Authored by Sven Henrich via NorthmanTrader.com,

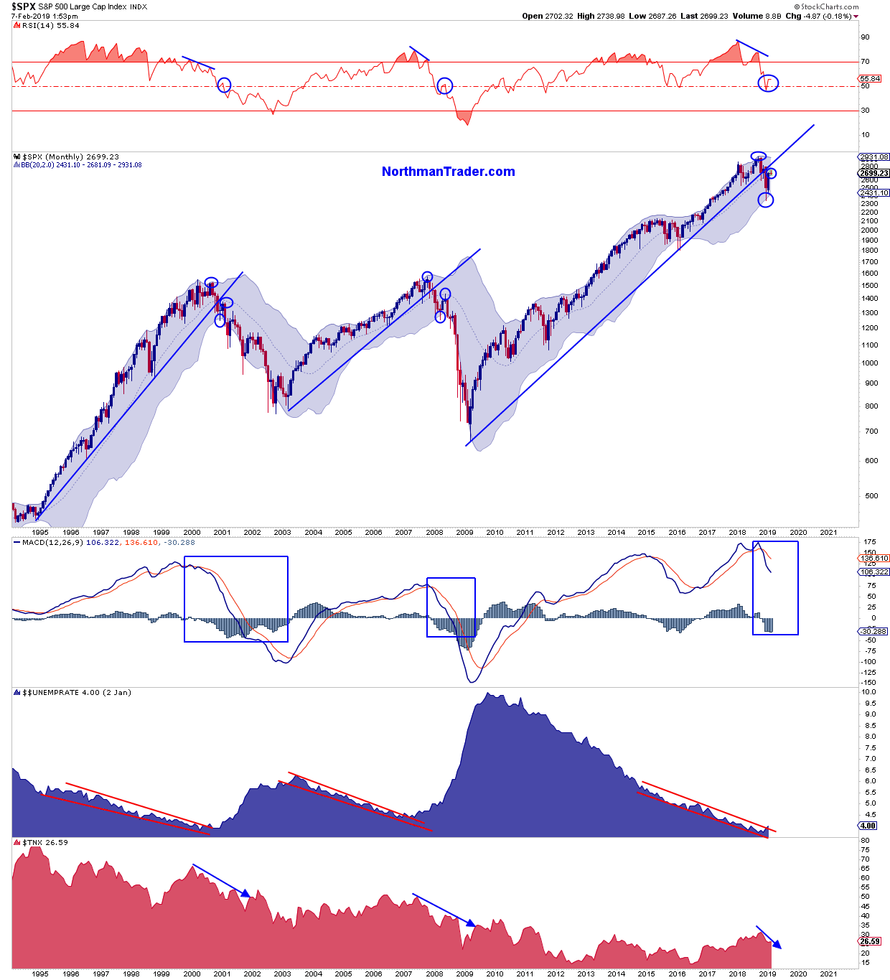

One down day a bear market does not make, but I’ve been analyzing a lot of market structures lately and have been outlining some of them in context of larger counter rallies following initial larger market tops. The question being whether the rally we just saw from late December into early February is following a historical script consistent with a bearish counter rally.

To this end I want do take note of precisely where today’s down day is coming from. Of course markets were short term overbought after a massive 400+ handle off the lows, but it’s often the context that matters and in this case it is noteworthy that the rejection today comes on the heels of $SPX hitting confluence resistance.

This morning I had an opportunity to discuss some of this with Brian Sullivan on CNBC, and I mentioned 3 specific time frames and 3 moving averages on these 3 time frames, specifically the daily 200MA, the weekly 50MA, and the monthly 15MA:

I noted that all of these MAs are occurring in the same price zone and I outlined the 2730-2760 area as the key resistance zone.

Lo and behold note now where $SPX is showing signs of weakness:

The daily 200MA:

The weekly 50MA:

The monthly 15MA:

I recently posed whether this rally was a bull trap and here’s the updated chart of everything:

Now let me be perfectly clear: It is way too early to tell, and for all I know today’s dip may just be another 1 day wonder, but we can observe that $SPX is reacting precisely in the areas it historically has shown to react in context of counter rallies.

And as I’ve outlined before, all this is taking place in context of a very steep and aggressive rally below the 200MA:

So watch the signals, and keep an eye on structures:

HAL: Just what do you think you’re doing, Dave?

HAL: Stop Dave. Stop Dave. I am afraid. I am afraid Dave. pic.twitter.com/hj0n3u7AD8— Sven Henrich (@NorthmanTrader) February 7, 2019

Markets are a journey and finding edges makes the journey worthwhile

Related Readings: All Hail Chairman POW, Signal Charts, Bull Trap

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2BoDXg4 Tyler Durden