Authored by Lance Roberts via Real InvestmentAdvice.com,

Martin Tarlie of GMO just recently wrote a great piece on the issue of the current U.S. Stock Market Bubble asking the question of whether or not it has finally burst. To wit:

“A new model explains this dichotomy between price action and fundamentals by suggesting that a bubble in the U.S. stock market started inflating in early 2017, and continued to inflate through the third quarter of 2018. In the fourth quarter, however, indications were that the bubble had started to deflate. And when bubbles deflate, they generally do so with a volatility bang.”

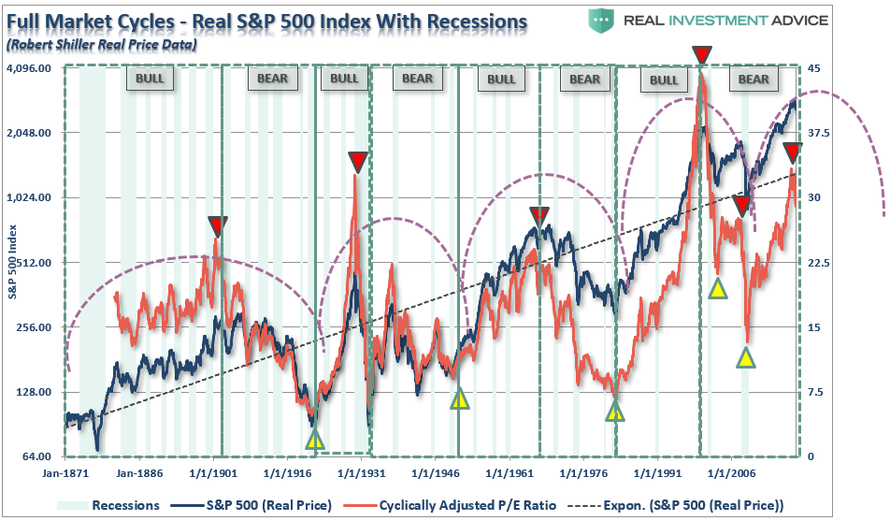

The primary premise is one of “mean reversions” particularly from elevated levels of valuations. These reversions are simply the liquidation of the excesses built up during the previous bull market cycle. The chart below shows the secular cycles of the market going back to 1871 adjusted for inflation. As Martin notes, current valuations, while lower than the 2000 peak, are still at levels seen only rarely in history. As I discussed just recently, new “secular” bull markets are not launched from such lofty levels.

As Martin concludes:

“The Bubble Model teaches us that bubbles form when times are good – high valuation – and expected to get even better – changes in sentiment are positive. Bubbles burst when changes in sentiment – not level out – turn negative.

Given that valuation is still high, our advice, consistent with our portfolio positions, is to continue to own as little U.S. equity as career risk allows.”

Since Martin is most likely correct in his assumptions, here are 10-basic investment rules which have historically kept investors out of trouble over the long term. These are not unique by any means but rather a list of investment rules that in some shape, or form, has been uttered by every great investor in history.

1) You Are A “Saver” – Not An Investor

Unlike Warren Buffet who takes control of a company and can affect its financial direction – you are speculating that a purchase of a share of stock today can be sold at a higher price in the future. Furthermore, you are doing this with your hard earned savings. If you ask most people if they would bet their retirement savings on a hand of poker in Vegas they would tell you “no.” When asked why, they will say they don’t have the skill to be successful at winning at poker. However, on a daily basis, these same individuals will buy shares of a company in which they have no knowledge of operations, revenue, profitability, or future viability simply because someone on television told them to do so.

Keeping the right frame of mind about the “risk” that is undertaken in a portfolio can help stem the tide of loss when things inevitably go wrong. Like any professional gambler – the secret to long term success was best sung by Kenny Rogers; “You gotta know when to hold’em…know when to fold’em.”

2) Don’t Forget The Income

An investment is an asset or item that will generate appreciation OR income in the future. In today’s highly correlated world, there is little diversification left between equity classes. Markets rise and fall in unison as high-frequency trading and monetary flows push related asset classes in a singular direction. This is why including other asset classes, like fixed income which provides a return of capital function with an income stream, can reduce portfolio volatility. Lower volatility portfolios will consistently outperform over the long term by reducing the emotional mistakes caused by large portfolio swings.

3) You Can’t “Buy Low” If You Don’t “Sell High”

Most investors do fairly well at “buying,” but stink at “selling.” The reason is purely emotional driven primarily by “greed” and “fear.” Like pruning and weeding a garden; a solid discipline of regularly taking profits, selling laggards and rebalancing the allocation leads to a healthier portfolio over time.

Most importantly, while you may “beat the market” with “paper profits” in the short term, it is only the realization of those gains that generate “spendable wealth.”

4) Patience And Discipline Are What Wins

Most individuals will tell you they are “long-term investors.” However, as Dalbar studies have repeatedly shown investors are driven more by emotions than not. The problem is that while individuals have the best of intentions of investing long-term, they ultimately allow “greed” to force them to chase last year’s hot performers. However, this has generally resulted in severe underperformance in the subsequent year as individuals sell at a loss and then repeat the process.

This is why the truly great investors stick to their discipline in good times and bad. Over the long term – sticking to what you know, and understand, will perform better than continually jumping from the “frying pan into the fire.”

5) Don’t Forget Rule No. 1

As any good poker player knows – once you run out of chips you are out of the game. This is why knowing both “when” and “how much” to bet is critical to winning the game. The problem for most investors is that they are consistently betting “all in, all of the time.”

The “fear” of missing out in a rising market leads to excessive risk buildup in portfolios over time. It also leads to a violation of the simple rule of “sell high.”

The reality is that opportunities to invest in the market come along as often as taxi cabs in New York City. However, trying to make up lost capital by not paying attention to the risk is a much more difficult thing to do.

6) Your Most Irreplaceable Commodity Is “Time.”

Since the turn of the century, investors have recovered, theoretically, from two massive bear market corrections. After 15 years, investors finally got back to where they were in 2000,.

Such is a hollow victory considering that 15-years to prepare for retirement are now gone. Permanently.

For investors getting back to even is not an investment strategy. We are all “savers” that have a limited amount of time within which to save money for our retirement. If we were 15 years from retirement in 2000 – we are now staring it in the face with no more to show for it than what we had over a decade ago. Do not discount the value of “time” in your investment strategy.

7) Don’t Mistake A “Cyclical Trend” As An “Infinite Direction.”

There is an old Wall Street axiom that says the “trend is your friend.” Unfortunately, investors repeatedly extrapolate the current trend into infinity. In 2007, the markets were expected to continue to grow as investors piled into the market top. In late 2008, individuals were convinced that the market was going to zero. Extremes are never the case.

It is important to remember that the “trend is your friend.” That is as long as you are paying attention to it and respecting its direction. Get on the wrong side of the trend, and it can become your worst enemy.

8) Success Breeds Over-Confidence

Individuals go to college to become doctors, lawyers, and even circus clowns. Yet, every day, individuals pile into one of the most complicated games on the planet with their hard earned savings with little, or no, education at all.

For most individuals, when the markets are rising, their success breeds confidence. The longer the market rises; the more individuals attribute their success to their own skill. The reality is that a rising market covers up the multitude of investment mistakes that individuals make by taking on excessive risk, poor asset selection or weak management skills. These errors are revealed by the forthcoming correction.

9) Being A Contrarian Is Tough, Lonely & Generally Right.

Howard Marks once wrote that:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, since momentum invariably makes pro-cyclical actions look correct for a while. (That’s why it’s essential to remember that ‘being too far ahead of your time is indistinguishable from being wrong.’)

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

The best investments are generally made when going against the herd. Selling to the “greedy,” and buying from the “fearful,” are extremely difficult things to do without a very strong investment discipline, management protocol, and intestinal fortitude. For most investors the reality is that they are inundated by “media chatter” which keeps them from making logical and intelligent investment decisions regarding their money which, unfortunately, leads to bad outcomes.

10) Comparison Is Your Worst Investment Enemy

The best thing you can do for your portfolio is to quit benchmarking against a random market index that has absolutely nothing to do with your goals, risk tolerance or time horizon.

Comparison in the financial arena is the main reason clients have trouble patiently sitting on their hands, letting whatever process they are comfortable with work for them. They get waylaid by some comparison along the way and lose their focus.

If you tell a client that they made 12% on their account, they are very pleased. If you subsequently inform them that ‘everyone else’ made 14%, you have made them upset. The whole financial services industry, as it is constructed now, is predicated on making people upset so they will move their money around in a frenzy. Money in motion creates fees and commissions. The creation of more and more benchmarks and style boxes is nothing more than the creation of more things to COMPARE to, allowing clients to stay in a perpetual state of outrage.

The only benchmark that matters to you is the annual return that is specifically required to obtain your retirement goal in the future. If that rate is 4%, then trying to obtain 6% more than doubles the risk you have to take to achieve that return. The end result of taking on more risk than necessary will be the deviation away from your goals when something inevitably goes wrong.

It’s All In The Risk

Robert Rubin, former Secretary of the Treasury, changed the way I thought about risk when he wrote:

“As I think back over the years, I have been guided by four principles for decision making. First, the only certainty is that there is no certainty. Second, every decision, as a consequence, is a matter of weighing probabilities. Third, despite uncertainty we must decide and we must act. And lastly, we need to judge decisions not only on the results, but on how they were made.

Most people are in denial about uncertainty. They assume they’re lucky, and that the unpredictable can be reliably forecast. This keeps business brisk for palm readers, psychics, and stockbrokers, but it’s a terrible way to deal with uncertainty. If there are no absolutes, then all decisions become matters of judging the probability of different outcomes, and the costs and benefits of each. Then, on that basis, you can make a good decision.”

It should be obvious that an honest assessment of uncertainty leads to better decisions, but the benefits of Rubin’s approach goes beyond that. For starters, although it may seem contradictory, embracing uncertainty reduces risk while denial increases it. Another benefit of “acknowledged uncertainty” is it keeps you honest. A healthy respect for uncertainty, and a focus on probability, drives you never to be satisfied with your conclusions. It keeps you moving forward to seek out more information, to question conventional thinking and to continually refine your judgments and understanding that difference between certainty and likelihood can make all the difference.

The reality is that we can’t control outcomes; the most we can do is influence the probability of certain outcomes which is why the day to day management of risks and investing based on probabilities, rather than possibilities, is important not only to capital preservation but to investment success over time.

via ZeroHedge News http://bit.ly/2sWVIhJ Tyler Durden