While search and social network companies, most of the funded by advertising, have left the bruising selloff of December far in the rearview mirror, as investors rush to bid up the high beta, high growth sector once again, the broader advertising market is suffering from a sharp repricing which today manifested itself in the world’s biggest advertising companies losing more than $5 billion in market value in under 24 hours.

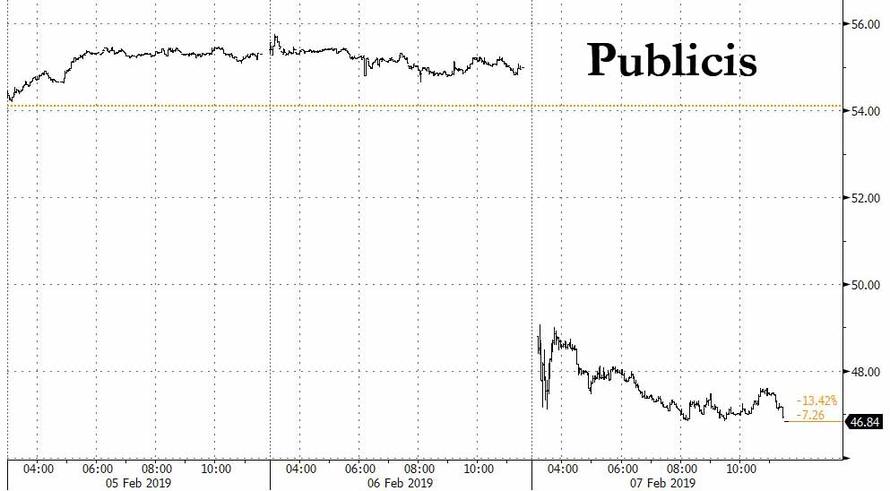

The rout, as Bloomberg notes, began Wednesday around midday in New York and spread around the globe after Paris-based ad giant Publicis Groupe said Q4 sales fell “unexpectedly” because of a decline in business with consumer goods brands in the U.S. Publicis shares plunged as much as 15%, their biggest intraday drop since the Sept. 11 terrorist attacks in the U.S.

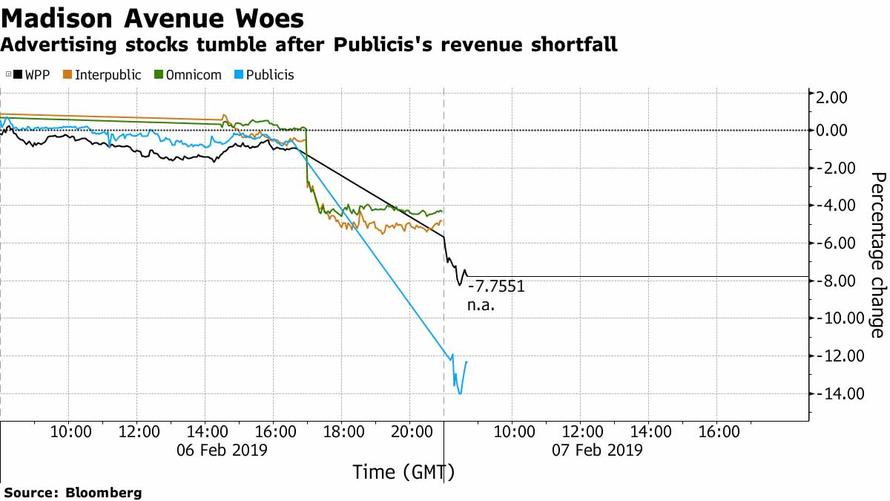

News of the unexpected industry slowdown promptly sent shares of Publicis’ biggest rivals tumbling as much as 9% once the implications for the wider industry sank in: after all, if consumer goods makers had less need for Publicis’ services, the same applies to WPP, Omnicom Group, Dentsu and Interpublic. Worse, Publicis has been seen as an early mover in shifting to the new digitally-driven advertising that’s supposed to keep corporate marketing departments loyal to the old ad firms. The fact that it had gotten no traction was clearly dismal news for the entire sector.

In emailed comments to Bloomberg, Mirabaud analyst Neil Campling said consumer goods companies can have as many as 25 ad agencies working for them and that looks inefficient. The alternative: just use Amazon and “connect directly to consumers”

“The key area hit is North America,” Campling said. “The combination of consumer packaged goods and North America for us points to the rise of Amazon more than anything else, offering a brand new channel for brands to connect directly to consumers.”

Meanwhile, in addition to an relentless shift to pure-play digital names such as Google and Facebook, Amazon has also been profiting from the shift away from legacy businesses; as a result its advertising revenue has been growing almost as fast as AWS as the company starts to give more prominent placement to sponsored products in search results, rather than those offering the lowest prices, while charging generously for said placement. Investors see the area as even more profitable than its main e-commerce business.

via ZeroHedge News http://bit.ly/2HX9T0L Tyler Durden