Ignore The Collapsing Soft Data: Bank Of America Says “Watch What They Do, Not What They Say”

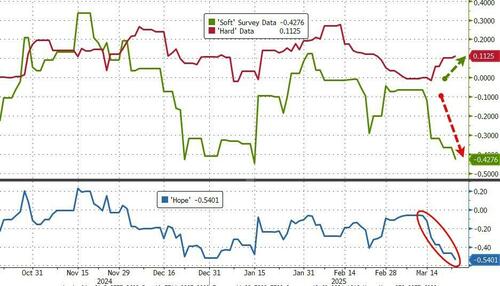

The data – as in actual, hard data, not vibes, or sentiment, or feelings, or expectations, also known as soft data – on the US economy in the last two weeks have pushed back on growing recession concerns sparked by weaker sentiment.

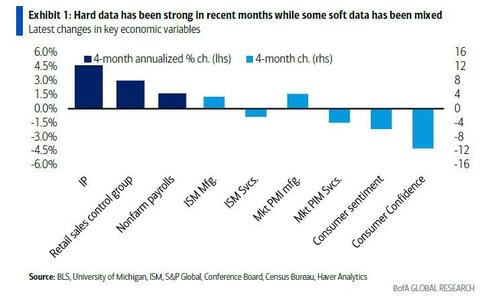

Last Monday retail sales were better than we expected as the control group rose by 1.0% m/m. This was followed by the latest industrial production (IP) which soared past expectations due to a surge in manufacturing—particularly autos and durables ex autos. Yesterday we were struck by far stronger than expected US PMI data. Yet all of this hard data has been in stark contrast to increasingly weak soft data, with today’s collapse in the Conference Board’s consumer confidence, where expectations plunged to a 12 year low, being the latest example.

Echoing what we say all the time about the Bank of America Fund Manager Survey, namely to ignore the schizophrenic responses offered by the respondents and just focusing on what they actually do, Bank of America economist Stephen Juneau has the same advice when it comes to this seemingly irrational divergence: Pay attention to what they do, not what they say.

According to Juneau, the strength of these hard data reinforce his view that actions speaker louder than words when it comes to activity. There is little doubt that uncertainty has risen, and it has affected both business and particularly consumer sentiment. The preliminary March University of Michigan consumer survey suggests consumers are increasingly worried about a stagflation outcome. However, there is little sign that these worries are translating into slower activity yet.

The three Cs: claims, capex and card spending: On one hand, consumers and businesses are right to be more concerned about the outlook than a couple of months ago as inflation has proven stickier than expected (incidentally a byproducts of the previous administration). But according to Bank of America, “the signal between survey-measures and real activity has deteriorated too much in recent years to be seen as reliable.”

Therefore, the chief BofA economist says it is far more meaningful to avoid the “vibes” and instead watch actual hard data, such as claims, capex and card spending data for signs that activity is weakening.

Until then, BofA remains constructive on the US economy.

Tyler Durden

Tue, 03/25/2025 – 13:20

via ZeroHedge News https://ift.tt/pfNP9TO Tyler Durden