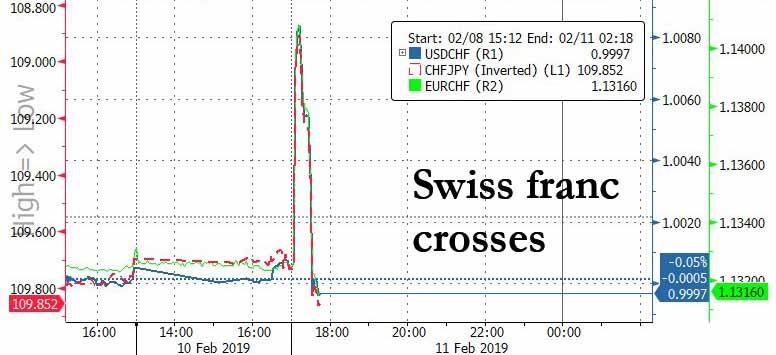

One month after various Yen, Lira and Pound cross flash-crashed in the aftermath of Apple’s shocking guidance cut, moments ago the Swiss franc was the latest currency to flash crash when the haven currency sold off sharply against dollar and yen and euro just after 5pm EDT, as dealers took advantage of the non-existent holiday liquidity (japan is closed) to execute a stop-loss run, according to Asia-based FX traders quoted by Bloomberg.

As a result, the USD/CHF soared as much as 0.9% to 1.0096 before paring move to be up 0.4% at 1.0045; the CHFJPY slumped 0.4% to 109.22 while the EURCHF surged as much as 1.14081 before paring gains.

However, as so often happens, moments after the initial crash, BTFDers emerged and all of the pairs are now stronger on the day, as the pile up extends this time to the opposite direction.

via ZeroHedge News http://bit.ly/2I7ju55 Tyler Durden