Key Events This Week: CPI, PPI, Retail Sales, Q1 Earnings Start And Fed Speakers Galore

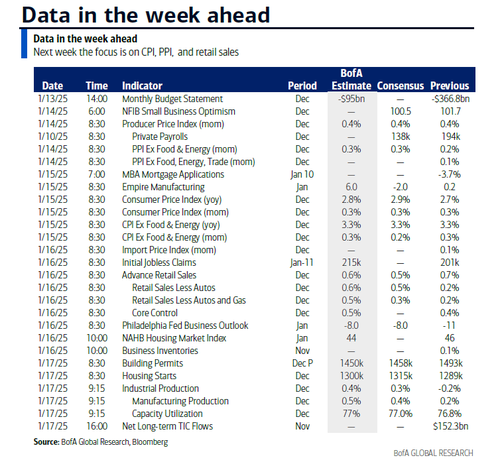

As DB’s Jim Reid writes in his weekly preview note, it’s hard to determine what’s icier at the moment, global bond markets or the weather across much of Northern Europe and even New York where sub zero temperatures have been the norm in recent days. But as the weather warms up a bit, whether the deep freeze in bond markets continues may be determined by how US CPI on Wednesday materializes after Friday’s blockbuster payrolls report. Elsewhere in the US the main highlights are the New York Fed 1-yr inflation expectations (today), PPI (tomorrow), retail sales (Thursday), building starts and permits and industrial production (Friday), and the unofficial start of earnings season on Wednesday with a selection of big banks reporting. Outside of the US, the key events are UK CPI and European Industrial production (Wednesday), UK monthly GDP and the ECB account of the December meeting (Thursday) and China GDP on Friday.

The full calendar of events, including central bank speakers, is at the end as usual but lets now go through the main highlights in more details.

There’s nowhere else to start other than Wednesday’s US CPI that occurs after 10yr UST yields climbed +16.1bps last week to close Friday at their highest since October 2023. DB’s economists expect headline (+0.40% mom forecast vs. +0.31% last month) to be impacted by strong food and energy and eclipse a tamer core (+0.23% vs. 0.31%). This would ensure a YoY rate of 2.9% (+0.2pp) and 3.3% (unch) respectively. The core rate’s steady decline from late 2022 petered in the second half of 2024 around current levels and that’s before Trump’s policies take effect. DB economists also eye how rents will boost this month’s release but with signs of rental disinflation ahead. The curve ball going forward will of course be policy.

For US PPI on Tuesday, headline (+0.4% vs. +0.4%) and core (+0.2% vs. +0.2%) will likely be similar in magnitude to CPI but as ever we will be most focused on the PPI categories that feed into the core PCE deflator namely, health care services, airfares and portfolio management. Elsewhere Thursday’s retail sales is likely to be strong given holiday spending trends in December with headline (+0.6% vs. +0.7%), ex auto (+0.5% vs. +0.2%), and retail control (+0.3% + 0.4%) all firm.

In terms of earnings, the kick-off on Wednesday sees JPMorgan, Goldman Sachs and BlackRock report. Bank of America and Morgan Stanley will follow on Thursday, when investors will be also closely watching the Taiwanese semiconductor company TSMC. DB’s equity strategists expect S&P 500 earnings growth near 13% in Q4, similar to the low double-digit growth seen in recent quarters.

There are also a few political points of interest this week with Senate confirmation hearings for Trump’s cabinet nominees including Secretary of Defense, Secretary of State and Attorney General among others. In France, the new Prime Minister Bayrou will deliver his General Policy Statement tomorrow which will likely be followed by a vote of no confidence which at this stage he will likely win due to abstentions from the far right and the socialist party.

Here is a day-by-day calendar of events, courtesy of DB.

Monday January 13

- Data: US December NY Fed 1-yr inflation expectations, federal budget balance, China December trade balance, Japan November BoP current account balance, BoP trade balance, December bank lending

- Central banks: ECB’s Lane and Rehn speak

Tuesday January 14

- Data: US December PPI, NFIB small business optimism, Japan December Economy Watchers survey, M2, M3, Italy November industrial production

- Central banks: Fed’s Williams and Schmid speak, BoJ’s Himino speaks, ECB’s Rehn, Lane and Holzmann speak, BoE’s Breeden speaks

Wednesday January 15

- Data: US December CPI, January Empire manufacturing index, UK December CPI, RPI, PPI, November house price index, Japan December machine tool orders, PPI, Italy November general government debt, Eurozone November industrial production, Canada December existing home sales, November manufacturing sales

- Central banks: Fed releases the Beige Book, Barkin, Kashkari, Williams and Goolsbee speak, ECB’s Lane, Guindos, Villeroy and Vujcic speak, BoE’s Taylor speaks

- Earnings: JPMorgan, Wells Fargo, Goldman Sachs, Blackrock, Citigroup

Thursday January 16

- Data: US December retail sales, import price index, export price index, January NAHB housing market index, Philadelphia Fed business outlook, New York Fed services business activity, November business inventories, initial jobless claims, UK December RICS house price balance, November monthly GDP, Italy November trade balance, Eurozone November trade balance, Canada December housing starts

- Central banks: ECB’s account of the December meeting, BoE’s bank liabilities survey (Q4 2024)

- Earnings: TSMC, UnitedHealth, Bank of America, Morgan Stanley

Friday January 17

- Data: US December industrial production, capacity utilisation, housing starts, building permits, November total net TIC flows, China Q4 GDP, December industrial production, retail sales, home prices, property investment, UK December retail sales, Italy November current account balance, ECB November current account, Canada November international securities transactions

- Central banks: ECB’s Escriva speaks

- Earnings: Truist Financial, Schlumberger

* * *

Finally, the key economic data releases this week are the CPI report on Wednesday and the retail sales report on Thursday. There are several speaking engagements by Fed officials this week.

Monday, January 13

- There are no major economic data releases scheduled.

Tuesday, January 14

- 08:30 AM PPI final demand, December (GS +0.3%, consensus +0.4%, last +0.4%); PPI ex-food and energy, December (GS +0.2%, consensus +0.3%, last +0.2%); PPI ex-food, energy, and trade, December (GS +0.2%, consensus +0.3%, last +0.1%);

- 10:00 AM Kansas City Fed President Schmid (FOMC voter) speaks: Kansas City Fed President Jeff Schmid will speak to the Central Exchange in Kansas City. A Q&A is expected. On January 9, Schmid said “My read is that interest rates might be very close to their longer-run level now. Regardless, I am in favor of adjusting policy gradually going forward and only in response to a sustained change in the tone of the data. The strength of the economy allows us to be patient.”

- 03:05 PM New York Fed President William (FOMC voter) speaks: New York Fed President John Williams will give opening remarks at a New York Fed event. Speech text is expected. On December 20, Williams said “I don’t think we’re at the long run neutral rate at all. I think we’re still at a restrictive stance of policy given where the fed funds rate is and where inflation is.” He also said “My baseline trajectory is moving rates down toward neutral. We need to be data dependent, and we have time to be patient and really assess the data. I think we’re in a great place, well positioned, and we just need to keep doing what we’re doing.”

Wednesday, January 15

- 08:30 AM Empire State manufacturing survey, January (consensus +3.0, last +0.2)

- 08:30 AM CPI (MoM), December (GS +0.40%, consensus +0.3%, last +0.3%); Core CPI (MoM), December (GS +0.25%, consensus +0.2%, last +0.3%); CPI (YoY), December (GS +2.91%, consensus +2.9%, last +2.7%); Core CPI (YoY), December (GS +3.27%, consensus +3.3%, last +3.3%): We estimate a 0.25% increase in December core CPI (month-over-month SA), which would leave the year-over-year rate unchanged on a rounded basis at 3.3%. Our forecast reflects an increase in used car prices (+1.0%) reflecting an increase in auction prices, another increase in airfares (+1.0%) reflecting a boost from seasonal distortions, and a slight rebound in the car insurance category (+0.3%) based on continued—albeit decelerating—increases in premiums in our online dataset. We expect the shelter components to rebound slightly on net (OER +0.30% vs. +0.23% in November; primary rent +0.25% vs. +0.21% in November). We expect seasonal distortions to boost the communications category relative to its deflationary trend (GS forecast flat vs. -1.0% in November). We estimate a 0.40% rise in headline CPI, reflecting higher food (+0.35%) and energy (+2.3%) prices. Our forecast is consistent with a 0.18% increase in core PCE in December. We will update our core PCE forecast after the CPI is released.

- 09:20 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will speak at an event in Annapolis, Maryland. Speech text and a Q&A are expected. On January 3, Barkin said “Inflation is not yet back to target, so we still have more work to do, but we don’t think we need to be nearly as restrictive as we once were to finish that job.” He also said that “The layoff rate remains near historic lows. A low hiring, low firing labor market is still a healthy one,” and added that “it feels like the current labor market equilibrium is more likely to break toward hiring than toward firing.”

- 10:00 AM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will give welcoming remarks and participate in a fireside chat.

- 11:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks at the CBIA Economic Summit and Outlook 2025. Speech text and a Q&A are expected.

- 12:00 PM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will speak at the Midwest Economic Forecast Forum. A Q&A is expected. On January 10, Goolsbee said “I think [the December employment report was] a strong report and it makes me more comfortable that the labor market is stabilizing at something like full employment.” He also said “If conditions are stable, and we don’t have an uptick in the inflation rate, and we keep having it come in around 2% with stable employment, I think that rates should go down to where I think neutral is. So, over the next 12-18 months, rates will be a lot lower than they are now.”

- 02:00 PM Beige Book, January meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the December FOMC meeting period noted that economic activity rose slightly in most districts, and “expectations for growth rose moderately across most geographies and sectors.” In this month’s Beige Book, we look for anecdotes related to the evolution of labor demand and firms’ expectations of activity growth for the remainder of the year.

Thursday, January 16

- 08:30 AM Philadelphia Fed manufacturing index, January (GS -5.0, consensus -5.0, last -10.9)

- 08:30 AM Retail sales, December (GS +0.6%, consensus +0.6%, last +0.7%); Retail sales ex-auto, December (GS +0.5%, consensus +0.5%, last +0.2%); Retail sales ex-auto & gas, December (GS +0.5%, consensus +0.4%, last +0.2%); Core retail sales, December (GS +0.4%, consensus +0.4%, last +0.4%): We estimate core retail sales expanded 0.4% in December (ex-autos, gasoline, and building materials; month-over-month SA), reflecting healthy growth in measures of card spending. We estimate a 0.6% increase in headline retail sales, reflecting lower gasoline prices but higher auto sales.

- 08:30 AM Import price index, December (consensus -0.2%, last +0.1%); Export price index, December (consensus +0.1%, last flat)

- 08:30 AM Initial jobless claims, week ended January 11 (GS 205k, consensus 210k, last 201k): Continuing jobless claims, week ended January 4 (consensus 1,877k, last 1,867k)

- 10:00 AM Business inventories, November (consensus +0.1%, last +0.1%)

- 10:00 AM NAHB housing market index, January (consensus 45, last 46)

Friday, January 17

08:30 AM Housing starts, December (GS +3.0%, consensus +2.8%, last -1.8%): Building permits, December (consensus -2.2%, last +5.2%)

09:15 AM Industrial production, December (GS +0.1%, consensus +0.3%, last -0.1%): Manufacturing production, December (GS +0.3%, consensus +0.2%, last +0.2%)

Capacity utilization, December (GS 76.9%, consensus 77.0%, last 76.8%): We estimate industrial production increased +0.1%, reflecting strong natural gas production but weak electricity and oil production. We estimate capacity utilization increased to 76.9%.

Tyler Durden

Mon, 01/13/2025 – 10:25

via ZeroHedge News https://ift.tt/jOKuL8X Tyler Durden