Almost exactly one month after trend-following CTAs flipped to net short for the first time in three years…

… accelerating the market’s slide into the Dec 24 bear market which lasted all of 5 minutes before a combination of Mnuchin’s invocation of the PPT (and bank liquidity check), Trump’s urge to buy stocks as it was “a tremendous opportunity to buy”, a massive pension fund rebalancing buy order and Powell’s dovish U-turn sent stocks soaring, CTAs are back to where they were for the most part since 2016: long.

This reversal was previewed last Thursday by Nomura’s Charlie McElligott, when we discussed the imminent CTA reversal in “Trading The Powell Capitulation: Nasdaq Meltup On Deck As CTAs Turn “100% Max Long.“

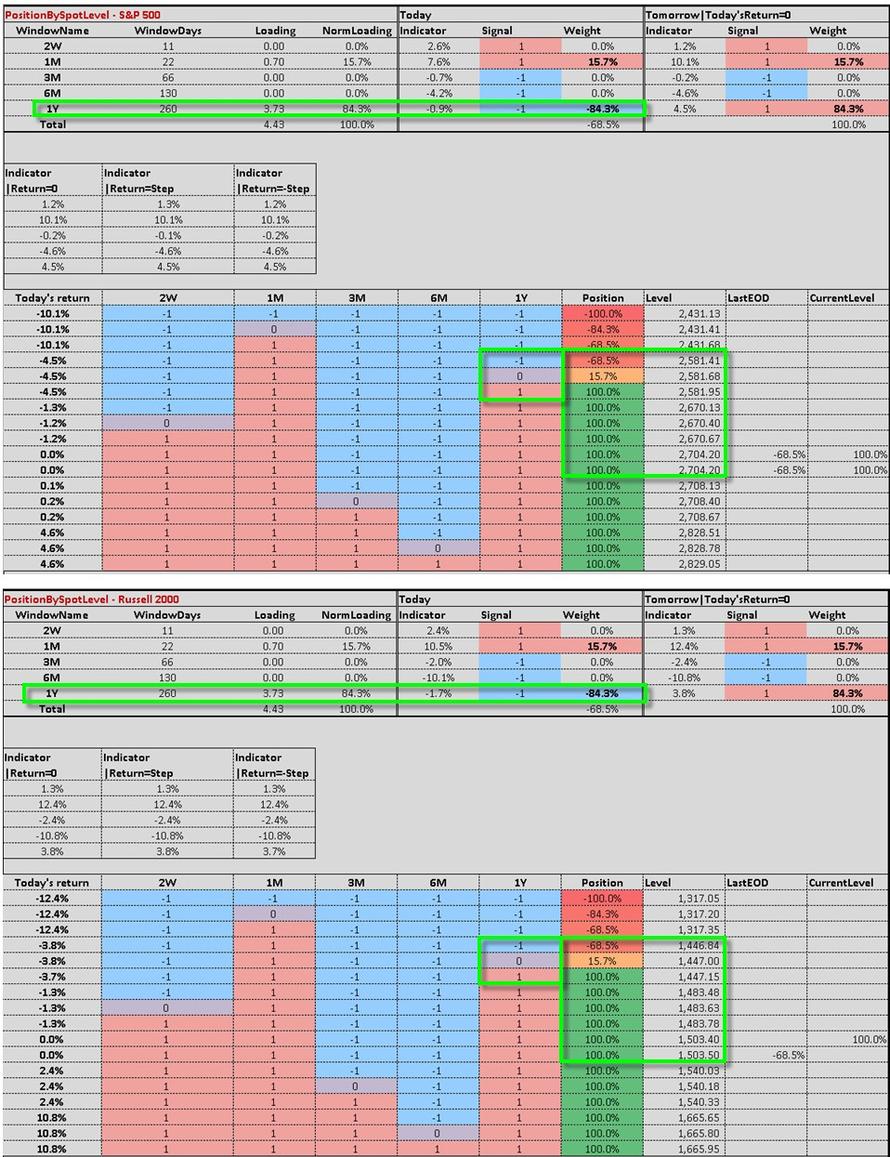

So following up to his latest positioning note, Charlies writes this morning that the anticipated CTA “flip” back “Max Long US Equities” is here, noting that “the Nomura QIS Systematic Trend model sees both SPX- and Russell- futures positions likely pivoting today from the prior “~-70% Short” back to “+100% Max Long” by the close (assuming current levels hold), joining Nasdaq, which re-established its own “Max Long” position last Thursday” and elaborates as follows:

The reversal also comes, as McElligott previously warned, as a result of the mechanical artifact of Feb 2nd and Feb 5th 2018 dates “dropping-off” from the 1Y model window, as the current weight for the 1Y window is 84.3% of the overall model allocation — and cumulatively, those two days a year ago saw S&P futures trade -7.73% / front-month VIX future +20 vols (+130.3%), meaning that CTAs suddenly see clear skies ahead, simply because they no longer see the Feb 5 VIXtermination event in the 1 year rear-view window.

So going-forward, at least when it comes to trend-following technicals, the Nomura strategist expects the following::

- The Nasdaq is very likely to maintain the “Max Long” position due to the strength of the price signal and despite the ongoing volatility in the 1Y ago environment’s drop-off dates, where it looks like the only day we could see it again turn “short” is nearly three weeks out—but before pivoting back “Max Long” again the following session

- In light of the ongoing risk-relief / Equities appreciation via the Fed’s pivot towards commencement of the “easing” cycle, the S&P is also increasingly likely to hold the “Max Long” for nearly another week and half from today, before seeing the potential to flip back to “-72% Short” for only a short multi-day period after, with the risk of ongoing oscillation between the “Max Long” and “-72% Short” for the two weeks thereafter due to the violence of last February’s market shocks

- The Russell is the least likely to “hold” this new “Max Long,” where again projecting “stasis,” we would see the model pivot back to “-69% Short” a week and a half out and likely hold that up to two weeks before it too would likely oscillate back-and-forth with the noise of Feb ’18 wreaking havoc on the signals

Yet just like in the aftermath of the late-December flip back to “Max Short”, McElligott warns of the risk of a prompt reversal, noting that “if we were to see a near-term US Equities selloff, it is just as likely that we could again “flip back” to outright “Short” positions” but assuming current levels hold, the models are back “Long”

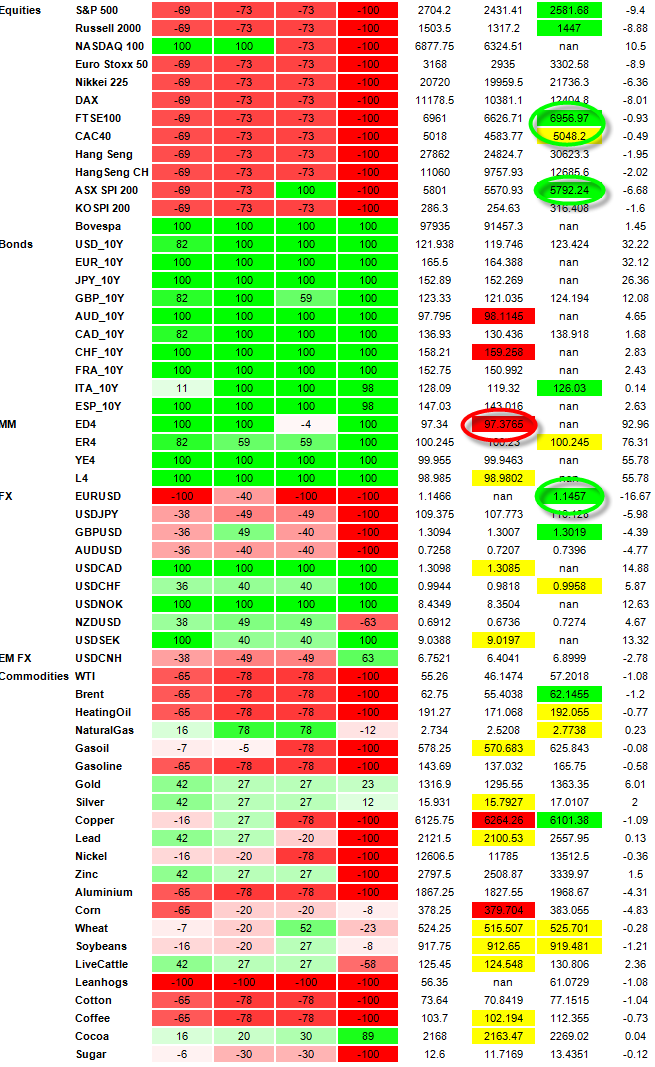

Finally, looking away from US equities, McElligott explains that since the Feb 5th 2018 “vol event” was largely a function of Equities/VIX market structure, “the roll-out dates do not look to cause as much widespread cross-asset calamity as one might think” meaning that within Global Equities, we are likely to see FTSE100, CAC40 and ASX covers to flip Long as well, so expect a muted impact there. Charlie however does expect the scale of the short in Brent Crude reduced nearly to “Neutral”; the scale of the short in EURUSD reduced (has been unstable / flipping back and forth of late); and the 4th Eurodollar “Max Long” reduced nearly to “Neutral” as examples of higher-profile assets which will be affected.

via ZeroHedge News http://bit.ly/2D7cH5S Tyler Durden