Authored by Sven Henrich via NorthmanTrader.com,

Lots of “bottom is in” calls these days after the 10%+ rally off of the December lows. I remain on the open minded train train awaiting for more evidence on the technical and macro front to come in. In my 2019 Market Outlook I made mention of industrial production as one of the key data points of interest to keep an eye on.

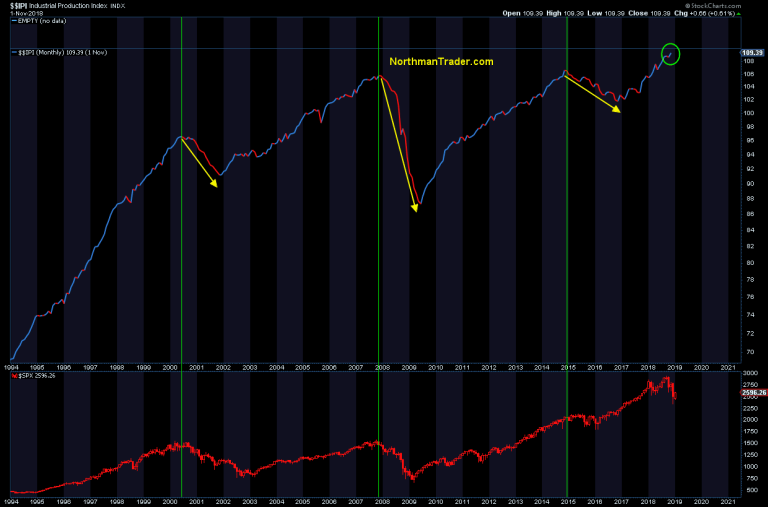

Specifically major market tops show some sort of reversal in industrial production accompanying a decline in market prices. While most look at the yield curve for a coming recession (and nothing wrong with that) the relationship with industrial production is pretty self evident as well:

The earnings recession in 2015/2016 of course famously stopped with global central bank intervention. There’s little sign of such intervention at this time.

And clearly we don’t have declining industrial production in the US. Yet.

But while we’re waiting for US data there are dark macro clouds forming on that front all over the world and the data appears rather concerning:

Germany:

France:

Add Italy to the mix and you have this:

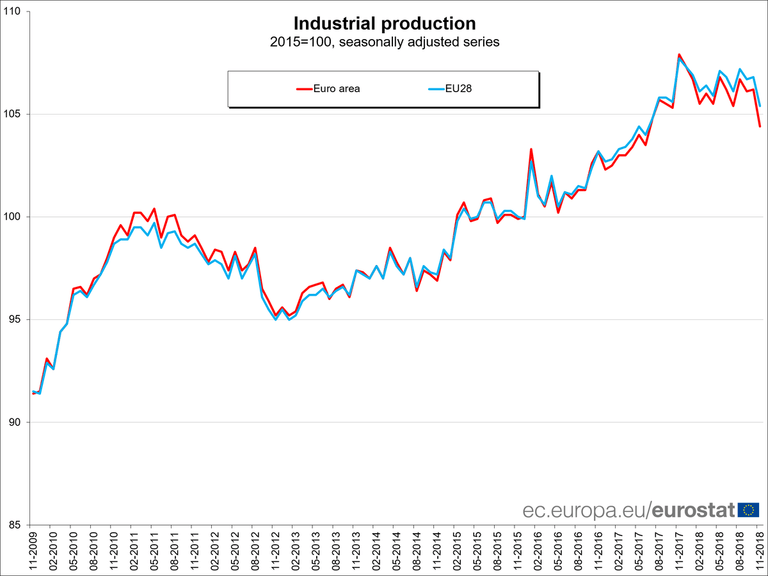

Taking Europe altogether in aggregate you get this picture:

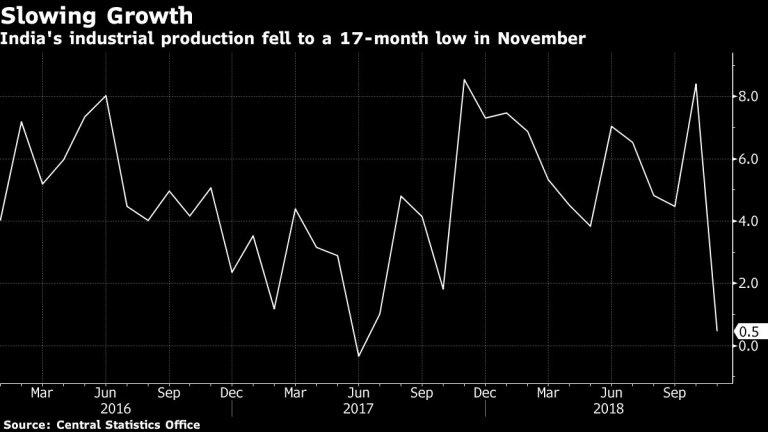

But it’s not just Europe in isolation. Here’s India:

Those are big declines and look awfully like a global trend emerging.

Indicative of a recession to come? One data point per country does not confirm a recession coming. How about two?

We’ll see. A few clouds a storm do not make. But get enough of them and the potential is there. Hence it’s very worth keeping an eye on industrial production everywhere, including the US. And see, I haven’t even mentioned China once

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via RSS http://bit.ly/2D9JWq6 Tyler Durden