Authored by Ted Dabrowski and John Klingner via WirePoints.com,

New Illinois Gov. J.B. Pritzker got a warning of sorts from Moody’s ahead of the governor’s first budget address. The rating agency’s most recent report highlighted the usual crises Pritzker must tackle: ballooning pension debts and chronic budget deficits. Moody’s rates Illinois just one notch above junk largely due to the state’s finances and malgovernance.

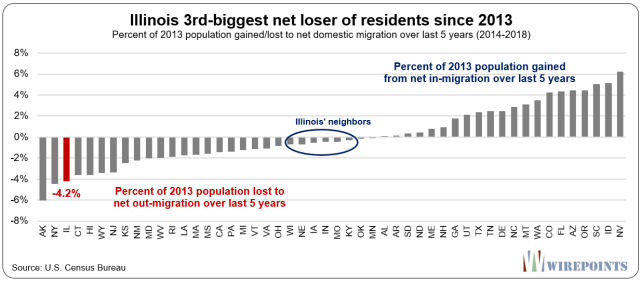

Moody’s says new revenue likely will be required to achieve stability, as you’d expect, because rating agencies love higher taxes. But for the first time, the agency has included outmigration among its top-three credit concerns. That matters because Pritzker’s number one prescription to “fix” Illinois is tax hikes, something that’s sure to accelerate Illinois’ out-migration trend and further erode the state’s tax base.

Moody’s calls it a “conundrum” for Illinois. From their report:

“… the population loss and relatively sluggish employment trends suggest a degree of economic vulnerability that poses a conundrum: revenue growth from existing sources will be too tepid to offset escalating fixed costs, while new taxes could threaten to increase the outflow of residents.”

These new comments are significant because Moody’s has long considered tax hikes a budget-balancing option for the state. That’s not surprising since Moody’s priority is the well-being of bondholders, not taxpayers. The agency’s ratings reflect the likelihood that bondholders get repaid – and tax hikes make repayment more likely.

But that’s only true as long as tax hikes don’t destroy the tax base and, ultimately, make the repayment of bonds less likely. It appears the flight of Illinoisans has gotten so big that Moody’s can no longer ignore it.

Moody’s reported:

“From 2013 through 2018, Illinois lost 544,541 residents through migration to other states (net of people who migrated into the state). This number amounted to 4.2% of Illinois’ 2013 population, the third-highest ratio among states [see Wirepoints graphic below]. These figures, though partly offset by foreign immigration and births, made Illinois one of only two states to lose population in each of the past five years.”

Which bring us back to Illinois’ usual problems.

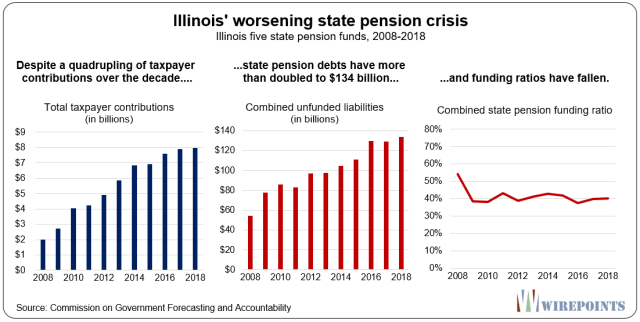

Moody’s writes that Illinois is already stretched to the limit paying for pensions – yet the plans require still more just to keep the debt from growing:

“Illinois faces burdensome – and growing – pension contribution requirements under state law, even though its annual pension payments are insufficient from an actuarial perspective.”

The ratings agency paints a grim picture, especially considering Illinois taxpayers have seen state pension debts grow by $80 billion over the decade despite a quadrupling in the amount of money they’re putting in.

Illinois’ high tax rates, increasing out-migration, enormous debts and a near-junk credit rating should force Pritzker to pursue a constitutional amendment for pensions. A reduction in retirement debts – for both pensions and retiree health insurance – is Illinois’ only true option. But all indications show the governor is loathe to pursue an amendment.

Instead, look for Pritzker to ignore Illinois’ conundrum and the flight of Illinoisans to continue.

Read more from Wirepoints about Illinois’ budget and pension crisis:

-

Illinois a national outlier when it comes to losing residents

-

What Pritzker’s progressive tax rates will probably look like

-

Moody’s vs. Illinois politicians: $100 billion difference in pension debts

-

$125,000: The pension debt each Chicago household is really on the hook for

via ZeroHedge News http://bit.ly/2TBrbBX Tyler Durden