US equity futures and global markets are tumbling as rising weekend fears that China’s DeepSeek’s R1 AI platform could lead to a collapse in capex spending plans, have culminated in a wholesale rout of tech names around the world. And since tech is by and far the most important sector to global equities, almost nothing has been spared (with the possible exception of the energy sector which for months was used as a pair trade to fund tech longs). As a result, what as of 6pm on Sunday night (when futs opened) was a mere DeepSelling trickle…

… has since transformed into a full-blown DeepSink rout, sending S&P futures down as much as 3% and Nasdaq futures down 5%, before a modest bounce. As of 8:00am, S&P futs were down 2.3%, and Nasdaq futs tumbled 3.9%, on futures volume that was about four times the 30-day average, as the the DeepSeek story forces investors to “question the market position of all the MegaCap Tech names and the entire AI supply chain.” Mag7 names are all plunging premarket by 4-6% while some former leaders are getting absolutely nuked such as NVDA -11%, AVGO -10.8%, VRT -18%. The global risk off panic means bond yields are collapsing while the USD is moving lower and commodities are mixed. Mag7 earnings take on heightened importance this week, but the SPX may be down 4-5% ahead of TSLA’s earnings on Weds. As JPM’s market intel team puts it, “Is AI dead or is one of the greatest buy-the-dip trades in recent memory?” Separately, President Donald Trump’s threats to impose tariffs on Colombia, which sent the dollar higher, also contributed to the contracts’ decline. Trump pulled the threat after reaching a deal with the Colombian government on the return of deported migrants.

In premarket trading, Nvidia plunged 12% in US premarket trading, setting it up for the biggest drop on record in terms of market capitalization after Cramer said last week it could be “breaking out.”

All AI-linked stocks slumped amid concern that AI models from Chinese firm DeepSeek could disrupt US technological leadership. C3.ai (AI) -6%, Palantir (PLTR) -6%, Super Micro Computer (SMCI) -9%; Chip-related stocks decline: Broadcom (AVGO) -12%, Lam Research (LRCX) -5%, Marvell Technology (MRVL) -14%; AI infrastructure-related stocks also traded lower: Amphenol (APH) -11%, ARM Holdings (ARM) -10%, Oracle (ORCL) -7%. The tech slump triggered by DeepSeek sent ripples into other industries. Needless to say, all Mag7 names were sharply lower: Alphabet (GOOGL) -3%, Amazon (AMZN) -4%, Apple (AAPL) -0.7%, Microsoft (MSFT) -6%, Meta Platforms (META) -3%, Nvidia (NVDA) -12% and Tesla (TSLA) -4%. Power stocks, which are typically less volatile, slid on fears of weaker electricity demand from AI data centres. Here are some other premarket movers:

- Akero Therapeutics (AKRO) surges 110% after the drug developer gave promising results from a mid-stage trial of its experimental treatment for patients with cirrhosis due to metabolic dysfunction-associated steatohepatitis — a liver disease.

- AT&T Inc. (T) climbs 2% after posting fourth-quarter results that beat Wall Street projections, driven by seasonal promotions and bundled product offerings.

- For some reason, cryptocurrency-exposed stocks also dropped as the emergence of a new Chinese artificial intelligence model triggered a global selloff in riskier assets. Coinbase (COIN) -4%, Mara Holdings (MARA) -5%, Riot Platforms (RIOT) -6%

- Logility (LGTY) jumps 23% after Aptean agreed to acquire the software company for $14.30 per share.

- SoFi Technologies (SOFI) tumbles 13% after the fintech company’s first quarter and full-year forecasts for adjusted Ebitda trail consensus expectations.

- Technology stocks slide after DeepSeek raised questions about high valuations of companies such as Nvidia.

The buzz over DeepSeek emerged over the weekend, with tech analysts saying the company’s AI model provides comparable performance to the world’s best chatbots at a fraction of the price. For some thoughts see here:

For investors, it put a question mark over an AI-driven rally that’s added $15 trillion to the Nasdaq 100 since 2022 and been at the heart of US equity gains.

“It does put a lot of scrutiny at the level of valuations,” said Benedicte Lowe, equity derivatives strategist at BNP Paribas Markets 360. “We are quite positive on US tech stock sector. But it puts pressure on the outlook and is a turning point for the companies at this stage in the cycle.”

President Trump’s spat over the weekend with Colombia also added to the bearish mood in the market. Trump had announced sweeping tariffs on the country and then abruptly changed course after reaching a deal on the return of deported migrants. “The incident again shows that tariffs are a negotiating tool, but markets need to price in some premium for the volatility that such announcements will bring,” wrote Mohit Kumar, a strategist at Jefferies. The Mexican peso underperforms with a 1% fall.

Tech will remain in focus for traders, with four of the Magnificent Seven stocks — Apple, Microsoft, Meta and Tesla — scheduled to release results this week. “With DeepSeek likely to stay in investors’ minds, muted gains for beats and severe punishment for misses may be the outcome of the earnings season,” said Patrick Armstrong, chief investment officer at Plurimi Wealth LLP.

In Europe, ASML Holding NV sank 10%, the biggest selloff since October, weighing on the Europe’s Stoxx 600, which was down 0.6%. Here are some of the biggest movers on Monday:

- ASML and ASM International lead a slide in European semiconductor stocks, while Siemens Energy also sinks, as shares tied to the artificial intelligence industry drop amid concern that AI models from Chinese firm DeepSeek could disrupt US technological leadership.

- BASF shares fall as much as 2.5% after the German company reported preliminary results, with earnings momentum in the chemicals divisions weaker than expected.

- Luxury shares fall as JPMorgan says recent share-price gains for Richemont and Burberry were likely down to company-specific dynamics and may not play out to the same extent for other luxury goods firms.

- Diageo shares fall as much as 1.2% after the distiller said it does not plan to sell the Guinness beer brand or its stake in Moet Hennessy.

- SGS shares jump as much as 7% while Bureau Veritas slides as much as 3.8% after the pair confirmed that talks about a possible combination have ended without a deal being reached.

- Ryanair shares rise as much as 4.2%, touching the highest since May, after a stronger-than-expected performance in the third quarter, driven by healthy close-in bookings during the holiday period.

- Universal Music shares gain as much as 7.6%, the most since August, after the world’s largest record label announced a new multiyear distribution agreement with Spotify Technology which includes new paid subscription tiers and the bundling of music and non-music content.

- WH Smith shares rise as much as 9.3%, their biggest intraday advance since September 11, after a report the company was exploring options, including a potential sale, for its high street unit, which includes more than 500 stores in the UK.

- BAT rises as much as 4.4%, hitting the highest level since March 2023, after an upgrade by UBS in which analysts contend the tobacco giant’s valuation is too low.

Earlier in the session, Asian stocks were steady Monday as Chinese shares’ gains on AI-fueled optimism offset selloffs in India triggered by concerns over an economic slowdown. The MSCI Asia Pacific Index gave up early gains to trade flat. Shares of Alibaba, Tencent and Toyota were among top gainers. Indian stocks, including Infosys and HDFC Bank, fell and weighed on the index. Chinese stocks in Hong Kong led gains at the start of a shortened trading week, with tech firms linked to DeepSeek rallying as investors assessed the Chinese AI app’s popularity. Chinese AI-related stocks reacted positively, with mainland-listed Merit Interactive Co. among those surging by their daily limits. Merit has some of the clearest links to DeepSeek after stating in an earlier filing that it had incorporated the homegrown AI firm’s model into marketing. In Hong Kong, the Hang Seng Tech Index climbed as much as 2% ahead of Lunar New Year holidays this week. Japan’s Topix index climbed, as market participants breathed a sigh of relief that the Bank of Japan’s interest-rate hike last week passed without turmoil. Markets in Taiwan, South Korea, and Australia were closed for a holiday Monday.

“We had a week of relative restraint on Trump’s part with regards to tariffs, with the dollar index easing to lowest level in more than four weeks,” said Kok Hoong Wong, head of institutional equities sales trading at Maybank Securities. “But that changed this morning after Trump slapped tariffs on Colombia, driving US stock futures lower and dollar higher in early Asian trade. DeepSeek, an open-source model that seemed to be able to run on lower-spec GPU, may pose a challenge to Nvidia’s dominance and other popular AI providers such as ChatGPT,” he said.

In FX, the Japanese yen climbs to the top of the G-10 FX leader board, rising 1.3% against the greenback as its safe-haven appeal comes to the fore. The Swiss franc also climbs 0.6%. FX was also hit after Trump announced sweeping tariffs on Colombia before abruptly pulling the threat when Colombia’s president agreed to comply with Trump’s demands. The Mexican peso underperforms with a 1% fall.

In rates, treasuries lead a rally in global government bonds, with US 10-year yields falling as much as 12bp across maturities and all but 30-year having reached lowest levels this year. Haven demand is at play with tech shares leading US stock index futures lower on perceived competitive threat from China’s AI startup DeepSeek. Yields remain at least 9bp lower led by intermediate sectors, steepening 5s30s spread by ~2.5bp toward Friday’s highs; 10-year, down 11bp near 4.51%, outperforms bunds and gilts by ~5bps. US session includes 2- and 5-year note auctions, an accelerated schedule that concludes with 7-year notes Tuesday, before Wednesday’s FOMC policy announcement.

In commodities, oil prices advance, with WTI rising 0.4% to $75 a barrel. Spot gold falls $6 to $2,765/oz. Bitcoin falls 5% to below $100,000.

It’s a busy week, which sees the Fed, ECB, PCE and the bulk of tech earnings; on Monday we start with the December Chicago Fed national activity index (8:30am) and new home sales (10am) and January Dallas Fed manufacturing activity (10:30am)

Market Snapshot

- S&P 500 futures down 2.0% to 6,013.00

- STOXX Europe 600 down 0.6% to 526.86

- MXAP little changed at 182.85

- MXAPJ down 0.3% to 573.64

- Nikkei down 0.9% to 39,565.80

- Topix up 0.3% to 2,758.07

- Hang Seng Index up 0.7% to 20,197.77

- Shanghai Composite little changed at 3,250.60

- Sensex down 1.1% to 75,351.00

- Australia S&P/ASX 200 up 0.4% to 8,408.87

- Kospi up 0.8% to 2,536.80

- German 10Y yield little changed at 2.52%

- Euro down 0.2% to $1.0476

- Brent Futures down 0.1% to $78.40/bbl

- Brent Futures down 0.1% to $78.40/bbl

- Gold spot down 0.3% to $2,761.00

- US Dollar Index little changed at 107.52

Top Overnight news

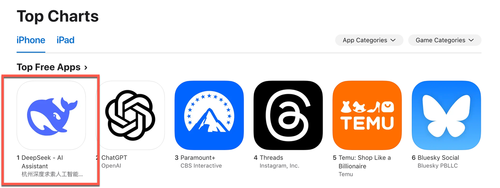

- Nvidia shares tumbled premarket as Chinese startup DeepSeek’s lower-cost AI model — which Marc Andreessen called “AI’s Sputnik moment” — cast doubt on sky-high tech valuations. Nasdaq futures fell more than 4%, putting broader tech stocks on track for a $1 trillion wipeout. ASML dropped more than 10%. DeepSeek’s AI assistant overtook ChatGPT to become the top free app on the US App Store. BBG

- Big Tech earnings this week may add to worries for equities bulls, with profit growth projected to come in at the slowest pace in almost two years. BBG

- US President Trump announced the US will impose emergency 25% tariffs on all Colombian goods coming into the US which will be raised to 50% in one week after Colombia denied entry to two US deportation flights. Trump also announced a travel ban and visa revocations on Colombian government officials and said he will fully impose emergency treasury, banking and financial sanctions on Colombia, while he added that the measures on Colombia are just the beginning.

- Colombian President Petro backtracked and offered his presidential plane to repatriate migrants coming back from the US, although Reuters reported that Petro threatened 50% tariffs on goods from the US in retaliation to measures announced by US President Trump. However, the White House later announced that Colombia has agreed to all of President Trump’s terms including unrestricted acceptance of all illegal aliens from Colombia returned from the US, while fully drafted IEEPA tariffs and sanctions on Colombia will be held in reserve and not signed but visa sanctions issued and enhanced inspections will remain in effect until the first plane of Colombian deportees is returned.

- Mexico reportedly refused a US deportation flight, according to officials cited by Reuters. However, the White House denied reports of Mexico refusing migrant flights and stated that Mexico has accepted several flights in recent days.

- Momentum is growing among US President Trump’s advisers to place 25% tariffs on Mexico and Canada as soon as Saturday ahead of negotiations: WSJ.

- Pete Hegseth was confirmed by the US Senate as Secretary of Defense through a 51-50 vote in which US VP Vance cast the tie-breaking vote.

- Elon Musk reportedly explores blockchain use in the US government efficiency effort.

- China’s economy stumbled in January, with factory activity unexpectedly shrinking to 49.1 after three months of expansion. Economists said the pre-Chinese New Year slowdown was more severe than usual. BBG

- The CSRC unveiled measures to boost index investments and the government approved 52 billion yuan ($7.2 billion) for long-term equity investment. BBG

- Israel started allowing Palestinians to return to northern Gaza, the AP reported. The White House earlier said Israel and Lebanon extended their truce until Feb. 18 as they began talks for the return of Lebanese prisoners. BBG

- German companies unexpectedly became more pessimistic at the start of the year. Ifo’s expectations index fell to 84.2 in January from 84.4 the previous month. BBG

- British business activity slumped and profit warnings rose, reports by the CBI and EY-Parthenon showed. PM Keir Starmer discussed trade on a call with Trump and agreed to meet soon. BBG

- Goldman predicts US sanctions won’t significantly impact Russian oil production because of high freight rates and cheap supply. Non-sanctioned ships are filling the gap left by blacklisted tankers, while the deepening discount of ESPO crude attracts price-sensitive buyers. GIR, BBG.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed in a holiday-thinned start to the week as participants digested disappointing Chinese PMI data, Trump’s tariff announcement on Colombia, and with Chinese start-up DeepSeek threatening US dominance in the AI sector with a low-cost model on par with OpenAI’s o1. Markets in Australia, South Korea and Taiwan were closed for holidays. Nikkei 225 reversed opening gains and dipped back beneath 40,000 amid headwinds from Trump tariffs and Chinese PMIs. Hang Seng and Shanghai Comp were kept afloat on the last trading day for the mainland before the Chinese New Year holiday despite the disappointing PMI data which showed headline Chinese Manufacturing PMI back in contraction territory. Nonetheless, there was notable strength seen in some AI-related stocks after Chinese tech start-up DeepSeek’s low-cost AI model was reported to be on par with OpenAI’s o1.

Top Asian News

- US President Trump said he is in talks with multiple people regarding buying TikTok and will likely have a decision on the app’s future in the next 30 days, while it was separately reported that the White House is working on a plan to have Oracle (ORCL) and an investor group takeover US TikTok.

- China’s Foreign Minister Wang is to visit the UK in February for talks with UK Foreign Secretary Lammy, according to The Guardian.

- China’s President Xi says they will be preventing and resolving risks in key areas and external shocks, to promote a sustained economic recovery and improvement in 2025, via Xinhua.

European bourses are almost entirely in the red while US futures are lower across the board amid the fallout from disappointing Chinese PMI data overnight, Trump’s tariff announcement on Colombia, and with Chinese start-up DeepSeek threatening US dominance in the AI sector with a low-cost model on par with OpenAI’s o1. Euro Stoxx 50 -1.5%, with heavyweight tech and energy names in the region slumping on the DeepSeek update; ASML -10.6%, ASM -14.2% and Siemens Energy -21%. Sectors somewhat mixed with a clear defensive bias given broader market risk aversion, with Tech lagging on the above alongside Energy which is also hit on Trump and Chinese PMIs, factors which weigh on Basic Resources as well.

Top European News

- UK PM Starmer spoke with US President Trump on Sunday and agreed to meet soon, according to the UK government.

- UK PM Starmer is expected to resist pressure from US President Trump to increase defence spending amid concerns surrounding public finances, according to The Times citing sources.

- UK Chancellor Reeves will call on sceptical Labour MPs on Monday to back her plans to boost the UK economy including the proposal to expand London’s Heathrow Airport, according to FT.

- UK Chancellor Reeves indicated the government would consider signing up to the Pan-Euro-Mediterranean Convention (PEM), a tariff-free trading scheme, according to The Telegraph.

- Fitch affirmed Netherlands at AAA; Outlook Stable.

FX

- DXY is lower on the session with the Dollar on the backfoot vs. safe-haven currencies such as JPY and CHF due to the risk-aversion on the AI-related updates. Index at a 107.21 low, matching the trough from Friday.

- JPY and CHF the outperformers, with USD/JPY testing but yet to breach 154.00 to the downside vs overnight 156.25 peak.

- EUR near the unchanged mark, benefitting slightly from the German Ifo metrics though they provide only minimal relief given internal commentary while the Single Currency is very much focused on the ECB this week. EUR/USD in 1.0455-1.0502 band.

- GBP is faring slightly better and taking advantage of the USD’s downside as it stands though Cable is yet to deviate significantly from the unchanged mark. EUR/GBP pressured and towards 0.8393 lows. Action which comes ahead of a speech from Chancellor Reeves on Wednesday, ahead of which press has been focussed on various growth initiatives from the gov’t.

- Antipodeans softer given the risk tone and soft Chinese data, with the Yuan also hit on this.

- On tariffs, MXN and CAD are both softer this morning after reports suggesting that President Trump could slap pre-emptive tariffs on Canada and Mexico as soon as Saturday; action is much more pronounced in the MXN.

- PBoC set USD/CNY mid-point at 7.1698 vs exp. 7.2295 (prev. 7.1705).

- Mexican Central Bank said it will consider larger cuts to the benchmark interest rate early this year due to slowing inflation and warned balance of risks for inflation remains tilted to the upside mostly due to the persistence of core inflation.

- Barclays month-end model indicates “moderate USD selling against most majors”; signal for Cable is “borderline strong”.

Fixed Income

- AI updates drive haven allure while Central Bank meetings move into focus; USTs post gains in excess of 20 ticks at a 109-07+ high into frontloaded supply on account of the FOMC this week.

- Bunds holding around the 132.00 mark having hit a 132.06 peak just after Ifo and the opening of the US pre-market, resistance at 132.15 and 132.22 from last Tuesday and Wednesday respectively.

- Further upside for the complex came from the German Ifo release which saw Business Climate and Current Conditions print firmer than expected, however Expectations slipped from the prior as expected and internal commentary points to stagflation.

- Gilts gapped higher by 41 ticks on the AI action to a 92.32 open before extending to a 92.60 peak post-Ifo and the US pre-market open. UK specifics not market moving thus far, lots of press attention on various initiatives the gov’t/Treasury is considering to drive growth ahead of a speech from Chancellor Reeves on Wednesday.

Commodities

- Crude benchmarks are modestly in the green. Having ground their way higher throughout the European morning and benefiting from the USD softness and ongoing geopolitical tensions; WTI and Brent at the top-end of USD 73.67-74.97/bbl and USD 76.57-77.88/bbl respective parameters.

- However, initial action was bearish given Trump’s tariff rhetoric, lower energy demand from datacentres for AI purposes and soft Chinese data all on the demand side. Furthermore, on the supply side Trump spoke with Saudi Arabia’s Crown Prince and discussed bringing oil prices down.

- NatGas under marked pressure given the potential implications on energy demand from Chinese start-up DeepSeek announcing a model on par with OpenAI’s advanced o1 model for a fraction of the costs. Elsewhere, EU to continue talks with Ukraine around gas supplies to Europe.

- Metals are lower across the board with XAU yet to find any haven allure from the above and losing out at the expense of haven-FX and Bonds. Though, XAU has lifted off lows and is towards the USD 2772/oz session high. Base peers lower given the risk tone and Chinese data, 3M LME Copper holding just above USD 9.1k/T.

- Russia’s Nornickel (Q4): nickel output 59KT (prev. 55.8), palladium 606 (prev. 547), 2024 nickel output 205KT (prev. 209).

- EU Commission says it will continue talks with Ukraine on Natgas supplies to Europe, will include Hungary and Slovakia.

Geopolitics: Middle East

- Israeli PM Netanyahu confirmed three hostages are to be released by Hamas and that Israel will allow Palestinians to cross into northern Gaza from Monday morning. It was also reported that Hamas said it handed over to mediators the required information regarding the list of hostages to be released during the first phase of the Gaza agreement.

- Hamas said that Israel procrastinates in implementing ceasefire terms by preventing displaced Palestinians from returning to northern Gaza, while it holds Israel responsible for any delays in the implementation of the agreement and the repercussions in subsequent stages. It was separately reported that Hamas released a list of 200 Palestinian prisoners to be released by Israel, according to Reuters.

- Israeli fire killed a Lebanese soldier and injured another in southern Lebanon, while it was also reported that Israeli fire killed two people and injured 31 in southern Lebanon. It was later announced that the death toll from Israeli fire in southern Lebanon rose to eleven.

- White House said the ceasefire agreement between Israel and Lebanon will continue to be in effect until February 18th, while Lebanon, Israel and the US will also begin negotiations for the return of Lebanese prisoners captured after 7th October 2023.

- UN envoy in Lebanon and UNIFIL said conditions are not yet in place for the return of Lebanese citizens to the south, according to a statement cited by Reuters.

- US lifted the pause on delivery of 2,000-pound bombs to Israel, according to a source cited by Reuters.

- US President Trump spoke with Jordan’s King Abdullah of Jordan about moving people out of ‘demolition site’ Gaza to neighbouring countries and said he will speak with Egypt’s President El Sisi, while it was separately reported that Egypt’s Foreign Ministry said Egypt rejects any attempt to move Palestinians out of their land.

- US Secretary of Defense Hegseth spoke with Israeli PM Netanyahu and stressed the US is fully committed to ensuring Israel has the capabilities it needs to defend itself.

- US Secretary of State Rubio said he is hearing the Taliban is holding more American hostages than has been reported, while he added that the US may place a very big bounty on Taliban’s top leaders. It was separately reported that Rubio spoke with Yemeni PM Ahmed Bin Mubarak and discussed cooperation to stop Houthi attacks.

- US President Trump’s Middle East envoy Witkoff will travel to Israel on Wednesday to oversee the Gaza ceasefire.

- Iran has launched AI-guided missiles during military manoeuvres in Gulf waters, according to Sky News Arabia citing Iranian press.

Geopolitics: Ukraine

- Russia said its troops captured Zelene in eastern Ukraine, according to IFAX.

- Moldovan President Sandu arrived in Kyiv for talks with Ukrainian President Zelensky.

- Belarusian exit polls showed incumbent Lukashenko won the presidential election with 87.6% of votes.

- Radio Free Europe editor posts that the EU ambassadors meeting has concluded and a six month extension to Russian sanctions is likely to come later today.

Geopolitics: Other

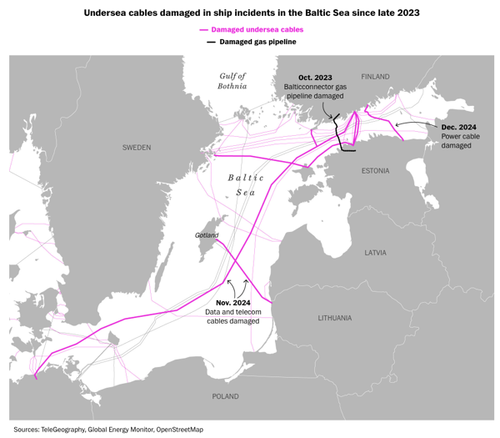

- Baltic Sea submarine fibre optic cable between Latvia and Sweden was damaged on Sunday morning which was caused by external influence, according to Latvian public broadcaster LSM citing the cable operator.

- North Korea tested a strategic cruise missile on Saturday, according to KCNA.

- China’s Coast Guard said two Philippine vessels entered waters near the reef in the Spratly islands on Saturday, while China’s Coast Guards intercepted the vessels and drove them away.

- Russia’s Kremlin says there is still no signal from the US side about a Trump-Putin meeting.

US Event Calendar

- 08:30: Dec. Chicago Fed Nat Activity Index, est. -0.06, prior -0.12

- 10:00: Dec. New Home Sales MoM, est. 2.4%, prior 5.9%

- 10:00: Dec. New Home Sales, est. 672,000, prior 664,000

- 10:30: Jan. Dallas Fed Manf. Activity, est. -3.0, prior 3.4

DB’s Jim Reid concludes the overnight wrap

One week down, 207 to go of Trump 2.0 and what have we learnt so far? It’s hard to say we’ve learnt too much, even with the best part of a hundred executive orders already signed. The market has been relieved that tariffs haven’t been issued on “day one” as previously promised but its only five days until the February 1st date Mr Trump suggested could be the point he puts tariffs on Mexico, Canada and China. So that will be the gorilla in the room this week. In addition, he’s ordered departmental reviews of existing trade practises with an April 1st deadline. So no news on tariffs isn’t necessarily good news. Yesterday Columbia was the latest to feel the wrath of Mr Trump as he ordered an emergency 25% tariff on the country, to be doubled in a week, over the country’s refusal to allow two planes of undocumented migrants returning from the US to land. However, in the early hours of this morning, the US removed the threat after the Colombian leader agreed to grant entry to US military flights deporting migrants. This 12 hour incident feels like a template for how the US will now deal with its foreign policy issues.

Outside of Mr Trump watching, there’s a lot going on this week with rate meetings from the Fed and Bank of Canada (Wednesday), and the ECB (Thursday); inflation data in Europe (Thursday/Friday), US (core PCE Friday), Japan (Tokyo CPI Thursday), and Australia (Wednesday); and Q4 GDP in the US, Germany, France, Italy and Euro Zone (Thursday). If that wasn’t enough, earnings season starts to take off in both the US and Europe with 102 S&P 500 and 53 Stoxx 600 companies reporting with four of the Magnificent 7 (Microsoft, Meta and Tesla on Wednesday, and Apple on Thursday) being the obvious highlight. In the AI world there’s been a lot of chatter in the last few days around Chinese firm DeepSeek’s announcement that it’s produced an open-source AI model that rivals some of the US tech giant’s equivalents for a fraction of the costs and using less sophisticated chips. As this story builds, Nasdaq futures are down -2.23% this morning, driving the S&P 500 down -1.17%. These are big moves for this time of day. It will be interesting if this story gets momentum and whether the Mag-7 loses some of their luster.

In theory the main event this week would normally be the Fed but in our economists’s preview here they expect a relatively quiet meeting with no rate move and limited guidance about future policy decisions. They believe that while Chair Powell may not rule out a March cut as he did last January, the broad signals from the meeting should confirm that such a cut is not likely with Powell possibly emphasising the underlying strength of the economy and signs of stabilisation in the labour market that would require patience in removing further restriction. When asked about Mr Trump’s policies and their impact on inflation expect Powell to play a straight bat and say that the committee wont prejudge policies in advance.

After the Fed we get Q4 US GDP on Thursday (DB expect 2.6%), and then the core PCE deflator on Friday. Our economists expect +0.20% vs. +0.1% in December which should just about help the YoY rate round down to 2.8%. The 3-month annualized growth rate should tick down slightly to 2.3% from 2.5% and the 6-month rate should be unchanged at 2.4%. The employment cost index (ECI) is also out on Friday and this will be a key release for the Fed as more subdued labour market pressure has given them comfort in recent months.

Over in Europe, our economists expect the central bank to deliver another 25 bps cut on Thursday taking the policy rate to 2.75% and see the description of the policy stance unchanged relative to December. See more in their preview here. The ECB will also release its bank lending survey tomorrow and the consumer expectations survey on Friday. Optimism is creeping back into Europe this year and the December 2025 ECB contract has gone up from 1.56% in early December to 2.07% on Friday implying less than four cuts from here. Much of course will depend on the extent that Europe is in the crossfire of Mr Trump and so far the market is relieved that nothing specific was announced last week but note that Trump on at least two occasions called out the European Union and said at his virtual Davos address that the EU treats the US “very unfairly” and “very badly”. So it would be wise to brace yourself for more news on this front.

Elsewhere in Europe, this week the focus will also be on flash January CPIs starting with Spain on Thursday. Prints for Germany and France are due Friday, with Eurozone-wide numbers out a week today. Our European economists expect headline and core Eurozone HICP to decline by 0.1pp to 2.3% YoY and 2.6% YoY. Their forecasts for Spain, Germany and France are 2.38%, 2.79% and 1.85%, respectively. See more in their latest inflation chartbook here and don’t forget the GDP prints in Germany, France and the Eurozone on Thursday, as well as Sweden on Wednesday. Other highlights include the Ifo survey in Germany today as well as Sweden’s Riksbank rates decision on Wednesday.

In Japan our economists preview the week-ahead including views on Thursday’s Tokyo inflation, industrial production and labour market data and key forecasts updates here. The day-by-day week ahead calendar is at the end as usual with a fuller list of key events, including the main earnings to be realised.

Asian equity markets are mixed in thin trading as the Columbia and DeepSeek stories reverberate. The Hang Seng (+0.87%) is leading the way but mainland Chinese stocks are flatish after weaker than expected manufacturing PMI data (more below). Chinese markets will be closed for the week-long Lunar New Year holiday from tomorrow. Elsewhere, Australian and South Korean markets are closed for holidays. 10yr UST yields (-3.25bps) have edged lower, trading at 4.59% as we go to print.

Coming back to China, the official factory activity unexpectedly shrank in January, coming in at 49.1 (v/s +50.1 expected), down from +50.1 thus reversing the expansionary momentum over the past three months. China’s non-manufacturing PMI fell to 50.2 in January, compared to 52.2 last month. Separately, China’s industrial profits jumped +11.0% in December from a year earlier, growing for the first time since July. Meanwhile, full-year industrial profits in 2024 fell -3.3% from the previous year, extending declines to a third consecutive year.

Looking back at last week now, risk assets put in a strong performance as investors were relieved by the lack of immediate tariffs after Donald Trump returned to the presidency. That helped the S&P 500 advance +1.74% over the week as a whole (-0.29% Friday), which included its first record high of 2025 on Thursday. Those gains were evident across the world, with Europe’s STOXX 600 up +1.23% (-0.05% Friday), whilst Japan’s Nikkei was up +3.85% (-0.07% Friday) even as they delivered a hike on Friday, one that was fully priced by the time it arrived.

These advances were supported by growing investor confidence that the Fed would still cut rates this year, particularly given the absence of tariffs so far. On top of that, oil prices fell back after four consecutive weekly gains, with Brent crude down -2.83% last week to $78.50/bbl. So collectively, that meant the amount of cuts priced in by the December meeting ticked up by +4.3bps to 42bps, meaning that futures still see at least 2 cuts in 2025 as more-likely-than-not. In turn, that helped Treasury yields inch lower, with the 2yr yield down -1.7bps (-2.3bps Friday) to 4.27% and the 10yr yield down -0.6bps (-2.3bps Friday) to 4.62%.

In Europe however, sovereign bonds struggled last week as the risk-on tone gathered pace across markets. That was particularly the case in Europe, where the 10yr bund yield was up +3.6bps (+2.0bps Friday) to 2.57%, which followed an upside surprise in the January flash PMIs on Friday. In Germany itself, the composite PMI was up to 50.1 (vs. 48.3 expected), which is its first month in expansionary territory since June. And for the Euro Area as a whole, the composite PMI was up to 50.2 (vs. 49.7 expected), which is its highest level since August. So that led to a few more questions about how rapidly the ECB would cut rates, with the amount priced in by the December meeting down -12.5bps over the week to 87bps.

Finally, spreads continued to tighten across the board last week. In fact, Euro IG credit spreads (-3bps) fell to their tightest level in 3 years, at 95bps. And among sovereign bonds, the Spanish-German 10yr spread also ended the week at its tightest in three and a half years, at just 62bps. US credit spreads also continued to tighten, with US IG down -2bps last week to 78bps, and US HY tightening -6bps to 256bps.