Authored by Brian Livingston via MarketWatch.com,

Every trader’s secret wish is to be psychic. If we could only know in advance whether the market was going to go up or down.

Well, good luck trying to predict next year’s return – or even just tomorrow’s. But surprisingly, there are several recognized methods for projecting the S&P 500’s return in the next 7 to 15 years, and they’re pretty good.

Decade-length forecasts won’t help any day traders make big profits this week. But longer-term investors can benefit a lot from these forward-looking estimates. Whatever goal you may be saving money for—a kid’s college tuition or a financial-freedom day that may be 10 years in the future – you want the answer to two questions:

-

Are we entering a “go-go decade,” such as 2009–2018, when most stocks grow up, up, up?

-

Or is this the beginning of a “bummer decade,” such as 2000–2009, when stock markets around the world crashed twice, ending not far from where they started?

If the next 10 years look like a downer, dude, diversifying your portfolio into securities other than stocks may pay you big dividends.

Financial experts like Warren Buffett and Robert Shiller are creators of long-term projection methods with data that goes back more than half a century. It’s well known that Buffett is one of the world’s richest people, and that Shiller won a 2013 Nobel Prize in Economics partly for developing his forecasting formula. Whether or not these seers actually have crystal balls, things have worked out pretty well for them.

Whatever goes up must eventually come down

Stephen Jones, a financial and economic analyst who works in New York City, tracks the formulas that several market wizards have disclosed. He recently updated his numbers through Dec. 31, 2018, and shared them with me. Buffett, Shiller, and the other boldface names had nothing to do with Jones’s calculations. He crunched the financial celebrities’ formulas himself, based on their public statements.

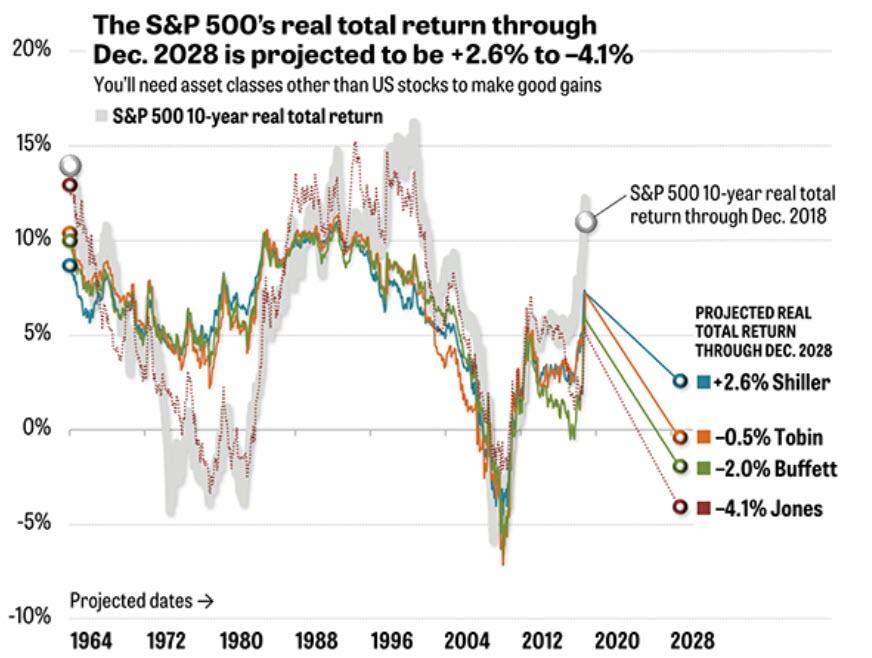

The graph above doesn’t show the S&P 500’s price levels. Instead, it reveals how well the projection methods estimated the market’s 10-year rate of return in the past. The round markers on the right are the forecasts for the 10 years that lie ahead of us. All of the numbers for the S&P 500 include dividends but exclude the consumer-price index’s inflationary effect on stock prices:

-

Shiller’s P/E10 predicts a 2.6% annualized real total return. Take today’s S&P 500 price and divide it by its companies’ average inflation-adjusted earnings over the past 10 years. This gives you a ratio that suggests whether the market is overpriced or underpriced. If you could buy one “share” of the S&P 500 index, your account would be worth around $2,700. After 10 years of 2.6% gains, you’d have $3,490. (Controversy alert: Various economists have proposed a number of improvements in the way Shiller’s ratio should be calculated.)

-

Buffett’s MV/GDP says minus 2.0%. Divide the S&P 500’s market value by the U.S. gross domestic product. Buffett wasn’t the first person to suggest this metric, but he’s said on the record that it’s “probably the best single measure of where valuations stand.” If the index fell 2.0% annualized, your $2,700 would turn into $2,206. Not so great.

-

Tobin’s “q” ratio indicates minus 0.5%. This metric divides the market value of all U.S. equities (not just the ones in the S&P 500) by the cost to replace all of the companies’ assets. It’s based on academic papers by economists James Tobin, a 1981 Nobel laureate, and William Brainard. This formula predicts that your S&P 500 account will drift slightly lower in real terms, not quite keeping up with inflation.

-

Jones’s Composite says minus 4.1%. Jones uses Buffett’s formula but adjusts for demographic changes. For example, as America’s population ages, this reduces economic demand. The resulting Demographically and Market-Adjusted (DAMA) Composite has predicted the S&P 500’s 10-year returns more closely than any of the other formulas since 1964. Let’s hope he’s wrong. A 4.1% annualized loss would drive your $2,700 account down to $1,776 after 10 years. That would be a 34% decline, almost as bad as the “lost decade” of 2000 through 2009.

The predictions might seem far apart, but they aren’t. The forecasts are all much lower than the S&P 500’s annualized real total return of about 6% from 1964 through 2018.

Jones is the first to say that these formulas, including his own, aren’t guarantees and can’t be used to time the market. After all, the S&P 500 could go up for the next five years at a 1% real rate, before dropping 9% a year for the next five years. The initial rally, followed by a fear cycle, would suffice to reduce your account to $1,776. That’s not a prediction – nothing about the market happens in a straight line – but remember that the S&P 500 has crashed much harder than a 34% loss TWICE in the past two decades.

“The market’s return over the past 10 years,” Jones explains, “has outperformed all major forecasts from 10 years prior by more than any other 10-year period.”

He attributes this to the unprecedented stimulation that the Federal Reserve pumped into the economy (and is now removing—watch out below). Markets tend to revert to their average performance over time, which is not nearly as much fun as it sounds.

If you can’t use these predictions to time the market, what good are they?

For long-term investors, the likelihood that the market is overpriced and will eventually pull back to a lower valuation should flash a bright yellow “caution” light. A disappointing decade is not the time to gamble your money on a 100% stock portfolio. Diversifying into other types of assets can prevent any one index – such as the S&P 500 – from dragging down your performance.

Long-established strategies such as Lazy Portfolios, which MarketWatch has tracked for years, and the newer Muscular Portfolios, encompass numerous asset classes besides just U.S. stocks and bonds. Those diversifying assets include real-estate investment trusts, commodities, precious metals, and non-US stocks and bonds.

During the 2007–2009 bear market, the S&P 500 lost 56%, adjusted for dividends and inflation. In the same period, Vanguard’s long-term Treasury fund gained 18%, and iShares’ gold actually rose 22%. No mater how bad the stock market may get, something else is always going up.

You are the captain of your own destiny, but you don’t have to go down with the ship when the S&P 500 hits the inevitable rocks. Diversify now.

Jones’s latest calculations aren’t publicly available yet, but you can read all about his methods in a Social Sciences Research Network white paper.

via ZeroHedge News http://bit.ly/2RLegjU Tyler Durden