Heading into the end of the of 2018, Morgan Stanley’s chief equity strategist Michael Wilson – best known for his “rolling bear market” call and his accurate claim that BTFD no longer works – made a good, bearish call… Only in retrospect it was too good, and as Wilson writes this morning, while he had “always expected” the S&P 500 to hit his bear case of 2400, he thought it would be in 1Q 2019… not at the end of 2018 as “we thought the market would need to actually see the earnings and economic data disappointments before reaching 2400.

However, a confluence of exogenous events, including perceptions of Fed miscommunication, Government shut down, poor year end liquidity and most notably a furious hedge fund liquidation to meet redemption requests, “conspired” to take the stock market to valuations we hadn’t see since the post-Brexit reaction in 2016, culminating in what the press called the “Christmas Eve Massacre” (and we called the “Mnuchin Massacre”)and “conspired to create one of the worst Decembers in history”.

As a result, Wilson thinks the market embraced his earnings recession call as earnings revision breadth rolled over. In short, after ignoring Morgan Stanley’s bearishness for nearly a year the market is now discounting the bank’s (formerly) out of consensus views on growth and “it may have even discounted a modest economic recession.” Or, as Howard Marks summarized earlier on Monday, “Nothing much changed except people were first ignoring the bad news and then they were obsessing about the bad news.“

Yet while initially, it appeared as if equity markets sold off for technical reasons more than fundamental ones, “on further inspection we think the market was simply pricing in the more growing risk of an earnings, and even an economic, recession. After all, if we could see that risk increasing, surely the market could too.”

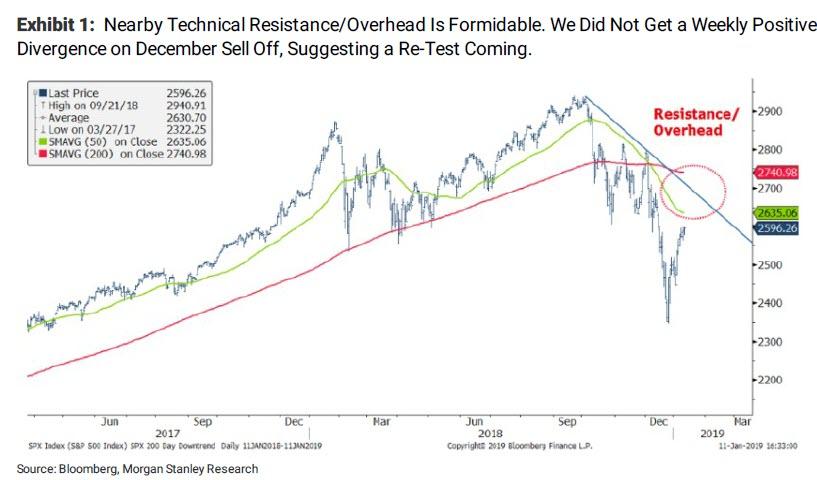

At roughly this time, Wilson and Morgan Stanley turned tactically bullish as “sentiment and positioning got washed out to levels we typically see during good buying opportunities.” Yet, as we noted last week, it’s not an all clear yet: “The issues we still need to deal with include the fact that we are in the midst of a fairly steep and broad negative earnings revision cycle, and there is significant technical resistance/overhead not far above current prices.”

In other words, there are two key risks preventing Wilson from turning outright bullish, namely that (1) valuations are still too high or (2) where earnings downside is even greater than what has been priced.

So in a twist, Wilson is once again leaning bearish, because “as we deal with these issues during 4Q earnings season and perhaps see some further deterioration in US economic data, we think the S&P 500 will suffer a re-test of the lows we experienced in December, but on less negative momentum and better breadth.“

Should that happen, and should the S&P slide back to Wilson’s bear case support level of 2,400, the MS strategist says he would be an “aggressive buyer” and “if we actually suffer the re-test we are expecting, we would be buyers of that almost regardless of what is going on, assuming it happens on less momentum and better breadth.”

To sum up, we think the broader market achieved our downside targets on valuation as well as on sentiment and positioning.

But what if the rally persists? In a word: sell, “since the fundamentals remain murky at best with earnings visibility deteriorating and revisions decidedly negative at the moment” and with economic data surprises turning negative, Morgan Stanley thinks “it could get worse in the near term, especially if the government shutdown persists.”

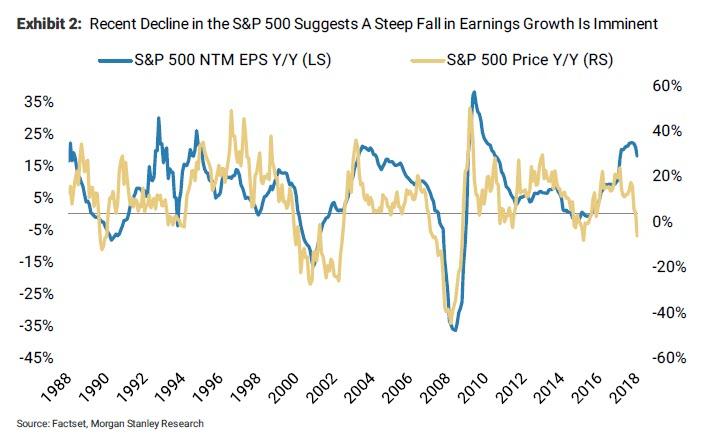

There is another reason why Morgan Stanley expects another drawdown in equities: analysts forecasts will soon reprice to reality, and in fact, will soon forecast an earnings recession, the first one since the 2016 commodity collapse episode.

As shown in the chart below, the recent y/y decline in the S&P 500 is close to what we observed in 1990; and if we get a full re-test and break as Wilson expects in the next few months, it will likely be equivalent. In other words, between here and there, the S&P 500 would be pricing in our earnings recession and perhaps a shallow economic recession. Consistent with Morgan Stanley’s 2019 earnings call, the strategist now expects the blue line in Exhibit 2 (NTM EPS growth) to rapidly catch-down to the yellow line (price change) as markets lead the fundamentals. Wilson suspects “such a rapid decline in forward earnings will provide a reason for stocks to revisit the December lows” but as he adds, “that’s the trap and the time to buy, not sell.”

Finally, the bank is also wary of the “significant overhead resistance created by the 4Q sell off”, and the lack of a weekly positive divergence during the December capitulation (Exhibit 1). As such, Wilson advises clients that “2600-2650 on the S&P 500 is a good level to start lightening up as we enter what is likely to be a period of negative news flow on earnings and the economy.”

via RSS http://bit.ly/2HaL8xJ Tyler Durden