US equity futures were already rolling over following yesterday’s momentum-driven rout, when a the latest report out of CNN (a polar opposite to the just as fake news from WaPo earlier this week, but fake nonetheless) claiming that Trump was “considering declaring a national economic emergency to provide legal justification for a large swath of universal tariffs on allies and adversaries” sent the dollar surging, all other G-20 currencies plunging, and sparked a broad selloff across risk assets. As of 8:00am ET, S&P futures were down 0.2%, bouncing from session lows of -0.4%, and reversing a gain of 0.4% earlier in the session; Nasdaq futures were hurting more, sliding 0.6% as many of the recent best performers were sold off hard, and none more so than quantum computers which were down about 20% as a group in premarket trading; the Mag7 was also largely red )Apple -0.5%, Nvidia +0.1%, Microsoft -0.09%, Alphabet -1%, Amazon -0.07%, Meta Platforms -0.9% and Tesla -1%). Europe’s Stoxx 600 Index lost 0.4% and Asian stocks slumped, with China tumbling as usual. Meanwhile, bonds extended their ongoing selloff, with the 10Y rising to 4.72% and triggering Goldman’s VaR shock threshold of a 60bps increase in 1 month. In the UK, 10-year bond yields rose to their highest since 2008 and the 30-year inflation-linked note is now yielding more than 2%, the most since the Truss crisis of 2022 as fears spread that Keir’s spending plans will spark a fiscal disaster.

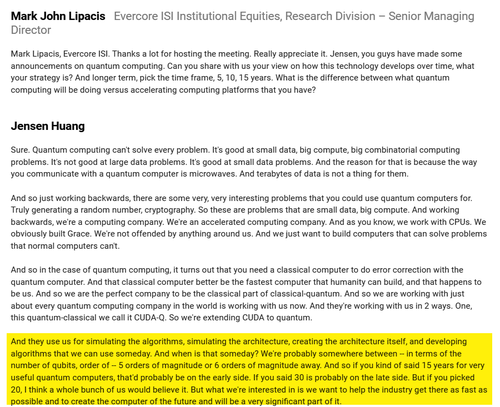

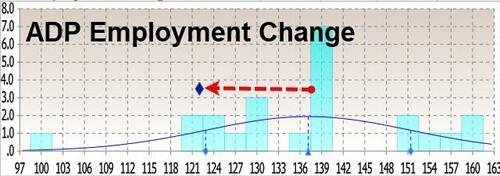

In premarket trading Quantum stocks tumbled after Nvidia CEO Jensen Huang said that “very useful” quantum computers are likely decades away. Quantum Computing (QUBT) -20%, D-Wave Quantum (QBTS) -21%, Rigetti Computing (RGTI) -23%, IonQ (IONQ) -13%. Sana Biotechnology (SANA) soars 232% after the company reported positive data from a study of its treatment of type 1 diabetes. Here are some other notable premarket movers:

- AAR (AIR) rises 3% after the provider of aviation services and parts posted fiscal 2Q sales that soared past estimates.

- Flutter (FLUT) slips 2% after the gambling firm cut its guidance for US preliminary revenue 2024 due to the impact of US sports results in the fourth quarter.

- Health Catalyst (HCAT) climbs 5% as KeyBanc turned bullish, saying the stock’s valuation is deeply discounted.

- Jasper Therapeutics (JSPR) falls 41% after posting data from the Beacon study of briquilimab.

- Olo (OLO) slips 5% after Piper Sandler downgraded the restaurant software firm, flagging concern about the 2025 outlook amid executive changes and workforce cuts.

- Palo Alto Networks (PANW) declines 2% after the security software received a pair of analyst downgrades.

S&P 500 figures started spiking lower just after 6 a.m. New York time following a report from CNN that Trump is considering declaring a national economic emergency to push through his tariff plans. Europe’s Stoxx 600 Index lost 0.4% and bond yields increased.

“Higher Treasury yields are a cause for concern for equity investors, especially when combined with speculation on what Trump may do,” said Lilian Chovin, head of asset allocation at Coutts & Co. in London. “Our view is that markets can digest higher yields, provided they are driven by stronger growth rather than inflation. In the near term it will be a challenge for risk assets.”

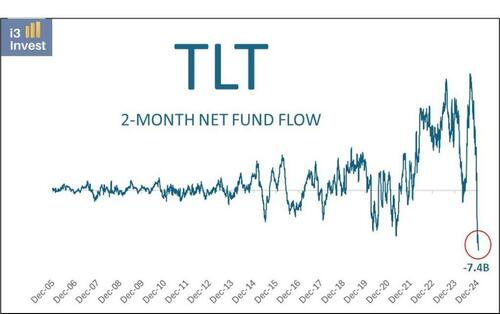

Amundi SA, Europe’s largest asset manager, sees a “reasonable” chance that the yield on 10-year Treasuries will again test the key level of 5%, a milestone only reached a handful of times over the past two decades. Citigroup’s wealth division also said a return to 5% — while not its base case — would offer a “really appealing” level at which to add. The yield was just under 4.70% on Wednesday.

Meanwhile, equity traders are bracing for further volatility over the coming weeks. “These first trading days have been a good overview of what could happen this year,” said Mabrouk Chetouane, head of global market strategy at Natixis Investment Managers. “Inflation, tariffs, Trump, growth, monetary policy — all these concerns could bring uncertainty.” Credit supply is also continuing after corporations and banks globally have raised roughly $111 billion this year through Tuesday. Spreads of corporate bonds remain near their lowest post-financial crisis level, despite the volatility in government debt.

In Europe stocks also reversed earlier gains, and what was a 0.4% rise has reversed into a 0.4% loss for the Stoxx 600 with financial services and banks leading gains. Here are the biggest movers Wednesday:

- Novo Nordisk gains as much as 2.4% after being upgraded to buy from neutral at UBS, which said shares in the Danish drugmaker are at an “attractive entry point” following an “overdone” selloff

- LSEG rises as much as 3.2% after making it on the list BofA’s “25 stocks for 2025” and the bank is adding it to a European list of top ideas, say analysts

- Vallourec jumps as much as 7.4%, after the French tube manufacturer announced it hit a target of zero net debt one year ahead of plan and is now ready to return capital to shareholders starting in 2025

- BCP shares advance 5.3%, rising to the highest level since May 2016, after JP Morgan raised the recommendation on the Portuguese lender to overweight from neutral on positive earnings momentum and generous payout

- Heidelberg Materials rally as much as 3.4% after analysts at BofA Global Research raised their price target on the building materials company, naming it one of its “25 stocks for 2025”

- Pluxee surges as much as 14% to the highest in four months after the employee benefits and motivation solutions firm beat analyst expectations for the first quarter

- European wind power-related stocks fall on Wednesday after President-elect Donald Trump said he would seek to prevent the construction of wind farms during his second term, threatening billions of dollars in planned projects

- Shell shares decline as much as 2% after 4Q trading update shows weakness across several divisions and may cause cuts in consensus expectations, RBC says in a note

- InterContinental Hotels Group slips as much as 1.6%, to trade at the lowest in six weeks, after Morgan Stanley downgraded the stock to underweight from equalweight

- Trigano falls as much as 7.9% in Paris, the most in about seven months, after the leisure-vehicle manufacturer reported a year-on-year revenue decline

Asian stocks dropped as concerns over a delay in further Federal Reserve interest-rate cuts weighed on sentiment. Tech shares tracked their US peers lower.

The MSCI Asia Pacific Index fell as much as 0.8%, with TSMC and Tencent among the biggest drags. A drop in US big tech after Nvidia’s product presentation failed to lift near-term prospects weighed on Asian chipmakers. Samsung Electronics bucked the trend after Nvidia’s founder expressed confidence in the Korean company.

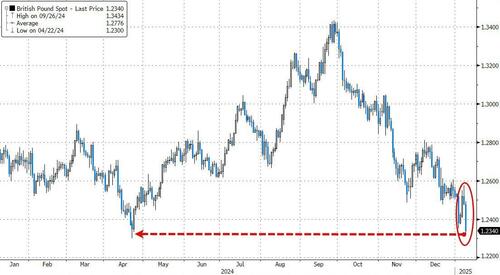

In FX, the Bloomberg Dollar Spot Index rises 0.3% while the Swedish krona sits at the bottom of the G-10 FX leader board, falling 0.4% against the greenback after CPI surprised to the downside.

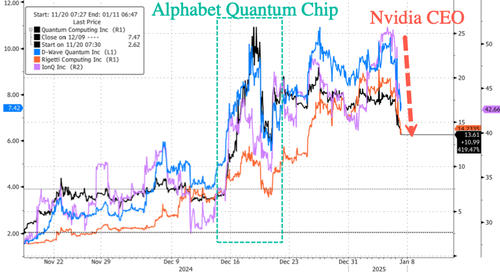

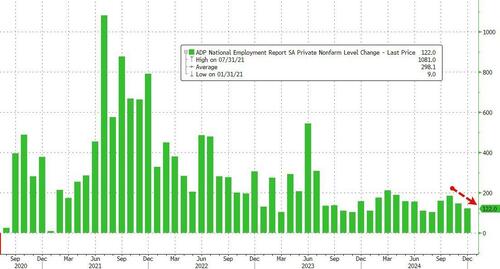

In rates, treasury futures saw continued downside pressure into early US session, reaching day’s lows amid bigger selloff in core European rates and after CNN reported that Trump was seeking an emergency declaration to push through tariffs. UK gilts led losses, with 10-year yields reaching highest level since 2008. US yields are cheaper by 1bp-3bp across maturities near session highs; 10-year, higher by 2.5bp near 4.71%, outperforms UK 10-year by about 7bp as persistent inflationary pressure continues to rattle UK markets; UK 10-year yield climbed more than 10bp to 4.789%. This week’s Treasury auction cycle concludes at 1pm New York time with $22 billion 30-year bond reopening; Tuesday’s 10-year note sale tailed slightly, by 0.2bp, as it drew highest yield since 2007. Corporate new-issue calendar is empty so far and expected to remain muted for the rest of the week after 33 offerings were priced on the past two days, topping dealers’ full-week forecasts for about $50 billion. Potential issuers today include refiner HF Sinclair, which held fixed-income investor calls Tuesday. US session includes December ADP employment change, weekly jobless claims and 30-year bond reopening poised to draw highest yield since 2007.

In commodities, oil prices advance, with WTI rising 0.8% to $74.80 a barrel. Spot gold adds $6 to $2,655/oz. Bitcoin falls below $96,000.

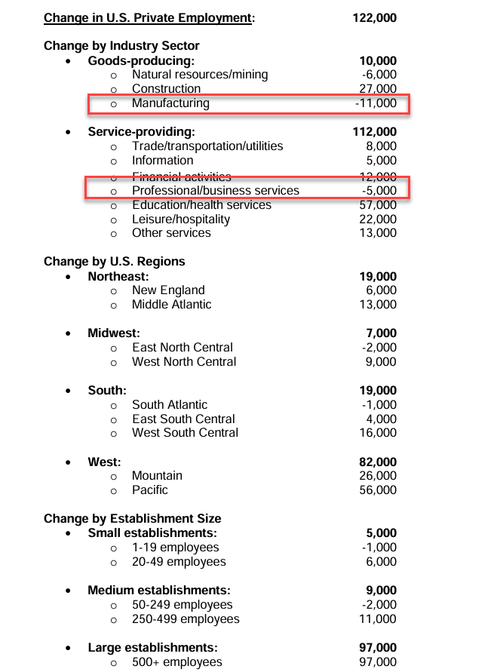

US economic data calendar includes December ADP employment change (8:15am), jobless claims (8:30am), November wholesale inventories (10am) and consumer credit (3pm). Fed speaker slate includes Waller at 8am; FOMC releases minutes from Dec. 18 meeting at 2pm

Market Snapshot

- S&P 500 futures up 0.2% to 5,968.50

- STOXX Europe 600 up 0.2% to 515.48

- MXAP down 0.6% to 180.83

- MXAPJ down 0.6% to 568.23

- Nikkei down 0.3% to 39,981.06

- Topix down 0.6% to 2,770.00

- Hang Seng Index down 0.9% to 19,279.84

- Shanghai Composite little changed at 3,230.17

- Sensex down 0.1% to 78,107.00

- Australia S&P/ASX 200 up 0.8% to 8,349.15

- Kospi up 1.2% to 2,521.05

- German 10Y yield up 3 bps at 2.51%

- Euro down 0.2% to $1.0322

- Brent Futures up 0.8% to $77.67/bbl

- Gold spot up 0.2% to $2,654.04

- US Dollar Index up 0.29% to 108.86

Top Overnight News

- China will subsidize more consumer products and boost funding for industrial equipment upgrades to boost domestic consumption. Meantime, the PBOC set its yuan reference rate at the strongest compared to estimates since April. BBG

- Yields on China’s 10-year sovereign debt hit record lows despite Beijing’s recent stimulus announcements, suggesting growing concern the nation will fail to avoid a deflationary spiral mirroring 1990s Japan. BBG

- The Bank of Japan will likely keep raising interest rates in the coming years as inflation appears on track to sustainably hit its 2% target, said former governor Haruhiko Kuroda. RTRS

- Samsung shares rose after Nvidia CEO Jensen Huang expressed confidence in the company’s ability to resolve technical issues producing a new type of memory chip for AI systems. BBG

- Europe is pushing back against Trump. Describing Greenland as European territory, French Foreign Minister Jean-Noel Barrot warned him against threatening the EU’s sovereign borders. And the EU’s industry chief called on the bloc to defend itself against protectionist measures. BBG

- German economic data for Nov falls short of expectations, including retail sales (-0.6% M/M vs. the Street +0.5%) and factory orders (-5.4% M/M vs. the Street -0.2%). BBG

- President-elect Donald Trump is considering declaring a national economic emergency to provide legal justification for a large swath of universal tariffs on allies and adversaries, four sources familiar with the matter told CNN, as Trump seeks to reset the global balance of trade in his second term. CNN

- Oil gained as an industry report pointed to a seventh weekly draw in US stockpiles. Inventories at the key hub in Cushing also slumped — by 3.1 million barrels — the API is said to have reported. That would be the biggest drop since August 2023 if confirmed by the EIA today. BBG

- Microsoft plans job cuts across the company soon, targeting underperforming employees. Business Insider

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the weak handover from Wall St where tech underperformed as yields climbed after the hot ISM Services and strong JOLTS data. ASX 200 gained amid strength in mining stocks and the top-weighted financial sector, while participants digested mixed monthly inflation data in which the Weighted CPI reading topped forecasts, but the annual trimmed mean figure softened. Capital Economics suggested would provide greater confidence the RBA is on track to meet its inflation mandate if it the result is replicated in the quarterly figures due later this month. Nikkei 225 gradually nursed the majority of its opening losses and reclaimed the key 40,000 level. Hang Seng and Shanghai Comp were pressured with market participants underwhelmed by the latest press briefing in Beijing where the NDRC announced to expand the scope of home appliance trade-ins eligible for subsidies, while frictions lingered with China’s MOFCOM voicing criticism over recent US restrictions on Chinese companies.

Top Asian News

- NDRC Vice Chairman announces loan discounts for equipment upgrades and expansion of trade-in program to include more consumer goods, while the number of types of household appliances eligible for recycling subsidies to increase from 8 to 12 with a maximum subsidy of 20% of the sales price for each item. NDRC said it will allocate special funds to support the recycling and treatment of waste electrical and electronic products, as well as include microwaves, water purifiers, dish-washing machines and rice cookers in the consumer goods trade-in subsidy scope. Furthermore, it will subsidise smartphones for up to 15% of the price and will support equipment upgrades of information technology, safe production and agriculture equipment.

- Chinese Finance Ministry official said the government has allocated CNY 81bln for consumer goods trade-ins so far this year, while a PBoC official stated they will step up financial support for private and small firms in equipment upgrades with the central bank allocating CNY 100bln of loans for select small technology firms.

- China condemned the US military blacklisting of Chinese companies and called on the US to immediately address its misconduct, while it said the US is endangering the stability of the global supply chain.

- China PCA December Prelim Retail Passenger Vehicle Sales +9% M/M (prev. +7.1%); +11% Y/Y (prev. 16.5%)

European bourses initially opened with a slight negative bias, taking impetus from a mostly negative APAC session. Soon after the cash open, sentiment improved in Europe, to currently display a modestly firmer picture, with only a couple of indices residing in the red. European sectors are mixed, with no clear out/underperformer in the session thus far. Financial Services lead, followed closely by Banks. Energy is found at the foot of the pile, with losses fuelled by Shell after it trimmed its Q4 production guidance. US equity futures are modestly firmer across the board, in an attempt to recoup some of the hefty losses seen in the prior session, which were sparked by hotter-than-expected US ISM Services and JOLTS Job Openings figures.

Top European News

- Banca Ifis Bids for Illimity Amid Italian Consolidation Wave

- UK Prepares to Sell New Five-Year Bonds as Borrowing Costs Surge

- IPT: Indonesia EUR Benchmark; 8Y MS+170 Area, 12Y MS+195 Area

- Novo Nordisk Gains After UBS Upgrade on ‘Attractive’ Entry Point

FX

- USD is continuing the strength from Tuesday which was facilitated by the hot ISM Services PMI data and as JOLTS data topped analysts’ forecast range. DXY re-approaches 109.00 to the upside (in a current 108.55-96 range). Attention now turns to the FOMC Minutes, ADP Employment and Initial Jobless Claims data.

- EUR attempted to regain some composure overnight after its slide beneath the 1.0400 level before feeling more pressure from the continued rebound in the USD. German Retail Sales were mixed, whilst Industrial Orders were downbeat, but did have some caveats (details in the data section below). EUR/USD resides in a 1.0311-57 range with downside levels including the 6th Jan low (1.0294).

- JPY traded indecisively overnight with USD/JPY on both sides of the 158.00 level amid a quiet data calendar for Japan and the mixed risk tone. Similar price action in Europe with the current intraday parameter between 157.91-158.32, with the pair eyeing yesterday’s highs (158.42).

- GBP is subdued in tandem with G10 counterparts on the back of the stronger USD. GBP/USD resides in a current 1.2441-94 range with the next downside level the 6th Jan low (1.2410).

- Antipodeans are feeling pressure from the firmer greenback and in the absence of major newsflow this morning. AUD/USD was choppy following the latest monthly inflation data from Australia in which the Weighted CPI printed firmer than expected but the annual trimmed mean CPI softened from the previous. AUD/USD trades within 0.6213-42 and NZD/USD within 0.5613-41.

- SEK is modestly weaker after softer-than-expected consumer inflation metrics across the board. Following December’s CPIF (cooler than expected) and the Minutes from the December meeting CapEco now expects the Riksbank to cut by 25bps in January (prev. exp. March).

- PBoC set USD/CNY mid-point at 7.1887 vs exp. 7.3435 (prev. 7.1879).

Fixed Income

- USTs are contained into a front-loaded US session on account of the Federal Holiday for Carter on Thursday. As such, we get ADP, Jobless Claims, FOMC Minutes and 30yr supply in today’s session. Into those events, USTs trade within a slim 108-04 to 108-09+ band which is entirely and comfortably within Tuesday’s 108-01 to 108-20 parameters. Ahead, US ADP, Jobless Claims ahead of speak from Fed’s Waller and then the release of the FOMC Minutes. Additionally, we await a 30yr supply which follows a tepid 3yr tap on Monday and a relatively soft 10yr outing last night.

- Bunds are similarly contained but with a slightly larger 131.90-132.14 range thus far with modest but ultimately fleeting action spurred by data this morning. A particularly soft Industrial Orders release and a mixed but largely weak Retail Sales report out of Germany sparked upside in Bunds early doors, to a retest of the above overnight peak; however, the move proved fleeting given large-order caveats to the Industrial Orders series. A 2035 outing had limited impact on Bunds.

- BTPs are the relative outperformers today after lagging yesterday on the announcement of two new syndications; this morning, we have seen marketing commence for a new 10yr BTP and a new 20yr Green BTP with orders in excess of EUR 125bln and EUR 110bln respectively.

- Gilts traded off highs in a 91.29-58 range ahead of a new 2030 auction; an outing which was mixed, with the b/c printing bang on 3.0 whilst the avg. yield is relatively high and a modestly wider tail, but ultimately had little impact on Gilts.

- UK sells GBP 4.25bln 4.375% 2030 Gilt Auction: b/c 3.0x, average yield 4.490% & tail 0.5bps.

- Germany sells EUR 3.781bln vs exp. EUR 5bln 2.00% 2035 Bund Auction: b/c 2.1x, average yield 2.51% & retention 24.38%

- Orders for Italy’s new 10yr BTP bond over EUR 125bln, for 20yr Green BTP over EUR 110bln, via Reuters citing leads; spread for 10yr +7bps, for 20yr +5bps.

Commodities

- Firmer trade in the crude complex despite the stronger Dollar, and extended on the prior day’s gains with upside seen after the latest private sector inventory data showed a larger-than-expected draw in headline crude. The complex saw additional upside in the European morning after reports that Ukraine had hit a Russian oil depot which served a military airfield, according to Ukraine’s Presidential Advisor. Brent Mar is currently just off highs in a USD 77.23-77.89/bbl parameter.

- Mixed trade across precious metals with spot gold and silver firmer whilst palladium trades flat/subdued. Spot gold trades in a current USD 2,645.40-2,654.90/oz range.

- Copper is on a firmer footing despite the stronger Dollar after the red metal lacked firm direction amid the mixed risk appetite in Asia and the subdued mood in China. 3M LME copper currently resides in a USD 8,983.00-9,056.00/t range.

- Private inventory data (bbls): Crude -4.0mln (exp. -0.2mln), Distillate +3.2mln (exp. +0.6mln), Gasoline +7.3mln (exp. +1.5mln), Cushing -3.1mln.

- Qatar set February Marine Crude OSP at Oman/Dubai + USD 0.45/bbl and Land Crude OSP at Oman/Dubai + USD 0.30/bbl.

- Shell (SHEL LN) Cuts Q4 Integrated Gas Production 880-820k boepd (prev. guided 900-960k boepd), LNG Volumes 6.8-7.2Mt (prev. guided 6.9-7.5Mt); optimisation results are exp. to be significantly lower than Q3’24. Guides Q4 Upstream: Production 1.79-1.89mln boepd, Underlying Opex USD 2.2-2.8bln. Guides Q4 Chemicals and Products: Refining Utilisation 74-78%.

- India has cut November gold imports by USD 5bln in the biggest revision, via Reuters citing sources; revised to USD 9.84bln (prev. estimated 14.86bln)

- China may trim fuel imports amid the 2025 tax hike, according to Reuters sources.

- India are looking at 2 new blocks in Jammu and Kashmir for Lithium exploration, according to Govt. sources.

Geopol

- Venezuelan President Maduro said two US nationals were arrested as part of a group of seven mercenaries. It was separately reported that the Biden administration is set to roll out new sanctions against Venezuelan President Maduro’s regime this week ahead of the Venezuelan Presidential Inauguration, according to an Axios reporter.

US Event Calendar

- 07:00: Jan. MBA Mortgage Applications

- 08:15: Dec. ADP Employment Change, est. 139,000, prior 146,000

- 08:30: Dec. Continuing Claims, est. 1.86m, prior 1.84m

- 08:30: Jan. Initial Jobless Claims, est. 215,000, prior 211,000

- 10:00: Nov. Wholesale Trade Sales MoM, est. 0.2%, prior -0.1%

- 10:00: Nov. Wholesale Inventories MoM, est. -0.2%, prior -0.2%

- 14:00: Dec. FOMC Meeting Minutes

- 15:00: Nov. Consumer Credit, est. $10.5b, prior $19.2b

DB’s Jim Reid concludes the overnight wrap

Morning from Copenhagen at an interesting time to be in Denmark, with the Danes currently in the crosshairs of Mr Trump as he vowed yesterday to “tariff Denmark at a very high level” if it didn’t give up control of Greenland. Asked if he would exclude the use of military force to obtain Greenland or separately take control of the Panama Canal he said “No, I can’t assure you on either of those two. But I can say this, we need them for economic security. We need Greenland for national security reasons.” So it will be interesting to hear the views of the locals today on this fascinating story. In fact in the unlikely event anyone is reading this in Greenland please feel free to get in touch! More from a remarkable Trump press conference later.

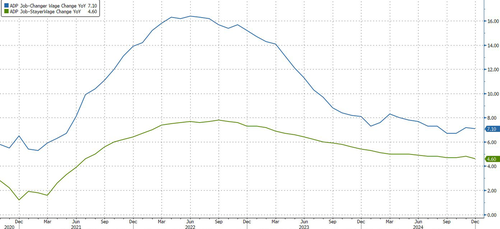

However, for wider markets it’s all about yields at the moment with some big or landmark moves again yesterday in a period where there continue to be doubts about whether the Fed can cut rates in 2025. A reminder that the DB house view post the election two months ago was that the Fed would have to be on hold for the whole of this year. Market pricing is catching that view up. The latest repricing had a few factors behind it, but the biggest was the ISM services print for December, where the prices paid indicator surged to its highest in almost two years, at 64.4. It’s true that the prices paid might not have the same impact as a CPI report, but it’s worth noting that a similar spike last January came right before some very strong US inflation prints in Q1 2024. And in turn, that led to a big reassessment of how quickly the Fed would cut rates, hence we saw such a big market reaction yesterday.

In terms of that reaction, Fed funds futures pushed back the likely timing of the next rate cut, with the probability of another cut by the March meeting falling from 44% on Monday to 41% by the close. And looking further out, the total amount of cuts priced by December’s meeting came down -1.6bps on the day to 37.5bps. But the bigger sell off came at the long end, with the 10yr Treasury yield (+5.5bps) closing at its highest since April, at 4.69%. In fact, yesterday’s Treasury auction saw the highest issue yield for a 10yr auction since 2007, at 4.68%. With the fresh steepening of the yield curve, the 2s10s curve moved up another +3.8bps to 39.0bps, which is the steepest it’s been since May 2022. And at the very long end, 30yr US yields (4.91%) have only been above 5% for six trading days in October 2023 since 2007 so we are in rarified air.

To be fair, it wasn’t just the prices paid indicator that led to that market reaction. For instance, the headline ISM services index was also stronger than expected at 54.1 (vs. 53.5 expected). On top of that, the JOLTS report for November showed job openings were up to a 6-month high of 8.098m (vs. 7.74m expected), so that helped to alleviate fears that labour demand was weakening. And in the background, oil prices were continuing to move higher, with Brent Crude closing at $77.05/bbl, which is the highest it’s been since October. So there were quite a few headlines that collectively pointed in a more hawkish direction.

The effects of that bond selloff were felt globally, and European yields also saw a significant rise in response to the US data. That included 10yr bunds (+3.4bps) which were up to 2.48%, and remaining on track for a 6th consecutive weekly rise. On the fiscal topic, this morning our economists published a blog (here) discussing the challenge Europe faces this year in plotting a course between ensuring fiscal stability and investing enough in growth and security.

In the meantime, gilts experienced some of the biggest losses, with 10yr gilt yields (+7.3bps) rising to their highest since October 2023, at 4.68%. And significantly, the 30yr gilt yield (+6.8bps) was up to 5.25%, which is its highest level since 1998. The problem for the UK government is that with yields where they currently are, they are close to breaching their own fiscal rules and as such may require additional tax rises.

The moves in European yields were mostly driven by the US data, as the European releases yesterday were much less eventful. Admittedly, we did get the Euro Area flash CPI print for December, but both headline and core CPI were in line with expectations, at 2.4% and 2.7% respectively. So there was little reaction in markets given they were in line with expectations, and the ECB is still widely expected to cut by another 25bps at their next meeting in just over three weeks’ time. However, one piece of news came from the German number, which was corrected to show a 2.8% inflation print on the EU-harmonised measure, not the 2.9% number that was reported the previous day. Imagine the potential market pandamonium if US CPI got corrected the day after a higher than expected print.

With bonds struggling across the board, equities also took a hit amid higher rates as well as a negative turn in tech sentiment. That saw the S&P 500 give up its opening gain to close -1.11% lower, its worst day since the rout that followed the hawkish Fed rate cut in December. The decline was led by steep losses for the Magnificent 7 (-2.53%), which came as Nvidia (-6.22%) was the second-worst performer in the S&P 500 following the announcement of new chips the previous evening. The product launch was impressive but left the market seemingly wanting more. Tesla (-4.06%) and Palantir (-7.81%), two of the tech companies that have gained since Trump’s election, were also among the five worst performers in the S&P 500. Outside of tech, the losses were more moderate, with the equal-weighted S&P down -0.33%. And over in Europe, there was a stronger performance, with the STOXX 600 up +0.32%.

Turning back to Trump’s press conference, his other headline-grabbing comments included demanding NATO countries spend 5% of GDP on defence, suggesting that the US could use “economic force” to absorb Canada and saying that he plans to rename the Gulf of Mexico to the Gulf of America. So plenty of US foreign policy uncertainty for investors to digest, especially on trade as the theme of tariffs again made a repeated appearance. On the economy front, Trump said that the outgoing administration had left a situation where “inflation is continuing to rage and interest rates are far too high”.

Asian equity markets are mostly trading lower this morning with Chinese stocks leading losses with the Hang Seng (-1.59%) trading notably lower while the CSI (-1.49%) and the Shanghai Composite (-1.46%) are extending their previous session losses after the US blacklisted major Chinese tech firms allegedly aiding Beijing’s military. Elsewhere, the Nikkei (-0.24%) is also seeing minor losses after clocking strong gains in the previous session. Elsewhere, the KOSPI (+1.11%) is outperforming as Samsung Electronics, the index heavyweight, has climbed over 3% as NVIDIA provided a vote of confidence in its ability to deliver through its current technical problems. This has offset disappointing results overnight.

Additionally, the S&P/ASX 200 (+0.93%) is also edging higher as trimmed mean inflation rate continues to fall, renewing hopes for a rate cut by the RBA. S&P 500 and NASDAQ futures are rebounding a bit, up +0.21% and +0.22% respectively.

Coming back to Australia, trimmed mean inflation for November came in at +3.2%, down from +3.5% in October. While this is still above the RBA’s inflation target of 2 to 3%, it is moving towards the range the central bank needs to cut rates and is softer than their quarterly projections from December. However, headline inflation rose from +2.1% to +2.3%. Meanwhile, yields on the policy sensitive 3yr government bonds fell -1.7bps to settle at 3.93%.

To the day ahead now, and data releases from the US include the ADP’s report of private payrolls for December, along with the weekly initial jobless claims. Meanwhile in Germany, we’ll get factory orders and retail sales for November. From central banks, we’ll get the minutes from the FOMC’s December meeting, and also hear from the Fed’s Waller and the ECB’s Villeroy.