginning to move in the direction of contraction due to an inadequate supply of crude oil. In fact, it is not just an inadequate crude oil supply, but also an inadequate supply of coal (per person) and an inadequate supply of uranium.

We know that when a boat changes direction, this causes turbulence in the water. This is similar to the problems we are currently seeing in the world economy. Physics dictates that the economy needs to shrink in size to match its energy resources, but no country wants to be a part of this shrinkage. This indirectly leads to major changes in elected leadership and to increased interest in war-like behavior. Strangely enough, it also seems to lead to higher long-term interest rates, as well.

In this post, I share a few thoughts on what might lie ahead for us in 2025, in the light of the hidden inadequate world energy supply. I am predicting major turbulence, but not that things fall apart completely. Stock markets will tend to do poorly; interest rates will remain high; oil and other energy prices will stay around current levels, or fall.

[1] I expect that the general trend in 2025 will be toward world recession.

With less oil (and coal and uranium) relative to population, the world can be expected to produce fewer goods and services per person. In some sense, people will generally become poorer. For example, fewer people will be able to afford new cars or new homes.

This trend toward lower purchasing-power tends to be concentrated in certain groups such as young people, farmers, and recent immigrants. As a result, older people who are well-off or firmly established may be able to mostly ignore this issue.

While the shift toward a poorer world has partially been hidden, it has been a huge factor in allowing Donald Trump to be voted back into power. Major shifts in leadership are taking place elsewhere, as well, as an increasing share of citizens become unhappy with the current situation.

[2] Many governments will try to hide recessionary tendencies by issuing more debt to stimulate their economies.

In the past, adding debt was found to be effective way of stimulating the world economy because energy supplies supporting the world economy were not seriously constrained. It was possible to add new energy supplies, quite inexpensively. The combination of additional inexpensive energy supplies and additional “demand” (provided by the added debt) allowed the total quantity of goods and services produced to be increased. Once energy supplies started to become seriously constrained (about 2023), this technique started to work far less well. If energy production is constrained, the likely impact of added debt will be added inflation.

The problem is that if added government debt doesn’t really add inexpensive energy, it will instead create more purchasing power relative to the same number, or a smaller number, of finished goods and services available. I believe that in 2025, we are heading into a situation where ramping up governmental debt will mostly lead to inflation in the cost of finished goods and services.

[3] Energy prices are likely to remain too low for fossil fuel and uranium producers to raise investments from their current low levels.

Recession and low prices tend to go together. While there may be occasional spikes in oil and other energy prices, 2025 is likely to bring oil and other energy prices that are, on average, no higher than those of 2024, adjusted for the overall increase in prices due to inflation. With generally low prices, producers will cut back on new investment. This will cause production to fall further.

[4] I expect “gluts” of many energy-related items in 2025.

Gluts are related to recession and low prices for producers. The underlying problem is that a significant share of the population finds that finished goods, made with energy products and investment at current interest rates, are too expensive to buy.

Even farmers are affected by low prices, just as they were back at the time of the Great Depression. We can think of food as an energy product that is eaten by people. Farmers find that their return on farm investment is too low, and that their implied wages are low. Low income for farmers around the world feeds back through the system as low buying power for new farm equipment, and for buying goods and services in general.

In 2025, I expect there will be a glut of crude oil due to a lack of purchasing power of many poor people around the world. My forecast is similar to the forecast of the IEA that predicts an oversupply of oil in 2025. Also, a December 2024 article in mining.com says, “A glut of coal in China is set to push falling prices even lower.”

Even wind turbines and solar panels can reach an oversupply point. According to one article, number of Chine solar panel builders seems to be far too high for world demand, leading to a potential shake out. As the share of wind and solar power added to the electric grid increases, the frequency of low or negative payment for wholesale electric power increases. This makes adding more wind turbines and solar panels problematic, after a certain point. We don’t yet have a cost-effective way of storing intermittent electricity for months on end. This seems to be part of the reason why there recently were no bidders for producing more offshore wind power in Denmark.

[5] I expect long-term interest rates to remain high. This will be a problem for new investments of all kinds and for governmental borrowing.

In Section 2 of this post, I tried to explain that a peak-oil impact is likely to be inflation. This occurs because ramping up debt to try to stimulate the economy no longer works to get additional cheap energy products from the ground. Instead of getting as many finished goods and services as hoped for, the added debt tends to produce inflation instead.

I believe that we are reaching a stage of fossil-fuel depletion where it is becoming increasingly difficult to ramp up production, even with added investment. Because of the added debt added in an attempt to work around depletion, inflation in the price of finished goods and services can be expected. Investors are beginning to see long-term inflation as a likely problem. As a result, they are starting to demand higher long-term interest rates to compensate for the expected decrease in buying power.

Figure 2. Interest rates on 10-year US Treasury Securities, in a chart by the Federal Reserve of St. Louis. Data is through December 30, 2024.

Figure 2 shows that US long-term interest rates have varied widely. There was a period of generally dropping long-term interest rates from 1981 to 2020. Starting in late 2020, interest rates began to rise; in 2023 and 2024 they have been in the 4% to 5% range. These relatively high rates are occurring because lenders are demanding higher long-term interest rates in response to higher inflation rates.

Because of inflationary pressures, I expect that long-term interest rates will tend to stay at today’s high level in 2025; they may even rise further. These continued high interest rates will become a problem for many families wanting to purchase a home because US home mortgage rates rise and fall with US 10-year interest rates. Often families are faced with both high home prices and high interest rates. This combination makes mortgage costs a problem for many families.

Governments are also adversely affected. They tend to hold large amounts of debt that they have accumulated over a period or years. Up until 2020, much of this added debt often was at a very low interest rate. As more long-term debt at higher interest rates is added, annual interest rate payments tend to rise rapidly. This can cause a need to raise taxes. Japan, especially, would be affected by higher interest rates because of its high level of government debt, relative to GDP.

Higher interest rates will also raise costs for citizens trying to finance the purchase of homes, and for investors wanting to build wind turbines or solar panels. In fact, investment in any kind of factory, pipelines, or electricity transmission will tend to become more expensive.

In a sense, we seem to be seeing the peak oil problem shifting in a way that affects interest rates and the economy in general. Either higher interest rates or higher oil prices will tend to push the economy toward recession. We tend to look for rising prices to signal an oil supply problem, but perhaps that only works when there is excessive demand. If the problem is really inadequate oil supply, perhaps we should look for higher long-term interest rates, instead.

[6] Industry around the world is likely to be hit especially hard by recessionary tendencies.

Industry requires investment. Higher interest rates make new industrial investment more expensive. Industry is also a heavy user of energy products. Putting these observations together, it shouldn’t come as a surprise if new industrial investment is one of the first places to be cut back because of peak oil supply.

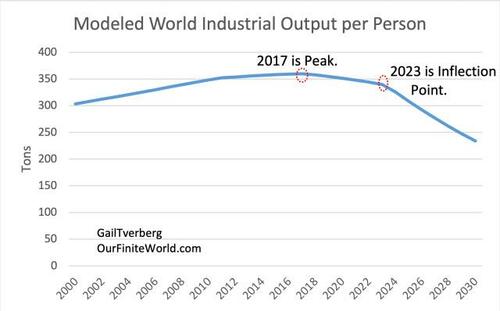

Figure 3. Expected world industrial output, based on calculations I made with using industrial output and population forecasts from detailed output data provided with the article Recalibration of limits to growth: An update of the World3 model” by Arjuna Nebel et al.

The original 1972 Limits to Growth analysis, in its base model, suggested that resources would start to run short about now. The variables in this model were recently recalibrated in the article, “Recalibration of limits to growth: An update of the World3 model.” Based on the detailed data given in the endnotes to the article, I calculated the expected industrialization per capita shown in Figure 3.

Based on Figure 3, this model shows that industrialization per person reached a peak in 2017. Peak industrialization (total, not per capita) occurred in 2018, which coincides with peak crude oil extraction (not per capita).

The model seems to suggest that after an inflection point in 2023 (that is 2024 and after), industrialization will start to fall more steeply. The model shows a decrease in production per capita of 4.1% in 2024 and of 5.3% in 2025. Such decreases would push the world economy toward recession.

The model suggests that people, on average, are getting poorer in terms of the quantity of goods and services they can afford to buy. New cars, motorcycles, and homes are becoming less affordable. Heavily industrialized countries, such as China, South Korea, and Germany are likely to be especially affected by headwinds to industrialization. I expect that the economic problems in these countries will continue and are likely to worsen in 2025.

[7] The US has tried to isolate itself from this nearly worldwide recession. I expect that during 2025, the US will increasingly slip into recession, as well.

There are several reasons for this belief:

(a) The US is heavily dependent upon imports of raw material. China is restricting exports of critical minerals used by the US. This will make it very difficult or impossible to ramp up high tech industries as planned.

(b) The US is heavily dependent on Russia for supplies of enriched uranium. Any plan for added nuclear electricity needs to consider where the uranium to power these plants will come from. It also needs to consider how this uranium will be enriched to the required concentration of uranium-235.

(c) If the US can ramp up crude oil and natural gas production, this can perhaps counter this trend toward US and world recession. Unfortunately, recent US oil supply has not been ramping up; instead its production has been fairly flat. Natural gas production has actually been lower since February 2024. Plans have been made to rapidly ramp up US liquefied natural gas (LNG) exports, but these plans cannot work if the US natural gas supply is already decreasing.

(d) The US government has had an advantage in borrowing because the US dollar is the world’s reserve currency. As such, the US is, in some sense, the first borrower, pulling the rest of the world along. The US, by making its short term interest rates higher than those of many other countries, was able to largely escape recession 2023 and 2024. Additional investment was attracted to the US by these higher interest rates. But the US cannot follow this strategy indefinitely. For one thing, a high US dollar handicaps exports. For another, interest costs on government debt become burdensome.

(e) Donald Trump has plans to close inefficient parts of government. These changes, if enacted, will reduce “demand” within the economy because workers in these sectors will lose their jobs. Over the longer term, these changes might be beneficial, but over the short term, they are likely to be recessionary.

(f) It is difficult for the US to do much better than the rest of the world. If the rest of the world is in recession, the US will tend to head in that direction, as well.

[8] I expect more conflict in 2025, but today’s wars will not look much like World War I or World War II.

Today, not many countries are able to build huge fleets of fighter airplanes. Even building drones and bombs seems to require supply lines that extend around the world. So, instead, wars are being fought in non-military ways, such as with sanctions and tariffs.

I expect that this trend away from direct military conflict will continue, with more novel approaches such as internet interference and stealth damage to infrastructure taking place instead.

I do not expect that nuclear bombs will be used, even when there is direct conflict between powerful adversaries. For one thing, uranium in these bombs is needed for other purposes. For another, there is too much chance of retaliation.

[9] I expect many types of capital gains will be low in 2025.

The situation we are facing now is the opposite of the drop in long-term interest rates observed between 1981 and 2020, in Figure (2), above. This historical drop in interest rates made it possible for businesses to more easily finance new investments. It also made it possible for individual citizens to be able to afford more homes and cars. It should not be surprising that this period has been a time of rising stock market prices, especially in the United States.

The world’s economic problem is that it no longer has the tailwind of falling long-term interest rates. Instead, rising long-term interest rates are becoming a headwind. Home prices are un-affordably high for most potential buyers at today’s interest rates. A similar problem faces those hoping to purchase agricultural equipment and farmland at today’s high prices and high interest rates.

We should not be surprised if home and farm prices stabilize and begin to fall. Prices of shares of stock are likely to encounter similar headwinds. Prices of derivative investments may perform even worse than the shares themselves.

Recently, a great deal of the strength of the US market has been in a few stocks. Artificial Intelligence (AI) needs to very quickly provide a lot of benefit to the stock market as a whole for this to change. I cannot imagine this happening. With the US slipping toward recession, I expect that the US stock market will at best plateau in 2025.

[10] With less energy available and higher interest rates on government debt, I expect to see more government organizations disbanding.

It takes energy, directly and indirectly, to operate any kind of governmental organization. Eliminating governmental organizations is one way of saving energy. This is what happened when the central government of the Soviet Union collapsed in 1991. I would think that parallel kinds of changes could start happening in the next few years, in many parts of the world.

At some time, perhaps as soon as 2025, the European Union could collapse. If things are going badly for many member countries, they will be less willing to support the European Union with their tax revenues. Other organizations that seem like they could be in peril include NATO and the World Trade Organization.

In some ways, such shrinkage would be in parallel with Trump’s plan for eliminating unnecessary governmental organizations within the United States. All these organizations require energy; cutting their number would go some way toward reducing crude oil and other energy consumption.

[11] It is possible that the world economy will eventually get itself out of its apparent trend toward recession, but I am afraid this will happen long after 2025.

We know that the world economy tends to operate in cycles. We would like to believe that the apparent current down-cycle is just temporary, but we can’t know this for sure. Physics tells us that we need energy supplies of the right kind for any action that contributes to GDP. Running short of energy supplies is therefore a very worrisome condition.

We also know that there are major inefficiencies in current approaches. For example, oil extraction leaves much of the oil resource in place. In theory, AI could greatly improve extraction techniques.

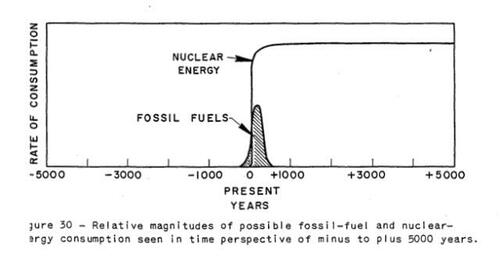

We also know that uranium consumption is terribly inefficient. M. King Hubbert thought that nuclear energy using uranium had amazing potential, but most of this potential remains untapped. Perhaps AI could help in this regard, also. If nothing else, perhaps recycling spent fuel could be made less expensive and problematic.

Figure 4. Figure from Hubbert’s 1956 paper, Nuclear Energy and the Fossil Fuels.

We can’t know what lies ahead. There may be a “religious” ending to our current predicament that we are discounting that is actually the “right story.” Or there may be a “technofix” solution that allows us to avert collapse or catastrophe. But for now, how the current down-cycle will end remains a major cause for concern.

Tyler Durden

Tue, 01/07/2025 – 18:25

via ZeroHedge News https://ift.tt/V0PKRYH Tyler Durden