Authored by Mike Shedlock via MishTalk,

Young adults are delaying marriage longer than ever. Student debt is a key reason…

A St. Louis Fed study shows As Fewer Young Adults Wed, Married Couples’ Wealth Surpasses Others’.

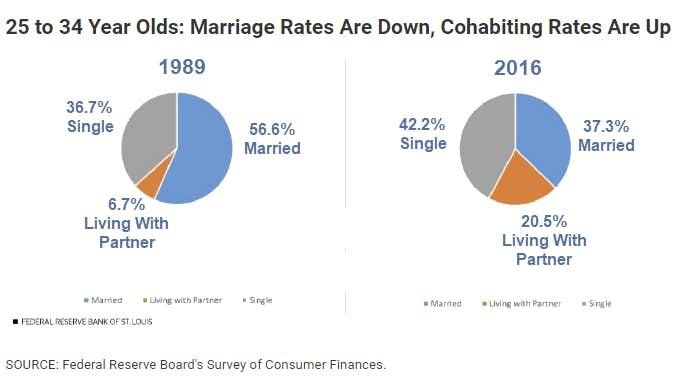

Since the 1960s, the median age at first marriage has steadily increased for both women and men. The last three decades were no different for young adults: The age at first marriage went from 26.2 for men and 23.8 for women in 1989 to 29.5 and 27.4, respectively, in 2016. As marriage rates decline in young adulthood, more young adults are choosing to cohabitate (reside with an unmarried partner) and are doing so at earlier ages. The increase in unmarried partnered young adult couples is evident. The share of married households dropped steadily from around 57 percent in 1989 to 37 percent by 2016, while partnered households grew from about 7 percent to 21 percent.

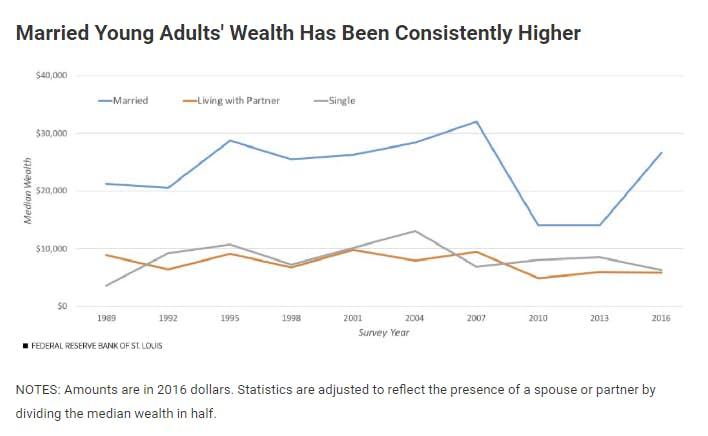

Wealth Effect

As the share of married young adult households declines, their median net worth (both total and when omitting housing-related assets and debts) has remained consistently higher than that of single households. From 1989 to 2016, the typical married household had around three times as much wealth as a partnered or single household.

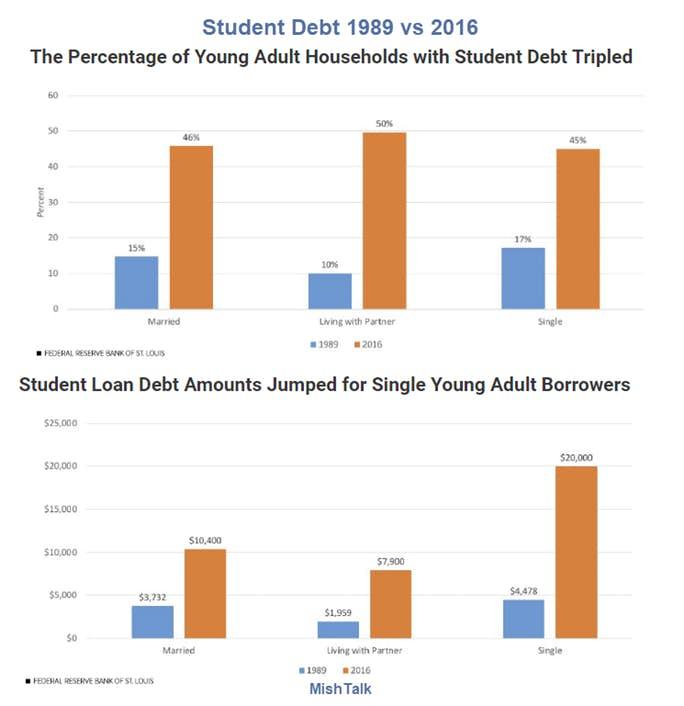

Student Loan Debt Is Widespread across Young Households’ Balance Sheets

The shifting share of married versus unmarried young adult households is also associated with changes in the composition of debt. This shift is most pronounced when examining the rise of student loan debt. Recent research suggests that growth in student debt levels is associated with marriage delays or avoidance. This suggests that young adults increasingly feel that their debt is an economic barrier to transitioning to adulthood and forming a family.

In 2013, the share of young adult households with student loan debt, 42.1 percent, surpassed the credit card debt rate, 40.1 percent, for the first time. By 2016, 46 percent of young adult households had student loan debt, triple the 1989 percentage.

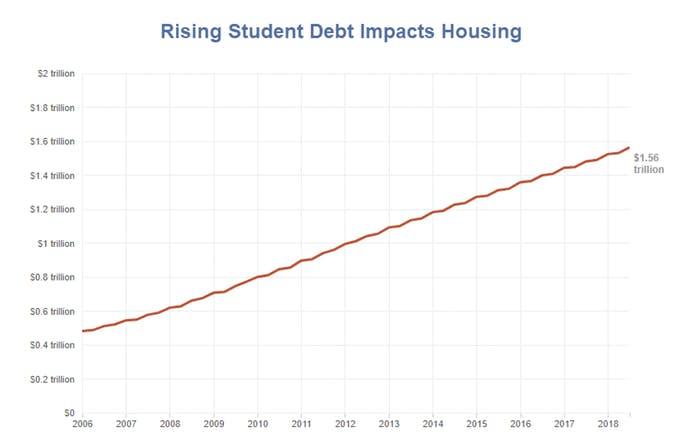

Heavy Student Loan Debt Forces Many Millennials To Delay Buying Homes

NPR reports Heavy Student Loan Debt Forces Many Millennials To Delay Buying Homes

Homeownership rates for people ages 24 to 32 dropped nearly 9 percentage points between 2005 and 2014 — effectively driving down homeownership rates overall. In January, the Fed estimated 20 percent of that decline is attributable to student loan debt.

“It’s not that they’re not going to buy homes. It’s just that they’ll purchase these homes later in life,” says Odeta Kushi, deputy chief economist at real estate research firm First American.

Baby boomers were 25, on average, when they purchased their first homes; millennials, by comparison, are waiting almost a decade longer, Kushi says.

“Approximately 40 percent of those who start college do not finish within six years. … That’s a huge number,” says Laurie Goodman, co-director of the Housing Finance Policy Center at the Urban Institute.

For those people, it is the worst of all worlds — they have the school debt without the higher wages to show for it.

Attitudes, Attitudes, Attitudes

Homeownership rates may rise, but not to the same rate as boomers. Student debt is only one pf the reasons. Attitudes about marriage, having kids, mobility, and debt have all changed.

This is not 1960 or 1971.

To top it off, houses simply are not affordable. That’s what the cohabitation rate shows. Wages have not kept up with home prices even without the burden of student debt.

via ZeroHedge News http://bit.ly/2DWQzfX Tyler Durden