JPMorgan Shares Jump On Stellar Q4 Earnings, Boost To 2025 NII Forecast

After last week’s earnings debacle by Jefferies, which is the bank widely viewed as a harbinger of how the rest of Wall Street does in any given quarter, some expected modest results from the big banks when they began reported Q4 earnings today. However, concerns proved to be unfounded based on the solid results by the largest US bank, JPMorgan, which just reported stellar earnings and officially launched Q4 earnings season. Here is a snapshot of what JPM reported for Q4:

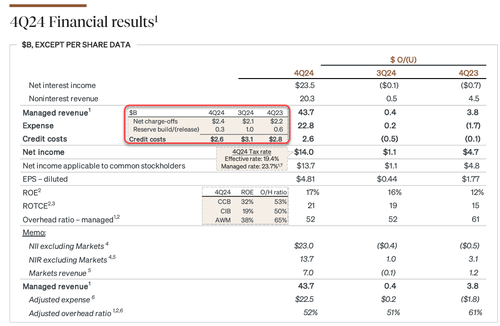

- Q4 EPS $4.81, beating estimates of $4.11 and up a whopping $1.77 from a year ago.

- Q4 net interest income dropped 3% but still surpassed expectations, coming in at $23.4 billion in the quarter, beating estimates of $23.1BN. The company said this year’s haul could be about $94 billion, more than the $89.8 billion analysts had been expecting.

- Q4 Adjusted revenue $43.74 billion, beating estimates of $42.01 billion

- FICC sales & trading revenue $5.01 billion, beating estimate $4.37 billion

- Equities sales & trading revenue $2.04 billion, missing estimates of $2.32 billion

- Investment banking revenue $2.60 billion, beating estimates of $2.56 billion

- Advisory revenue $1.06 billion, beating estimates of $921.7 million

- Equity underwriting rev. $498 million, beating estimates of $445.9 million

- Debt underwriting rev. $921 million, missing estimates of $1.03 billion

- Net yield on interest-earning assets 2.61%, beating estimates of 2.53%

- JPM’s provision for credit losses was $2.63 billion, below the estimate $3.04 billion, and was the result of $2.36BN in chargoffs (also below the $2.39BN estimated) coupled with another $267 million reserve build (which however was well below last quarter’s $1 billion)

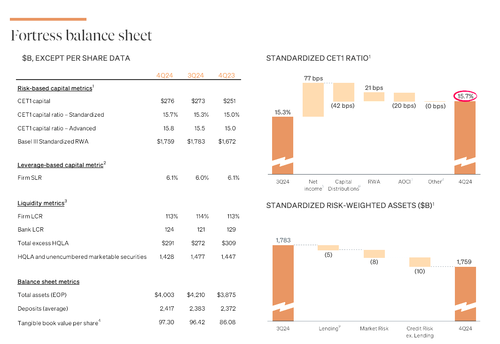

Not surprisingly, the balance sheet of the largest US bank, remains “fortress” and how can it not when the government hands the bank the best assets of failed banks on a silver platter, which keeping the toxic sludge for US taxpayers. Here are the details:

- Total deposits $2.41 trillion, below the estimate $2.44 trillion

- Loans $1.35 trillion, matching the estimate $1.35 trillion

- Return on tangible common equity 21%, beating the estimate 17.2%

- Return on equity 17%, beating estimates of 14.1%

- Standardized CET1 ratio 15.7%, beating the estimate 15.2%

- Managed overhead ratio 52%, missing estimate 54.7%

- Tangible book value per share $97.30, beating the estimate $97.10

- Book value per share $116.07, missing the estimate $116.65

- Cash and due from banks $23.37 billion, beating the estimate $22.86 billion

What is notable is that for the first time in a while, JPM’s total asset base shrank, with total assets down to exactly $4.0 trillion, down from $4.2 trillion last quarter, even as deposits rose again from $2.383 trillion to $2.417 trillion.

Looking at the expense side of things, here too there was good news with JPM reporting…

- Total compensation expenses of $12.47 billion, below the estimate $12.71 billion

- Non-interest expenses $22.76 billion, below the estimate of $22.96 billion

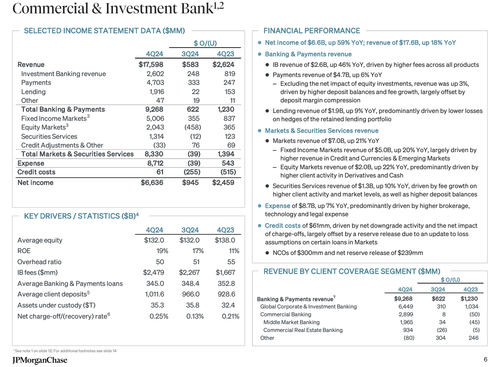

Turning to the all important Commercial and Investment bank group, as noted above, here things were generally stronger than expected, with JPM beating on FICC, Investment banking, advisory, and equity underwriting, while missing on Equity sales and trading and on debt underwriting. Overall, net income for the group was $6.6BN, up 59% YoY on revenue of $17.6BN, up 18% YoY. Of these, Markets revenue was $7.0 billion, up an impressive 22% YoY with the details as follows.

- FICC sales & trading revenue $5.01 billion, beating estimates $4.37 billion, and up 20% YoY, largely “driven by higher revenue in Credit and Currencies & Emerging Markets”

- Equities sales & trading revenue $2.04 billion, missing estimates of $2.32 billion, and up 22% YoY, predominantly driven by higher client activity in Derivatives and Cash

- Securities Services revenue of $1.3B, up 10% YoY, driven by “fee growth on higher client activity and market levels, as well as higher deposit balances”

- Investment banking revenue $2.60 billion, beating estimates of $2.56 billion

- Advisory revenue $1.06 billion, beating estimates of $921.7 million

- Equity underwriting rev. $498 million, beating estimates of $445.9 million

- Debt underwriting rev. $921 million, missing estimates of $1.03 billion

On the expense side, JPM reported $8.7B, up 7% YoY, predominantly driven by higher brokerage, technology and legal expense; As for credit costs., they were $61mm, driven by net downgrade activity and the net impact of charge-offs, largely offset by a reserve release due to an update to loss assumptions on certain loans in Markets.

Commenting on the quarter, CEO Jamie Dimon said that “the US economy has been resilient” however, “two significant risks remain. Ongoing and future spending requirements will likely be inflationary, and therefore, inflation may persist for some time. Additionally, geopolitical conditions remain the most dangerous and complicated since World War II.”

Dimon also said that client asset net inflows totaled $486B in 2024, adding that “we have consistently said that regulation should be designed to effectively balance promoting economic growth and maintaining a safe and sound banking system.”

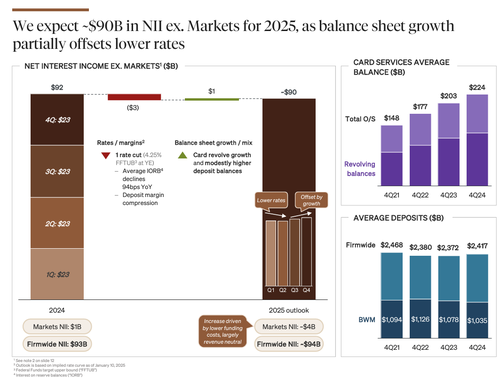

Looking ahead, JPM said that it expects $90BN in Net Interest Income ex markets for 2025, as its “balance sheet growth offsets the drop in rates.” Including markets, NII would be $94 billion, well above the $89.8BN analyst estimate.

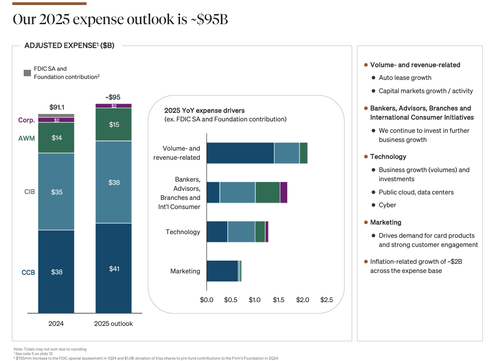

On the expense side, JPM sees about $95 billion in total adjusted expense, up from $91.1BN in 2024, due to expenses increases across all sectors.

JPMorgan did a U-turn on 2025 NII guidance in the quarter. In October, Chief Financial Officer Jeremy Barnum said the $87 billion consensus estimate at the time was “a little toppy.” By December, however, the interest-rate outlook was higher, and Marianne Lake, who runs the lender’s sprawling consumer unit, told investors that 2025 NII could come in about $2 billion higher.

Finally, the bank also expects an card service NCO rate of 3.6% for the full year.

Commenting on the results, Goldman bank analyst Richard Ramsden gave it a thumbs up, saying “we expect a positive market reaction to results, as JPM: 1) delivered better NII and fees; 2) increased the 2025 NII ex Markets guidance and implied all in NII guidance; and 3) kept flat 2025 expense guidance.”

Some more highlights from his note:

- Summary of key quarterly trends: The quarterly core ROTCE of 20.2% came in 230bps above the Street, and 325bps above management’s medium-term ROTCE guidance of 17%. JPM’s NII came in better than GSe/consensus, driven by a 9bps NIM beat, on much lower deposit costs, despite 2% lower avg. earning assets (lower loans, but higher cash and securities). Core fee income was 4% higher, on higher capital markets, and consumer fees. The core efficiency ratio was 230bps better than like consensus. The company repurchased $4.3bn of stock (gross) in the quarter, with a CET1 ratio of 15.7%, vs. a 13.5% target.

- Summary of guidance and vs. expectations: Management increased the 2025 NII ex Markets guide to $90bn vs. ~$89bn previously, and rolled out an all in NII guidance of $94bn, which was vs. an implied guidance of ~$92bn, in our view, and compared to GSe/Street of $92.7bn/$91.1bn. They also kept the 2025 expense guidance flat at ~$95bn, and vs. GSe/Street of $95.9bn/$95.3bn.

- We look for further clarity on: 1) the key assumptions underpinning the NII guide into 2025, given the much better 4Q24 ($424mn better than consensus, or ~$1.7bn annualized), and much lower deposit costs; 2) the capital markets outlook, given questions around the pace of the build in investment banking (aside from in DCM); 3) the ability to generate efficiency improvements over the next two years, after continued, robust expense discipline in the quarter, combined with better revenue (higher fees and higher NII vs. the Street, and lower expenses); 4) the path and speed of credit normalization; and 5) an early read on uses of excess capital, given the potential for regulatory reform under the new US presidential administration.

Without any major red flags in the earnings which generally beat across the board, shares of JPMorgan, up 46% in the 12 months through Tuesday, gained 2.2% in early trading.

JPM’s Q4 investor presentation can be found here.

Tyler Durden

Wed, 01/15/2025 – 07:58

via ZeroHedge News https://ift.tt/DAqNhmL Tyler Durden