Submitted by Carlo Sacino,

The latest sensation from the yearly rally of global elites in Davos is Rutger Bergman, 30 years old Dutch historian and first time attendee.

He’s the perfect character: a cosmopolitan, globally mobile, upper class, white progressive berating (fellow) like-minded Davos attendees for polluting the world with their private jets and not spreading their wealth around.

His rant went viral:

‘’Start talking about taxes! Taxes, taxes, taxes. (…) Michael Dell asked a question: ‘’Name me one country where a top marginal tax rate of 70% has actually worked?’’ And… you know… I’m actually a historian.. the United States, that’s where it has actually worked, in the 1950s, during Republican President Eisenhower (…) the top marginal tax rate was 91% for people like Michael Dell (….) I mean this is not ROCKET SCIENCE’’.

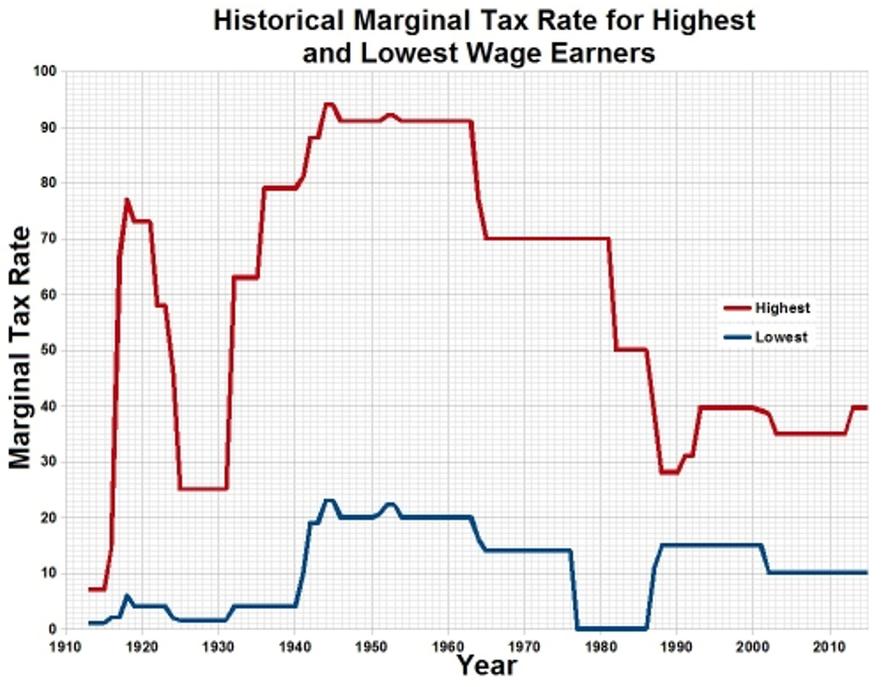

Let’s go through a history lesson. First the history of top marginal rates for the past century in the US:

The first large hike is in 1917. Bregman is a historian, he knows what happened during that year: it’s the year the US entered the First World War. The top marginal tax rate remains high through the war, then decreases. After the 1929 market crash and Roosevelt electoral triumph, it increases again in 1932 (New Deal) and once more in 1936 as the world prepared for the 2nd World War. As the war escalates, the top marginal tax rate does as well. It peaks in 1944 at a whopping 94%.

When WW2 finally ends, the threat of a Soviet invasion of Western Europe preserves the high tax rate all throughout the 50s. After the great crises in the early 60s, Cuba and the Berlin wall, finally tensions de-escalate and so do taxes. With the advent of Reagan and the progressive implementation of free flow of capital, a drastic reduction is unleashed through the 80s. It roughly lasts to today.

So, what does exactly history teach us? That high marginal tax rates work? Only if you have a war economy requiring the elite willing to subsidize the war effort and capital controls. Unfortunately, that’s apparently a too complex analysis for a history Phd that attends Davos.

According to his Wikipedia page, Bregman is also an advocate of a fifteen hours workweek, universal basic income paid to everybody and open borders as a migration policy. Pretty ironic because if UBI may ever succeed anywhere, it’d require the strictest border controls.

Bregman’s popularity highlights a humongous problem within the Western world: the intellectual class. He’s not an expert in economics (and those often don’t do too well either), but even when it comes to his discipline of choice, something is clearly lacking. Whether it’s competence or intellectual integrity it doesn’t matter: he’s being already hailed as a hero by many liberal-leaning media and we’ll likely hear from him more.

Among polluters that lecture the world about pollution, tax evaders that discuss inequality and elitist politicians that warn us about the danger of people voting in a democracy, a historian that doesn’t know or doesn’t understand history fits perfectly at Davos.

via ZeroHedge News http://bit.ly/2SsSBfS Tyler Durden