Submitted by Eric Peters of One River Asset Management

“Surely you remember Bill Simon?” asked the CIO. And I shrugged. “You’ve seen so little,” he said, sighing, frustrated by my youth.

“Well, Bill Simon was a Wall Street bond king who became Treasury Secretary under Nixon, when markets were rioting. Treasury feared they’d have a failed bond auction in 1976.”

The inflationary process began in the mid-1960s — fueled by a massive tax cut (1964), anemic productivity growth, tight labor markets, and public policy that encouraged strong wage gains to battle inequality between rural poor and middle-class urban workers.

In 1966, rate hikes sparked a non-recessionary 20% equity decline that frightened the Fed into reversing policy. Stocks rallied to new highs in 1968. And that was it.

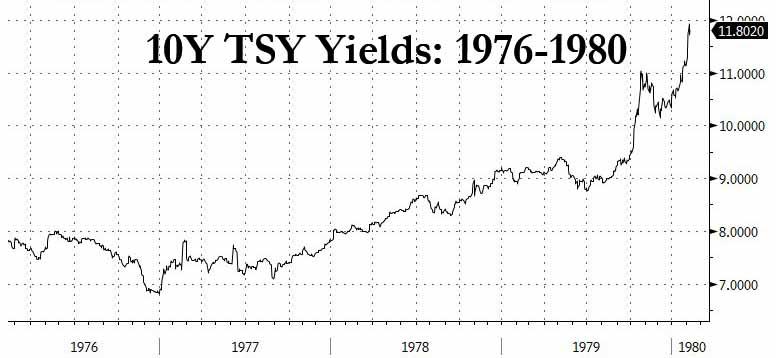

Two decades of post-war prosperity and stability gave way to the tumultuous 1970s. The Fed fell hopelessly behind the curve until Volcker took over in 1979. In early 1980, on an inflation-adjusted basis, the S&P 500 was down 50% from its 1968 peak, and on that basis reclaimed the 1968 high in 1993.

“So, in 1976 people legitimately feared the government would fail to fund itself. But Bill Simon had a plan. He’d issue bonds 50bps higher than prevailing market yields.” Odd-lot buyers could purchase up to $300k for their personal accounts.

“I stood in line with hordes of others to pick up free money,” recalled the CIO. “They were called the 8s of ’86.” The 8% coupon bonds maturing in 1986 rallied briefly but by 1981, prices had fallen 25%.

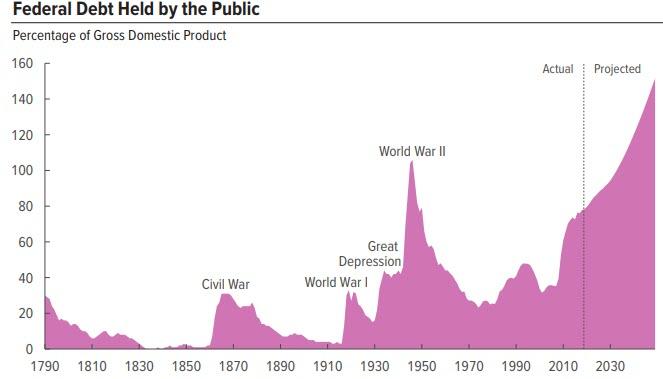

“Traders today have no sense for how quickly markets can revolt when inflation and budget deficits start rising, even modestly,” he said. The US budget deficit grew from 1.0% in 1973 to 3.9% in 1976 (it will be 5.0% in 2019).

“But when I look at how markets started to behave in Q4 of 2018, perhaps they got a little glimpse.”

via ZeroHedge News http://bit.ly/2N0k7fM Tyler Durden