I’ve been banging on for months along with Martin Armstrong that the real problem overhanging these markets is not an over-priced U.S. equity market. That’s a sympton of a much bigger problem.

The real problem is an over-valued European sovereign bond market.

Looking at today’s bond market we see technical breakouts on yields to the upside across the continent. And we’re not talking the usual suspects here, like Italy, Portugal or Greece.

No, we’re talking about Germany.

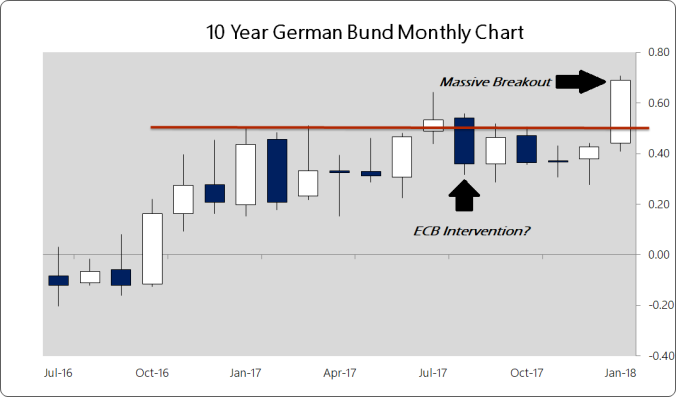

Note the cluster of resistance at 0.5%. The market rejected taking yields on German 10 year debt above that level no less than six times in the past fifteen months.

Today, yields are at 0.685% and tomorrow is the end of the month. Looks like we’re going to get a major bearish signal in German debt tomorrow.

While all the headlines are agog with stories about the Dow Jones dropping a couple hundreds points off an all-time high, German bunds are getting killed right before our eyes.

The Dow is simply a market overdue for a meaningful correction in a primary bull market. And it’s a primary bull market brought on by a slow-moving sovereign debt crisis that will engulf Europe.

It’s not the end of the story. Hell, the Dow isn’t even a major character in the story.

In fact, similar stories are being written in French 10 year debt, Dutch 10 year debt, and Swiss 10 year debt. These are the safe-havens in the European sovereign debt markets.

Meanwhile, Italian 10 year debt? Still range-bound. Portuguese 10 year debt? Near all-time high prices. The same this is there with Spain’s debt. All volatility stamped out.

Why?

Simple. The ECB.

For Euro Eyes Only

The ECB’s quantitative easing program and negative interest rate policy (NIRP) drove bond yields across the board profoundly negative for more than a year.

And despite ECB President Mario Draghi’s jaw-boning and assurances, he can no more exit this program than Bitcoin billionaires can exit the crypto-market and get back into dollars without the kind of pain that would stagger, if not break, the industry.

But, the ECB is trapped and cannot allow rates to rise in the vulnerable sovereign debt markets — Italy, Portugal, Spain — lest they face bank failures and a real crisis.

The problem with that is, the market is scared and so they are selling the stuff the ECB isn’t buying – German, French, Dutch, Swiss debt. In simple terms, we are seeing the flight into the euro intensify here as investors are raising cash.

The euro and gold are up. The USDX continues to be weak even though capital is pouring into the U.S. thanks to fundamental changes to tax and regulatory policy under President Trump.

In the short term Dow Jones and S&P500 prices are overbought. Fine. Whatever. But, the real problem is not that. The real problem is the growing realization in the market that governments and central banks do not have an answer to the debt problem.

Trump is being fought every step of the way to keep the dream alive of a U.S. economy brought to the same low state of the EU’s democratic-socialist ‘shitholes.’ He’s winning, by the way, because, for the most part, he is on the side of rational, incentive-based economic theory.

He’s hopeless on some issues, but the core of his tax-cut plan supersedes those failings.

The Real Savings Story

However, the real story is the end of the current monetary system and the repudiation of neoliberal/neoclassical economics. Despite Armstrong’s wailings against the Austrian School of Economics and the Quantity Theory of Money, this is Mises’ revenge.

He actually makes the Austrian case in a recent blog, but refuses to admit that what he’s describing are the effects of money printing rather rooting out the underlying cause of the deflation he’s rightly seeing.

It’s too bad, actually. Because a mixture of his cycles work and a deeper understanding of Austrian Business Cycle Theory, which is NOT synonymous with the Quantity Theory of Money, would be a a synthetically more powerful combination than either of them on their own.

Printing money undermines the confidence in the value of it. There is no way around that. In fact it is the entire point of printing money. At most points in the inflationary boom/bust cycle increasing the money supply will create price inflation.

Again, that’s the point.

This price inflation comes from the confidence that people have in the issuers of the money that they have things under control, that they are printing the right amount of money to offset price deflation and spark a boom.

And as long as that confidence holds, then expansionary monetary policy will create a new economic boom that can be measured in increasing nominal output.

However, in doing so the money issuers, in this case the central banks, distort the structure of production by mis-pricing the cost of money, the interest rate. They artificially drive interest rates below the real rate of the market’s risk tolerance.

This signals to producers to engage in projects that there isn’t enough capital in the pool of real savings to cover. I covered this in a post at length last year.

But, there will always come a point where the creation of more money units will not inspire enough confidence in the system to maintain asset prices being artificially propped up by more money.

And when that happens it will be the boom to end all booms, where printing of more money will not create more confidence but less. And even a core economy like the U.S. will be bound by this fact. If Trump is allowed to do his job he will postpone that day for a while, but the structural problems of the U.S.’s economy are too deep to avoid some damage.

Trapped, Trapped I Say!

That’s where the ECB is now. There is no political will in Europe to change its taxing and regulatory environment. In fact, Germany wants more punitive Austerity not less. It demands the worst possible combination of conditions on its confederates, lower government spending (good), higher taxes to pay for the debt servicing (awful).

It’s nothing but a capital destructive scheme meant to punish and destroy the prospect of future growth.

The ECB is flirting with losing the confidence of bond traders and institutional investors who rightly see all European sovereign debt as over-valued, especially as rates in the U.S. begin to rise.

We have been in a deflationary cycle since 2008. The Fed printed money to save the banks. The money never circulated because it paid the banks to park the money on reserve with the Fed, interest on excess reserves.

However, that interest did, along with government deficit spending, keeping prices for those things with inelastic demand curves — food, electricity, health care, housing — continually rising while real wages contracted.

The U.S. economy is about to be unleashed by Trump’s tax cut law. It will be able to absorb higher interest rates for a while. Yield-starved pension funds, as Armstrong rightly points out, will be bailed out slightly forestalling their day of reckoning.

And in doing so, higher rates in the U.S. are driving core-rates higher in Europe. An overly-strong euro is crushing any hope of further economic recovery in the periphery, like Italy. The debt load on Italy et.al. has increased relative to their national output by around 20% since the end of 2016.

This will put the ECB at risk of a massive loss of confidence when Italian banks start failing, Italy’s budget deficit starts expanding again and hard-line euroskeptics win the election in March.

As capital is drained out of Europe into U.S. equities, the dollar, gold and cryptocurrencies, things should begin to spiral upwards rapidly.

This is the story the bond markets are telling us today.

via RSS http://ift.tt/2BGRnRF Tyler Durden