Last week, when discussing the trajectory of the market, Nomura‘s Charlie McElligott said that the fate of the rally, or lack thereof, depends on two main things: where the dollar goes from here, and what happens to inflation.

And while the dollar persistently refuses to drop despite – or rather in spite of – Wall Street’s top consensus trade for 2019 being a lower dollar now that the Fed has reversed dovishly, the bigger question is with the unemployment rate now below most estimates of full employment for a couple of years, why is inflation still below target?

Needless to say, with the FOMC now highlighting “muted inflation pressures” as a reason to remain patient, this question has taken on renewed importance, especially since asset prices have shown a heightened sensitivity to inflationary spikes.

However, according to Goldman, the main answer is that “there just isn’t that much of a puzzle to begin with” and in a note from the bank’s chief economist, Jan Hatzius writes that “The Phillips curve has flattened over the decades to the point where an unemployment rate 1pp below the full employment rate tends to raise inflation by just 0.1-0.2pp. With the unemployment rate about ½pp below our estimate of full employment, the state of the labor market alone implies inflation should be at most a tenth above the 2% target, or two-tenths above the current 1.9% rate of core PCE inflation.”

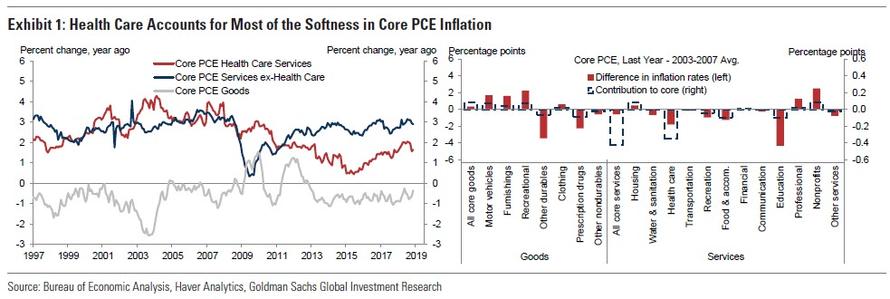

As the bank then shows in the chart below, the health care services category — which accounts for roughly 19% of the core — is the main reason that inflation has run a bit softer than the pre-recession average. The left panel shows that health care services inflation was in line with broader core services inflation before the recession but is now much softer, at least according to the BLS’ hedonically adjusted measurement and whether or not heathcare inflation is indeed that low in the “real world” is an entirely different matter, while other core services and core goods prices have grown at roughly normal rates.

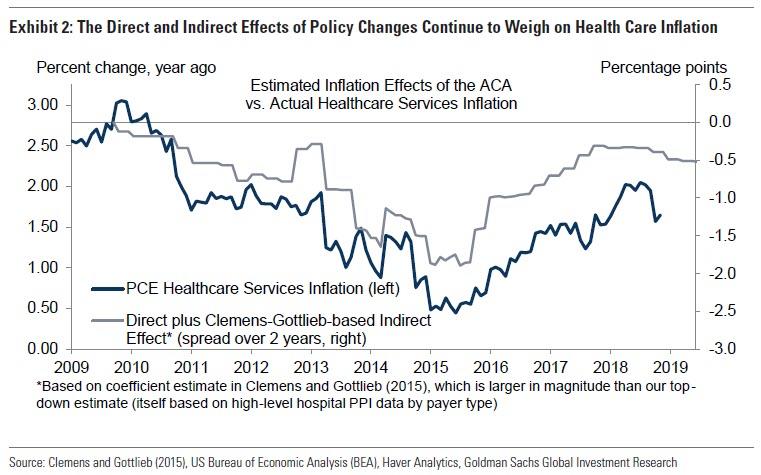

Assuming the BLS’ measure is accurate, Goldman then notes that much of the prolonged softness in health care services inflation in recent years reflects the direct and indirect effects of legislation and sector-specific trends. And while at this point, the direct effects of the Affordable Care Act (ACA) on public-payer healthcare costs are likely behind us – which allegedly depresses healthcare service costs, even if many Americans have a diametrically different take of what Obamacare has done to their healthcare spending – the after-effects have lingered in a couple of ways.

And since the Fed only cares about what the the BEA reports in its core PCE, and any “real world” anecdotes are promptly dismissed, the fact that according to “empirical” analysis the culprit for sticky low inflation is Obamacare, it has significant bearing on both readings of inflation and the Fed’s monetary policy, which is why Goldman’s take actually matters.

And speaking of Goldman’s take, Hatzius writes that in the bank’s estimates, ACA-mandated Medicare cuts continue to have sizeable disinflationary spillover effects on private-sector prices, as shown in the next chart below.

In addition, Goldman claims that ACA and other ongoing cuts to government reimbursement rates have reportedly led to an increased focus on cost discipline and disinflationary efficiency gains, adding that “these effects can’t last forever, but they have been a persistent disinflationary force in recent years and are likely to fade only gradually.” Needless to say, we find this “analysis” to be laughable in light of unprecedented drug price increases observed in recent years, which while a critical political talking point for years now somehow fails to ever trigger any inflation model.

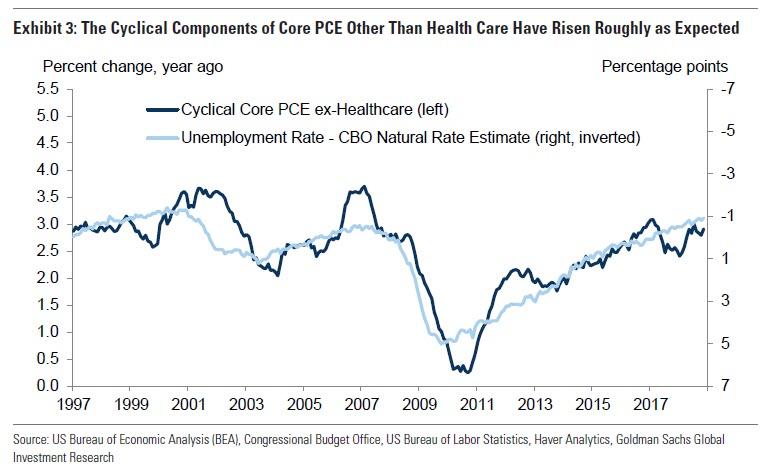

Meanwhile, outside of the health care sector, Goldman claims that the other components of the core PCE index that usually follow a cyclical pattern have accelerated roughly as they should. In fact, according to an analysis by the bank’s economists, inflation in these categories is only very slightly below the expected level. Exhibit 3 illustrates this by scaling the chart’s axes in line with the regression results.

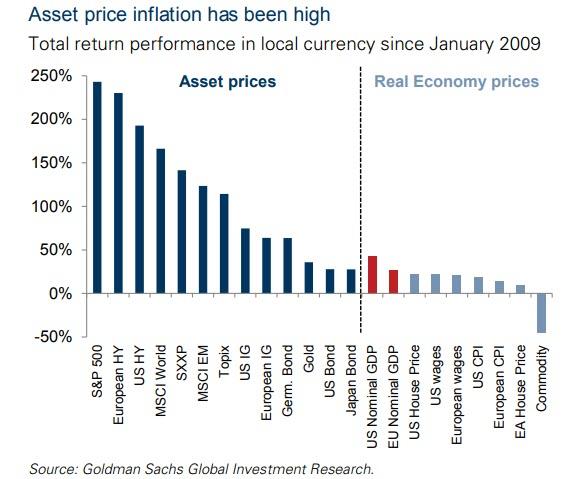

So how is it that whereas inflation in asset prices is rampant, with many openly warning of a new asset bubble, price increases in the real economy are so low as to allow the Fed to stay “patient” indefinitely, thus perpetuating the stock bubble?

Here Goldman’s findings above reinforce what past inflation research has also found.

- First, the Phillips curve is alive but flatter, meaning that changes in slack now have more moderate effects on inflation.

- Second, non-cyclical factors—from health care policy changes and measurement changes on the downside to new taxes or tariffs on the upside—can have relatively large effects on inflation.

But it is Goldman’s third observation that is most stunning because according to the bank’s economists, the first two findings “reinforce that the inflation puzzle is exaggerated—inflation is simply not that reliable a cyclical indicator. As former Fed Chair Janet Yellen put it, “such ‘surprises’ should not really be surprising.”

That, for lack of a better word, is idiotic considering that with unemployment now largely meaningless and only inflation the gating factor to Fed monetary policy, for Goldman to say that “inflation is simply not that reliable a cyclical indicator” when it is the only thing that is greenlighting the Fed recent stunning dovish reversal, is outrageous, and has staggering policy consequences, as it means that the Fed is now relying on an overtly broken indicator to adjust the cost of money, and in the process is blowing even greater asset bubbles, even as the “unreliable” inflation indicator that is inflation continues to be depressed for purely political reasons.

In any case, Goldman concludes that its findings also shed some light on the inflation outlook for 2019, and notes that the “disinflationary pressures on health care inflation that account for much of the remaining softness should diminish somewhat, while the cyclical pressures that appear to be operating fairly normally should intensify somewhat.”

This should take core inflation from a bit below 2% to a bit above—not a drastic change, but likely enough to sway policymakers in favor of a rate hike later this year.

Unless of course this does not happen, and “later this year” Goldman is forced to trot out another essay explaining why “inflation is simply not that reliable a cyclical indicator”, even though the Fed clearly is delighted to use it as a cyclical indicator if it means continuing to blow the biggest asset bubblein history.

via ZeroHedge News http://bit.ly/2DtzdWq Tyler Durden