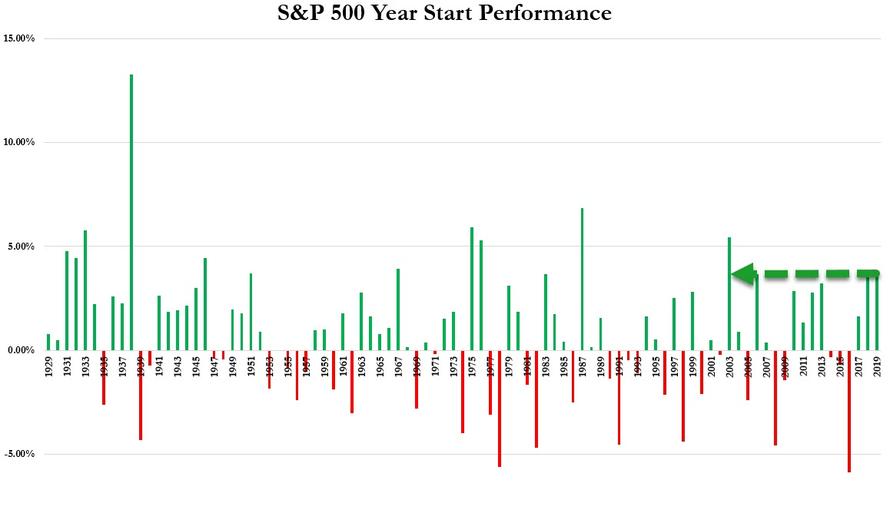

The greatest stock run since 2008’s halfway-down bounce. The greatest short-squeeze since March 2009 lows. The greatest oil win streak in history… and the best start to a year for the S&P 500 since 2003? Everything sounds awesome, right?

Well, since The Fed hiked rates in December, stocks are actually unchanged…

So, as former fund manager and FX trader Richard Breslow notes, the good news is you really haven’t missed anything… but the bad news is that markets trade like a mess.

Via Bloomberg,

This all remains very much a work in progress, so beware of serially jumping to conclusions. Any of them. Any individual economy, let alone the global economy, simply can’t lurch from growth fears one day to budding optimism the next. And the same is true of a whole host of other systemically important issues investors are grappling with.

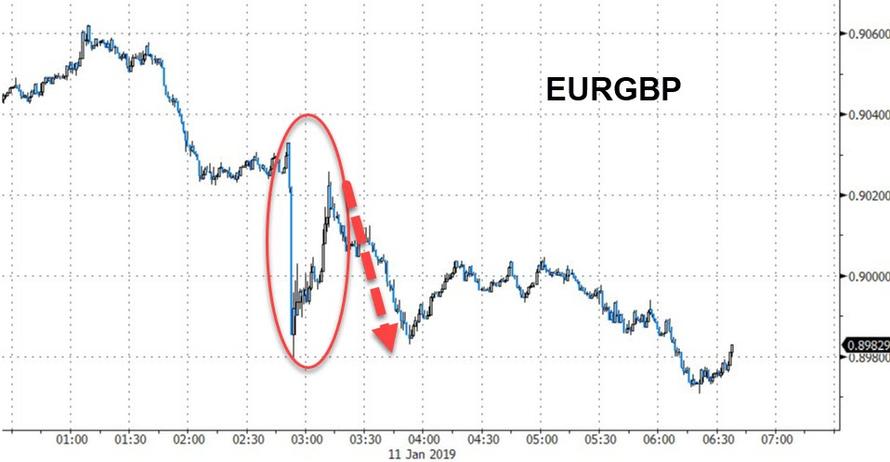

In the course of today’s European morning we saw EUR/GBP rally on negative comments about where things stand on Brexit. We saw it crash off on a headline about a delay in the process. It quickly bounced back on the denial headlines. Then there were the analyst comments that a delay would be nice in the short run but not a “big game changer.” And after all the drama, the currency pair went back to flat on the day. Right in the middle of the same range we’ve watched play out for over a month.

That’s just one stark example of how many other assets have been trading. And even those that have been directionally moving have mostly just managed to return to levels that are very familiar. The Australian dollar is up quite handily this morning on “trade optimism.” It remains in a channel downtrend and sits between two moving averages. Both of which have proven their meaningfulness.

West Texas crude has been behaving like a champ this month. It’s hard not to be impressed. But it’s now sitting right in the middle of that pesky $50-$55/bbl range that raises ambiguity about whether it’s rejecting a false breakdown at the end of December or preparing to do something more dramatic to the upside.

Equities are acting out their own version of nothing-is-definitively-settled drama. Up nicely on the month. Everyone is happy. Or they would be if they hadn’t been caught with an underweight exposure. But so far the indexes have stalled out right below resistance. It’s easy to be bullish and also to look at a chart and see how stocks imploded from these same prices a month ago.

None of this is meant to try to be depressing. Quite the opposite. It seems like this is one of those years when traders aren’t going to be forced from the get-go to pay or sell extremes to get involved. It may be frustrating but it’s also less scary.

It’s a product of the fact that so many important and market-impactful issues remain completely unresolved. You get a chance to watch events unfold and make your own judgments without that nagging fear that everyone else knows something that you don’t. And people have, so far, apparently resisted the impulse to get too far out over their skis.

I’m beginning to wonder whether we may have to settle into a period of violent range trading while awaiting greater clarity. Which means there are tremendous opportunities out there if you remain both skeptical and open-minded.

via RSS http://bit.ly/2Fm0nBZ Tyler Durden