EV-Critical Battery Metal Cobalt Soars As Congo’s Export Ban Disrupts Supply Chains

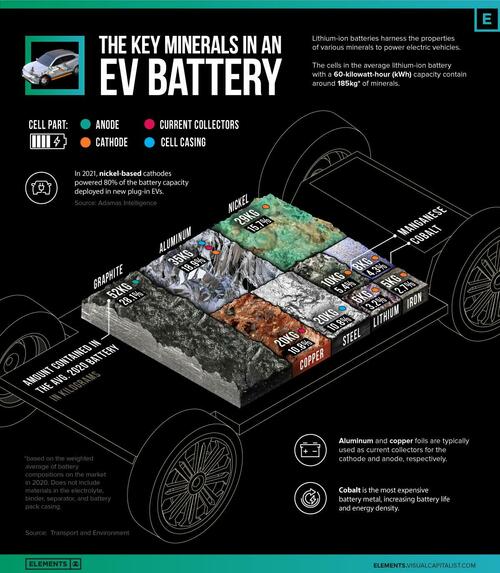

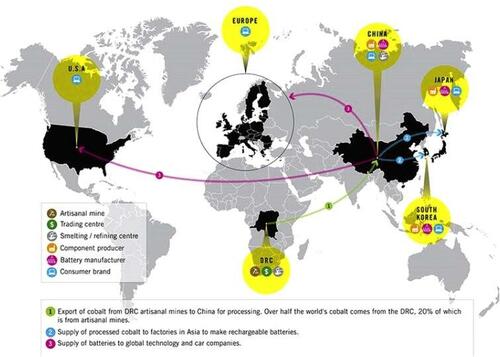

The Democratic Republic of Congo’s four-month suspension of cobalt exports has driven up prices of the critical metal, which is heavily used in lithium-ion batteries—the backbone of the renewable energy industry.

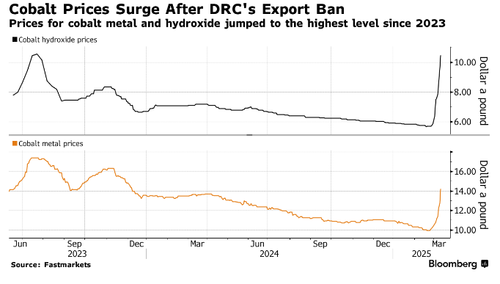

New Fastmarkets data shows that a pound of cobalt hydroxide—the main product exported from the DRC, the world’s top producer—has surged 84% since the DRC suspended exports last month to counter a market glut that had pressured prices to multi-year lows. Prices reached $10.50 per pound on Tuesday, the highest level since July 2023. The price of cobalt metal has also soared 43%

Chart courtesy of Bloomberg.

Telf AG, the marketing agent for cobalt mined in the DRC by Eurasian Resources Group, has invoked force majeure clauses in its supply contracts, allowing it to suspend deliveries due to the export ban outside its control.

Telf told customers that the impact ban is still being assessed and that it will not be able to meet any delivery obligations.

“The cobalt export ban has been publicly announced by the DRC government, and like many other industry participants, we are currently assessing our options in response to these developments,” a Telf spokesperson told Bloomberg.

According to the US Geological Survey, the DRC produced 76% of the world’s cobalt supplies, critical for the electric vehicle market.

The latest export ban mirrored the 2022-23 suspension when the DRC halted exports of both copper and cobalt from CMOC’s mines due to a tax disagreement with the Chinese company. At the time, CMOC accounted for 10% of global cobalt production.

A four-month suspension of cobalt exports will likely generate the short-term outcome: higher prices followed by sliding prices…

Fastmarkets analyst Robert Searle told AFP News that the DRC’s temporary ban may have “significant risks” for “Chinese companies that have invested billions of dollars into the DRC’s mining industry. This uncertainty and the ban caught them off guard and could slow further investment in the country.”

Searle pointed out that “higher cobalt prices and (supply) disruptions could see a greater deployment” of cobalt-free batteries from EV companies pushing away from the metal “in the coming years.”

“The oversupply in the cobalt market has predominantly been driven by the growth in mined supply in the DRC,” said Searle.

Cobalt prices are expected to continue rising in the coming weeks. However, prices will likely plummet again once the export ban is lifted. Rather than relying on short-term fixes, a long-term supply agreement to balance production is needed…

Tyler Durden

Thu, 03/13/2025 – 04:15

via ZeroHedge News https://ift.tt/RC68sME Tyler Durden