Despite surprisingly strong 2018 results and 2019 estimates out of General Motors last week, it’s becoming clearer that a recession in the U.S. auto industry is already underway. All one has to do is look around: factories are closing, shifts are being truncated and thousands of layoffs have taken place.

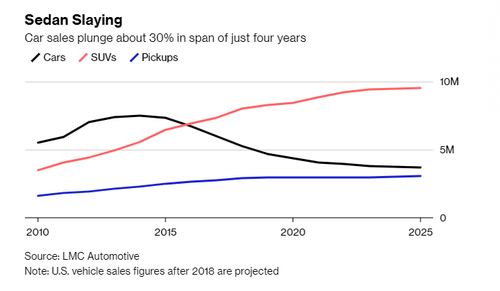

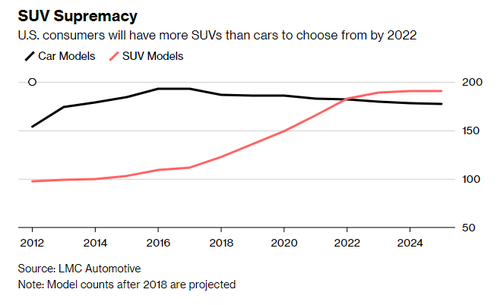

Meanwhile, Detroit is showing increasingly more signs that it is in the midst of a recession as demand for sedans has collapsed. This collapse has been the result of most consumers moving to sport utility vehicles and pick-ups. In fact, the models that used to be the lifeblood of the car industry, sedans like the Honda Accord and Ford Fusion, only made up 30% of US sales in 2018.

Sedans are estimated to sink to 21.5% of the US market by the year 2025, according to research from LMC Automotive. That will leave car manufactures with extra factory capacity that will be capable of producing some 3 million more vehicles than buyers want. This type of overcapacity has resulted in losses and has catalyzed past recessions for the industry.

Jeff Schuster, senior vice president of forecasting at LMC Automotive, simply told Bloomberg: “You could classify this as a car recession.”

As a result, the mood at the upcoming North American International Auto Show in Detroit this week should be a key indicators. The car show is being moved to the summer next year in an attempt to try and re-establish its relevance, as car dealers who are attending this January won’t include once notable attendees as Mercedes-Benz, BMW and Audi. Why? Perhaps because Morgan Stanley analyst Adam Jonas recently predicted that manufacturers will use the Auto Show as an opportunity to lower guidance.

Meanwhile, as we said last Friday when GM raised its guidance, we were skeptical about any material upside, and we remain skeptical.

“We’re not sure if Barra is only raising guidance now to (double) cut it later, or perhaps betting on a timely resolution to the trade war (or maybe both), but it’s tough to feel like there isn’t much more here than what meets the eye,” we noted on Friday. The total overcapacity by US auto makers is the equivalent of 10 extra plants, according to Bloomberg. This would account for at least 20,000 potential jobs being scrapped; this means that more cuts are on their way. Jeff Schuster continued: “GM has taken some actions, but they still have some well-underutilized plants. So we may not be done with this yet.”

Traditionally when this kind of problem has arisen, automakers have taken sedans and stuffed them into rental lots and commercial fleets. Now, that tactic is only serving to add to the current capacity crisis. Fleet channels are already stuffed: these sales helped inflate the market over the last few years, even though individual retail sales peaked three years ago.

Mark Wakefield, head of the automotive practice at distressed turnaround consultant AlixPartners stated: “The car recession and the retail recession have already arrived in the sense that retail sales peaked in 2015 and have gone down ever since. Cars have just been crushed.”

And again, crossover SUVs are getting the blame. Some of the issue is attributed to the fact that SUVs now get almost as good of fuel mileage as sedans. The Chevy Equinox, for instance, only gets one mile less per gallon than the Chevy Malibu, a popular sedan.

But outside of Detroit, executives at companies like Toyota are sticking out with sedans. Jim Lentz of Toyota North America said: “We are not going to get out of that business [making sedans]. We still see an opportunity there.”

Interestingly, the wide adoption of sedans was a result of the last automotive recession. When gas prices were much higher and the industry last had to go through layoffs and plant closings, many of the Detroit factories changed from making SUVs to making sedans, using gas mileage as a selling point. But now, with fuel costs no longer a prohibitive factor, that cycle has turned once again.

via RSS http://bit.ly/2AInmDI Tyler Durden