Authored by Lawrence McDonald via The Bear Traps Report,

The Legendary “W” Games

Over the last 250 years of American political gamesmanship, both parties have played year-end games into the arms of a new incoming administration. In early 2000, the incoming George Walker Bush team discovered that every keyboard in the White House and other administrative offices was missing the “W” key.

The outgoing Clinton staff had removed all the “W” keys to annoy the new administration after an extremely contentious election.

The damage was small, estimated at $15,000.

But the bigger message here was that when the party that runs the White House changes, the outgoing administration will leave some proverbial “time bombs” for their successors.

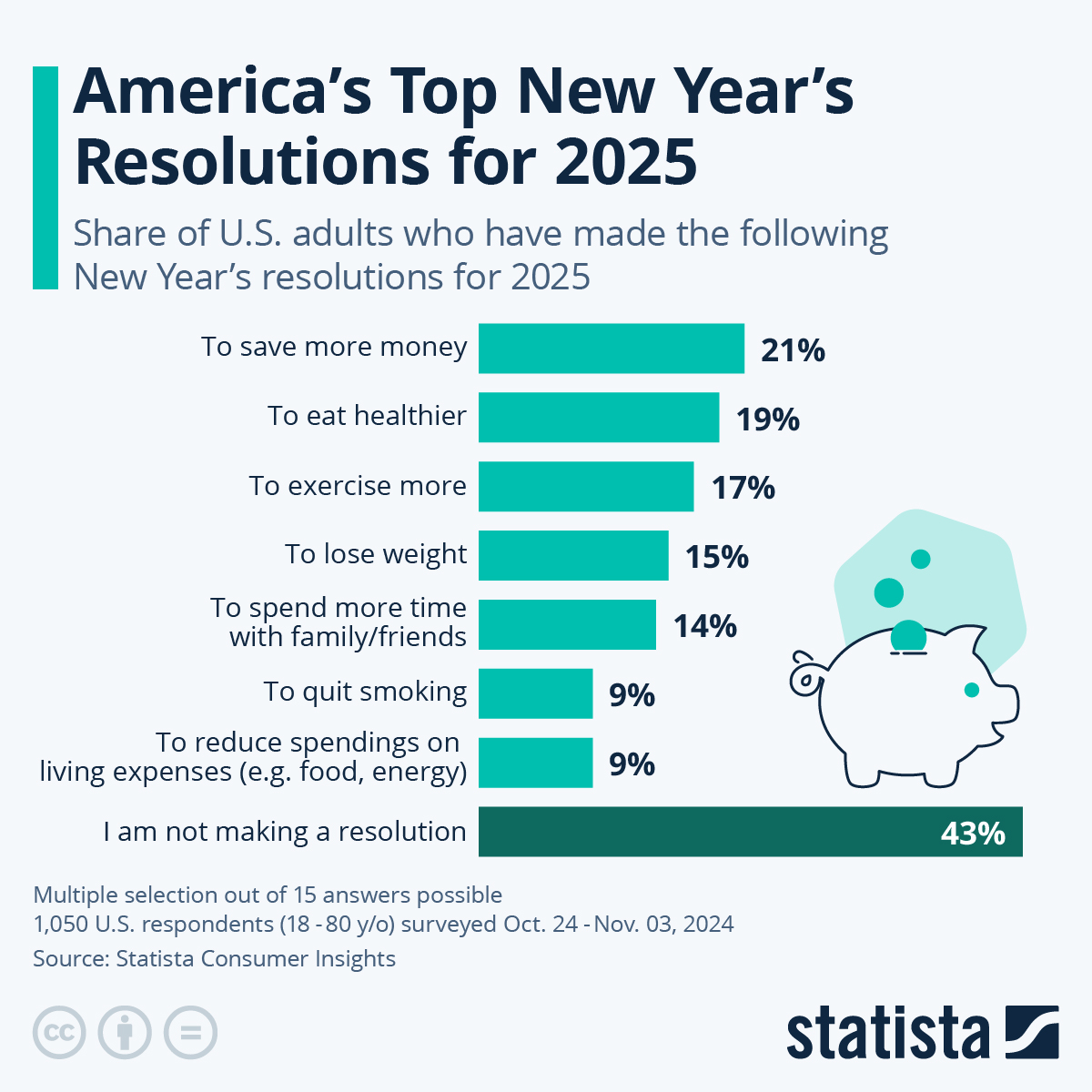

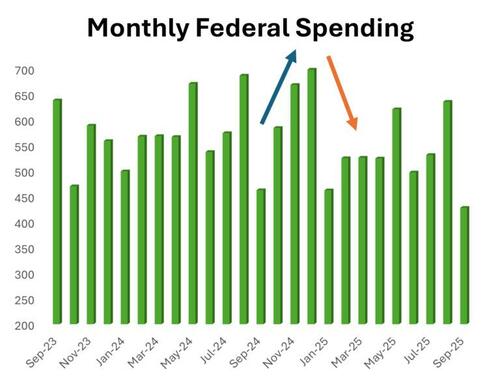

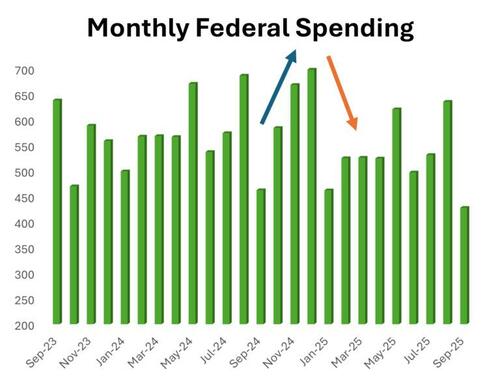

While the damaged keyboards were more like a bad joke, what Biden is doing to Trump now is serious business. The outgoing administration has opened the spigots table max to get every penny out the door while they can under the existing budget.

It’s almost like they are looting the Treasury before they leave town.

Biden is Opening the Floodgates with Spending

Spending for 2025 is expected to exceed $2Tr by the time Biden leaves DC on January 20th. This is over 30% of the annual budget, and Trump will have to cut spending for the rest of the year to stay within the limits of the allocated budget. This could mean a notable slowdown in GDP growth in the first quarters of 2025.

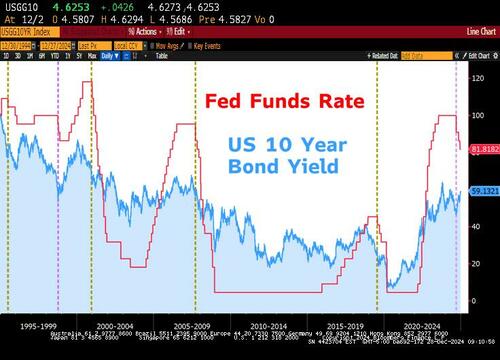

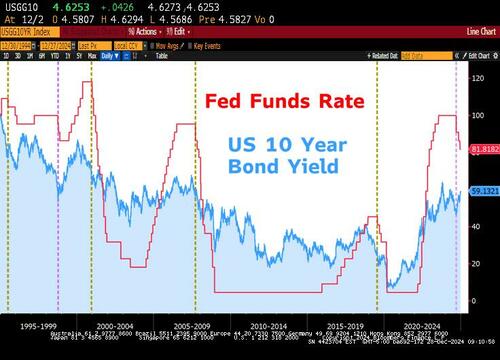

Bonds have taken Notice

Ever since the Fed cut rates in September, U.S. 10-year bond yields are about 1% higher, and mortgage rates are following in lockstep. Hedge funds are selling short, betting on lower bond prices into colossal incoming bond sales from the U.S. Treasury. This is a highly unusual activity and has the fingerprints of the bond vigilantes everywhere; a revolt is in the works.

Lunatics – as Usual – on Capitol Hill

Congress, in its usual fashion, has failed to agree on the next budget, so the government is currently operating under a “continuing resolution” (CR). This continuing resolution means the government is allowed to spend the same amount of money they spent last year, which is $6.75TR. The government’s fiscal year started on October 1st, and Biden is on a run rate to spend almost $2TR by the end of December and a deficit that may exceed $800bl (+60% y/y). So, when Trump comes in on January 20th, he has three quarters left of the government’s fiscal year, but by then, Biden has spent more than 30% of the total allocated budget. This forces Trump to cut spending right off the bat. We estimate spending could drop by $500bl quarter over quarter, or 25% from Q4 to Q1. This is an estimate, and the timing of spending can change. But the fact is that Biden is emptying the coffers before Trump gets in. Every week, more money and weapons are sent to Ukraine, more subsidies are given to semiconductor makers to build plants in the US, and more government employees are hired.

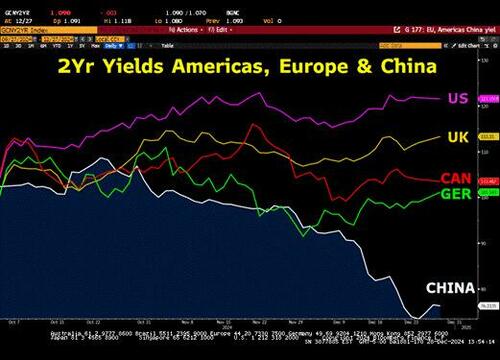

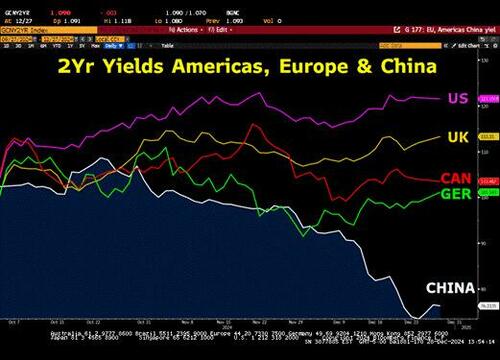

US Yields Surge While Others Languish

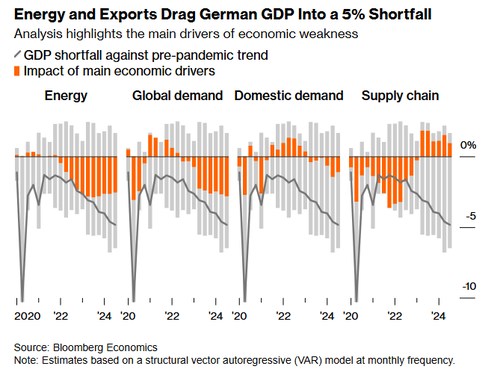

Since September, US Yields have surged over 20% on Biden’s sugar high, while Canadian and German yields are down since then, Chinese yields have collapsed, and UK yields are only modestly above the September level.

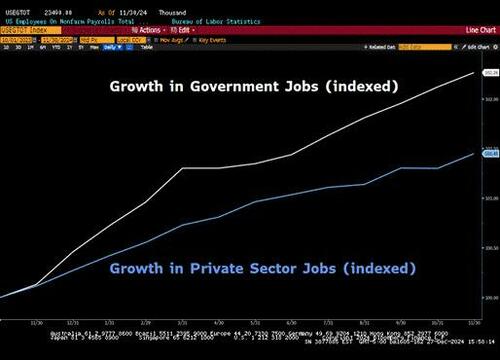

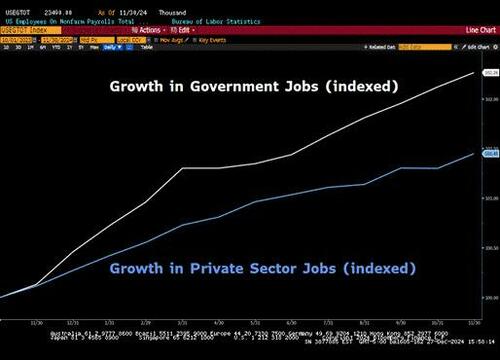

Government Job Growth Twice the Rate of the Private Sector

Private sector job growth has lagged government job growth significantly in the last year as the government keeps hiring people.

Why is this so Bad?

We believe that this spending deluge by Biden on his way out is partially to blame for the surge in bond yields in Q4. Some may say it’s because of Trump and his promised tax cuts, but the Republican House majority is so slim that it’s unclear how much of a fiscal stimulus Trump is actually able to get through Congress. Also, the incoming Senate majority leader Thune (R, SD) has said he will only get one bill through reconciliation in FY 2025 and another one in FY2026. His priority is on immigration and energy legislation, so a fiscal spending bill might not come until late 2025 or early 2026 if anything. But if yields are being pushed up by all this spending in Q4, then what will happen if spending falls back in early 2025? And what will happen to GDP growth? A $500bl drop in government spending from Q4 to Q1 is the equivalent of 1.7ppt of growth. So, if Q4 nominal growth comes in at 5.7% annualized, this could drop to 4% in Q1 if government spending slows down accordingly.

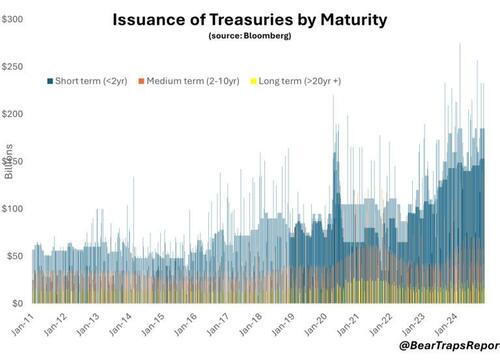

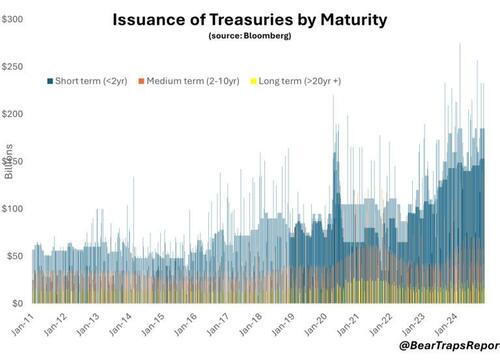

Treasury’s Reliance on Short-Term Debt Exploded in Recent Years

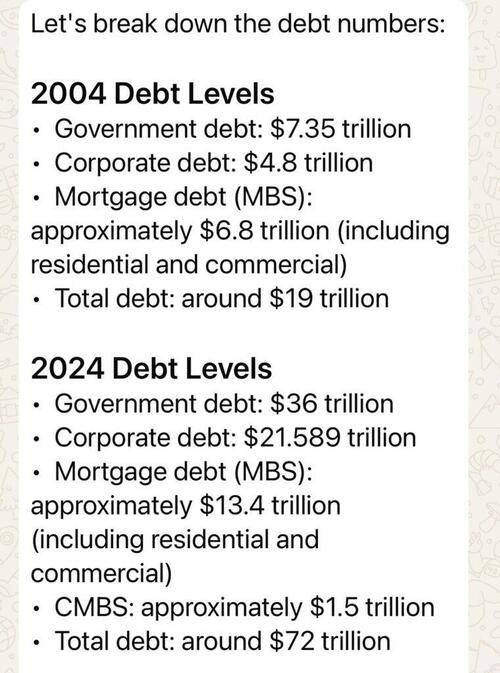

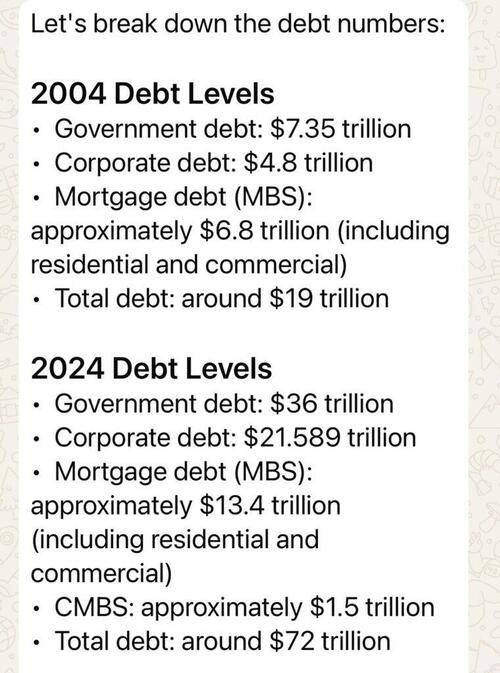

Election Rigging? We are witnessing a Covid era like spending in 2024 without a pandemic. The Treasury Department has come to rely on short-term bills to fund the government. But with $36Tr of debt, the Treasury has to issue bills almost every day to keep funding the government and to refund maturing debt.

Interest Payments on the Federal Debt Load

-

2026: $2.1T?

-

2025: $1.5T?

-

2024: $910B

-

2023: $658B

-

2022: $475B

-

2021: $352B

-

2020: $224B

*CBO data, Bloomberg. The average weighted coupon on the U.S. debt load is about 2.7% vs. over 4.5% for 10-year U.S. Treasuries. As bonds mature, they get refinanced at much higher yields.

$10Tr of Debt Refinancing Next Year

In 2024 Treasury faced around $10Tr of maturing debt. To refinance this debt, it issued a whopping $26Tr of bills and bonds. More than 84% of that paper was short-term bills with a maturity of 6 months or less. Treasury keeps re-issuing bills with a maturity of 4 to 8 weeks or 3,4 to 6 months, which are the most popular maturities in a continuing, ever-increasing roll down of the debt, day after day, month after month.

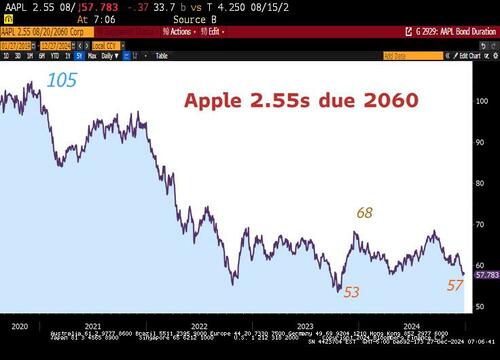

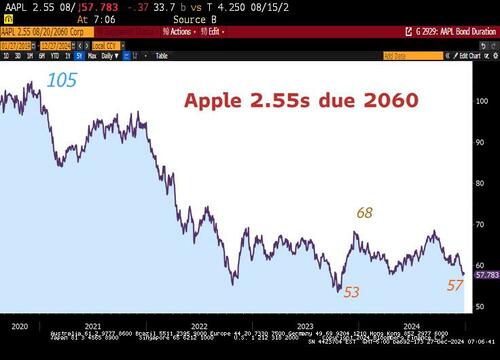

Apple Long-Term Bonds and Interest Rates

ALERT – By issuing nearly a colossal load of extremely short-term bills, Janet Yellen succeeded in suppressing bond volatility in an election year and, in our view, strategically placing that bond market volatility into 2025 after the election. You can “why” see above, she wanted LESS long-term paper in circulation markets in the election year. Now, in 2025 – this paper has to be rolled over and termed out into longer-dated bonds. The USA is behaving like a financially trapped emerging market country. Living on the “front-end” of the yield curve is a VERY dangerous game. The Apple AAPL 2.55% bonds due 2060 are trading down at 57 cents on the dollar. If long-term bond yields go to 6%, take a guess where this bond will trade. Near 47 cents on the dollar? Now think of the trillions of USD loans issued in 2017-2021 on bank balance (commercial real estate, mortgages, corporate debt outstanding). Losses are in the trillions of dollars with higher incoming interest rates.

Interest Rates UP – Bond Prices DOWN

Never, ever forget that 6% today is equivalent to the destructive capacity of 10% twenty years ago. Interest rates up, mean bond prices down. A 1% move in interest rates higher today is an entirely different, far more lethal equation.

Incoming Stress Points

In 2025 the U.S. Treasury faces $9.6Tr of maturities in their so-called publicly held debt. In Q1 alone — the government faces $5.58Tr of maturities (bonds coming due, redemption), but 86% of those are short-term bills that the Treasury department rolls over into new 4-week, 8-week, 3,4, or 6-month bills, among others.

As a result, almost daily bill auctions are coming to a theater near you, as the Treasury Department mindlessly keeps pushing new paper into the market to pay back the colossal amount of maturing debt.

Is There Any Reason to Buy Treasuries?

The new Treasury department under Scott Bessent may reduce bill issuance a bit and increase coupon paying issuance, just to alleviate some of the pressure on the bills market and extend the duration of outstanding US debt. Now that the big slush fund that bought all these bills, the so-called Reverse Repo Facility (RRP), is close to being depleted, it will be harder to sell all that short-term paper. In addition, Goldman Sachs expects that the Federal Reserve will stop the run-off of treasuries from its balance sheet by the end of January and begin buying treasuries again with the proceeds of the maturing MBS on its balance sheet. As such, the Fed becomes a modest buyer of treasuries next year, which allows the Treasury to increase coupon issuance without disrupting the long end.

One big bullish catalyst for treasuries would be a regulatory change to exempt treasuries from the Supplemental Leverage Ratio (SLR). It is unclear if and when this would be implemented, although Bessent was hinting at regulatory relief for banks to boost banks’ treasury holdings. Exempting treasuries allows banks to hold more Treasuries on their balance sheets without needing to hold additional capital against them, freeing up the capacity for banks to participate more actively in the Treasury market. Its unclear how much treasury demand that would create, but in 2021, when the temporary SLR exemption was reinstated after COVID, prime dealers reduced their Treasury holdings from $250bl to $125bl in 2 months. A change in the SLR ratio may come but is going to take months before the rules are changed. A phase-out of QT for treasuries would be a more immediate, albeit more modest, relief for the bond market. According to this timeline, the Fed will end up buying $100bl of treasuries in 2025, a big change from the $500bl of treasury sales in 2024.

The Fed has been Politicized

We have been very critical of Yellen’s term at the Treasury, but upon some further reflection, we think it’s really the case that Yellen’s only real issue was acting in the short-term interests of her boss and her party as opposed to thinking longer-term about how the government finances itself on a sustainable basis.

Her decision to fund the government with T-bills over duration securities and violate long-standing Treasury Department “norms” was incredibly short-sighted, but as someone who works for the President, ORDERS to follow.

Many have been super critical of her for these decisions because she should know what they would lead to and how really what she (and Powell together) has done is favor asset owners and the wealthy over everyone else in America, exacerbating wealth inequality to precarious levels in this country while still not bringing inflation back down to target. So ultimately, her decisions got her team knocked out of office anyway.

Looking forward, though, the issue is that there is no one in the government who is really thinking about and acting on behalf of the longer-term interests of the country when it comes to how much debt we are raising and how we are financing the government. The myopia about these decisions to get the existing political party in control through the next election is incredibly concerning.

The Fed has said this is not their lane; however, they are elected to 14-year terms and are supposed to be above politics. There are things they could have done to offset the politicization of the Treasury. They chose not to, they continue to protect asset holders and the Treasury market, decisions that really just make them become political as well. They could have better neutralized Treasury’s political decisions through more active QT, actually selling securities instead of just rolling them off, not adding to their duration holdings such that the weighted average maturity (WAM) of their positions is longer than Treasury’s own WAM. Powell’s Fed needs to be getting way more criticism than they are currently about these decisions which have made it harder to bring inflation down for the average American.

So if the Treasury is not going to think long term and the Fed is not going to either (the Fed actually is complicit because they don’t allow any real treasury market dysfunction to exist, which would be the way to deal with these long term issues by having the market / bond vigilantes do their thing), then who will? This is a problem, the bond market is starting to figure it out, term premiums are starting to normalize and the new administration will have to make some big decisions early on in their term.

Maybe @elonmusk and @DOGE can look into this as well. Someone has to!

* * *

Pick up Larry’s new best-selling book — “When Markets Speak“ – On Amazon today.