Another day, another attempt to buy the dip to make sure everything looks awesome…

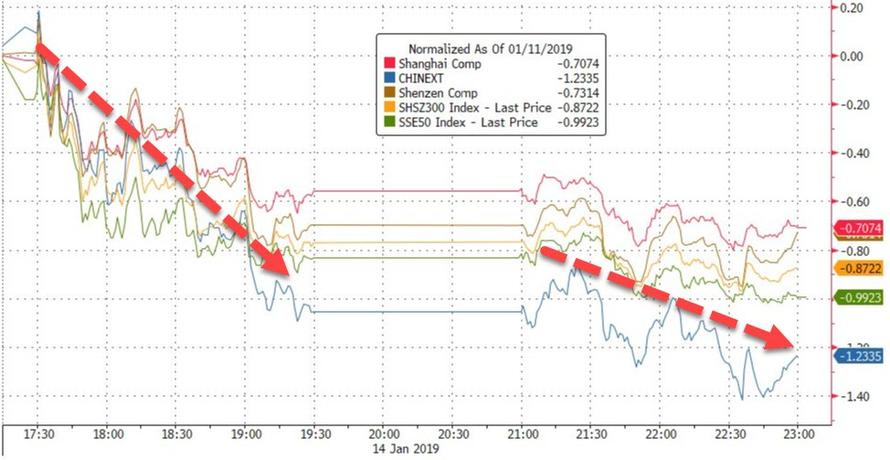

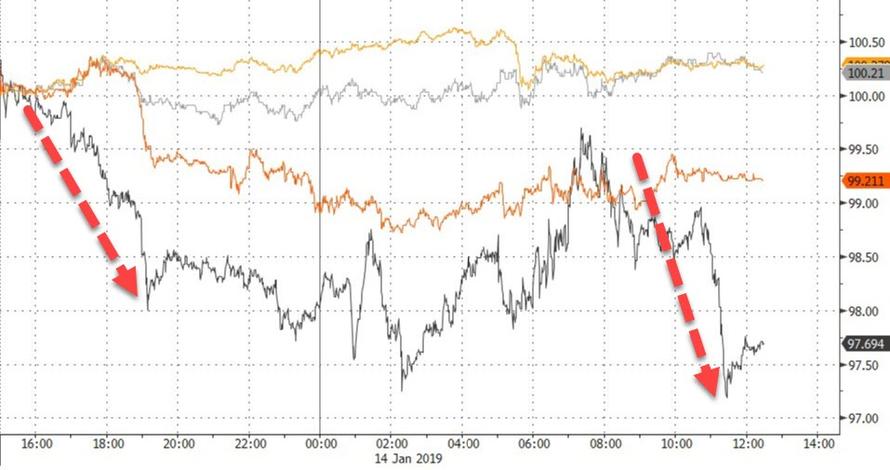

Ugly China data sparked weakness in stocks (no bad news is good news here)…

European markets were not pretty…

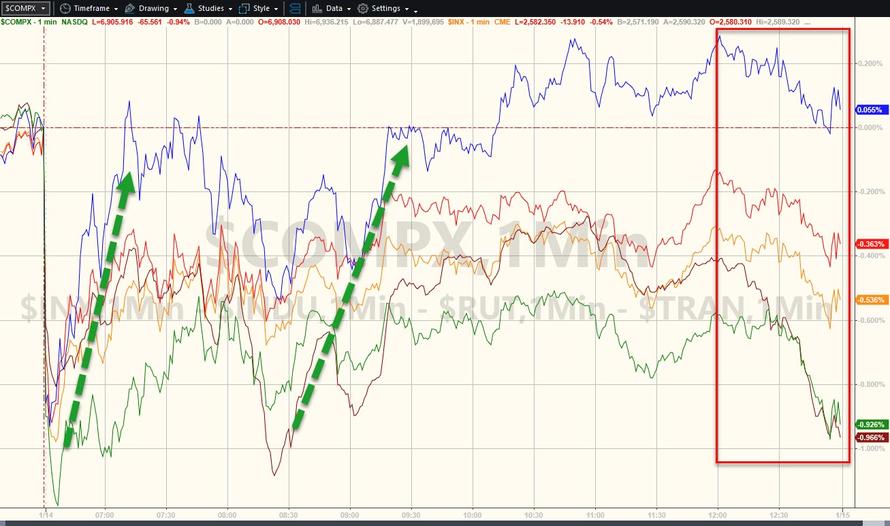

US Equity futures were down pretty good overnight, but a combination of Trump commenting once again on “very good China talks” and the US cash market open, prompted the no ubiquitous buying spree to erase a lot of the day’s damage…

0933ET TRUMP SAYS U.S. DOING VERY WELL WITH CHINA

On the cash side, Trannies moved green, but the rest of the majors – despite a valiant effort – were unable to make it…

US Equities are back in the box between 50 and 61.8% retrace of the Dec drop…

PG&E was pulverized on bankruptcy headlines…

After disappointing Citi FICC earnings, the bank traded down almost 2% in pre-market but was then panic bid during the day session…

FANG Stocks also saw the dip bought but were unable to break back to even… this is the first down day for FANGs in 7 days…

Biotechs suffered first loss in 10 days..

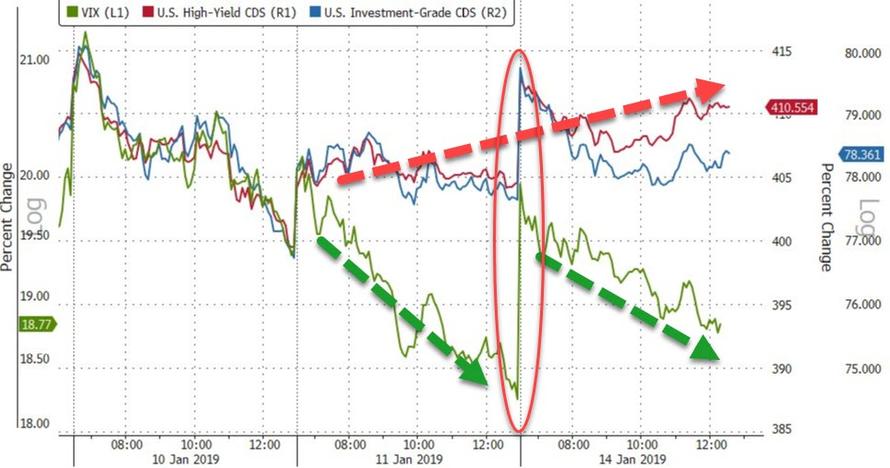

VIX and Credit decoupled (Credit worse as VIX compressed)…

HY Credit markets dropped for the second day in a row (after 6 straight up)…

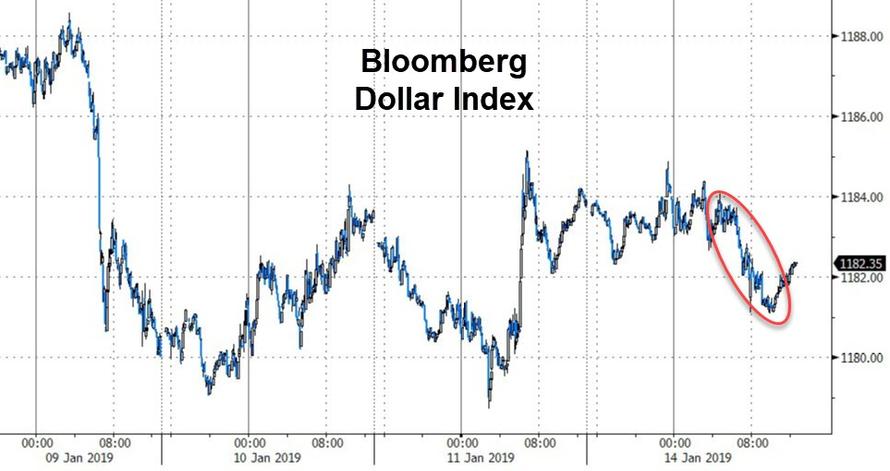

The Dollar was flat overnight but selling began as US markets opened…

Cable popped above 1.29 – near two month highs – ahead of tomorrow’s critical Brexit vote…

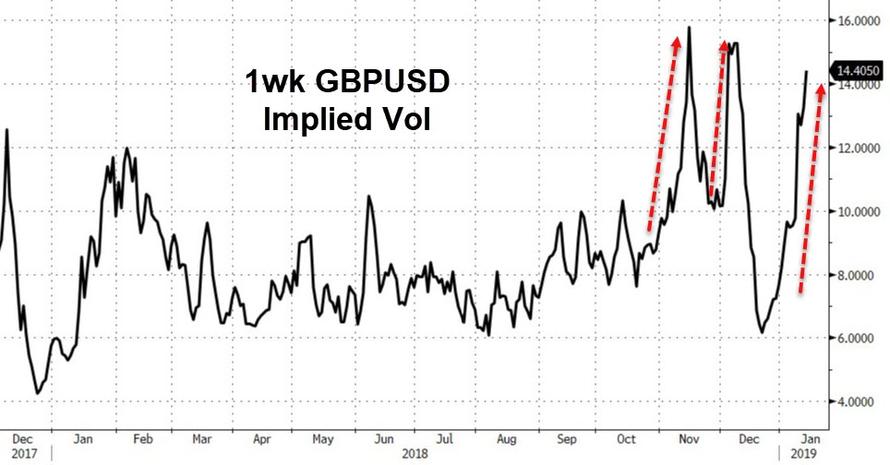

And while cable has been rallying, so has the demand for protection…

Cryptos jumped on the day, on the back of China and Russia headlines…

Copper and crude were weaker (China) as PMs clung to very modest gains on the day…

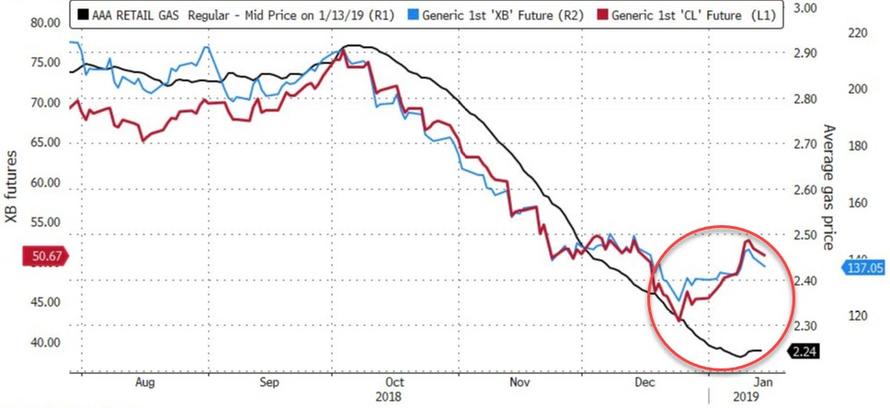

WTI slumped back to a $50 handle on heavy volume…

The short-term silver lining of lower gas prices at the pump, may be short-lived…

And while WTI tumbled, Nattie soared on the heels of concerns over supply amid the snowstorm coming to NYC…

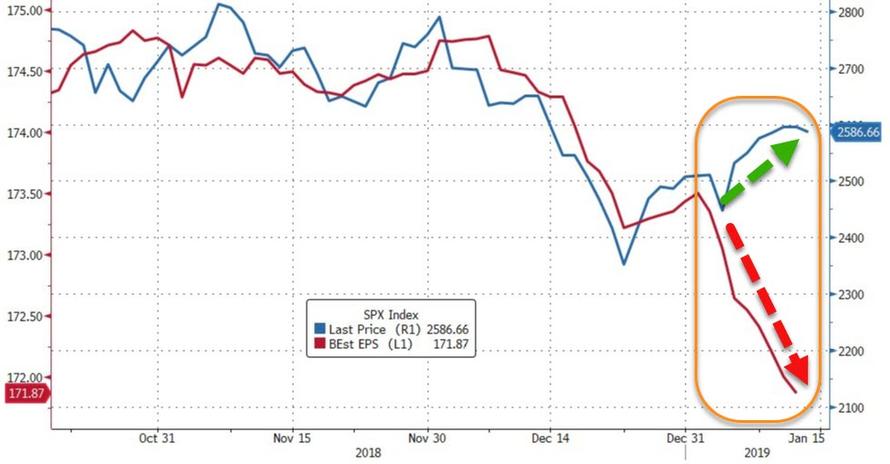

Finally, just one thing… forward earnings expectations continue to slide…

“Probably nothing”

via RSS http://bit.ly/2FqierG Tyler Durden