America’s richest people aren’t the “idle rich” – jumping off diving boards into giant vaults full of coins and taking off for adventures with their nephews.

According to A new working paper co-authored by members of Princeton University, US Berkeley, Chicago’s Booth School of Business, and the US Treasury Department, the top 0.1 percent, or those earning more than $1.6 million per year, are the working rich.

Using tax data linking 11 million firms to their owners, the paper found that entrepreneurs – such as doctors, lawyers, financial professionals, car dealers and beverage distributors (?) are driving income inequality.

Business owners in the top 1 to 0.1 percent making between $390,000 and $1.6 million annually included physicians, professional and technical workers, dentists, specialty trade professionals, and those in legal services. Owners in the top 0.1 making over $1.6 million included physicians, dentists and other skilled professionals as well as financial investors, automobile dealers and oil and gas extractors. –Princeton.edu

“We set out to understand what has been driving top incomes in recent years, and that upended some previous findings about the rich,” says co-author Owen Zidar, assistant professor of economics at Princeton University’s Woodrow Wilson School of Public and International Affairs. “People are earning a lot of dollars through private businesses, and that’s important evidence that should influence the debate around taxing millionaires.”

In an effort to analyze the effect of the 2017 tax reforms on small businesses and other pass-through entities, the paper studies the effect of similar tax reforms under President Reagan – which raised corporate taxes and lowered them on individuals, making pass-through entities far more attractive.

They found the median number of owners of a pass-through company was two, and they hit their peak income in their 50s. Around 93 percent of these owners were actively engaged in the business. Most top earners are not getting their income from labor; 75 percent comes from human capital income. For example, most top income is derived from active service provision as well as the personal network, reputation, and recruiting prowess of entrepreneurs, not from idle ownership of financial assets. –Princeton.edu

“It’s common to wonder whether business owners grew the pie, or simply extracted more money from workers,” said Zidar. “It looks like both are important, but growing the pie may be more significant.”

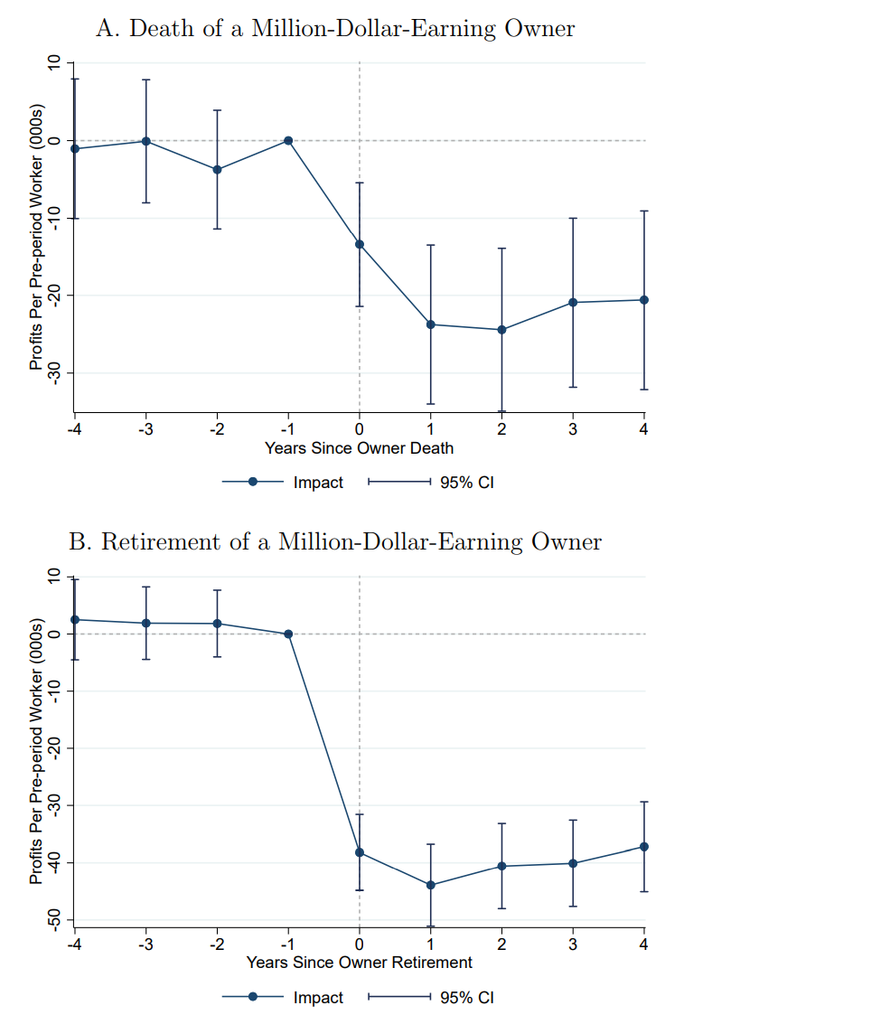

Effects of an owner’s death

In order to determine whether top owners were simply collecting checks or actually contributing to their businesses, the researchers analyzed what happened to businesses after an owner died or retired. In both cases, profits plummeted by over 80% and did not recover.

“We show that if you look and decompose this income, a lot of it comes from these pass-through businesses, and that activity more closely resembles labor than the idle rich,” said Zidar. “Our results suggest that educating the country’s next generation of innovators may be more important than tax incentives.”

via ZeroHedge News http://bit.ly/2I55ZD2 Tyler Durden