For the first time since July, The Bank of Japan tapered its 10-to-25-year JGB purchases by 20 billion yen at Tuesday’s regular operation.

BoJ purchased 180 billion yen of 10-25 year bonds vs 200b yen on Feb. 4. The last taper was in July 2018 and this reduction drops the purchase amount to its equal lowest since 2014 (when Abenomics was unleashed on the world)…

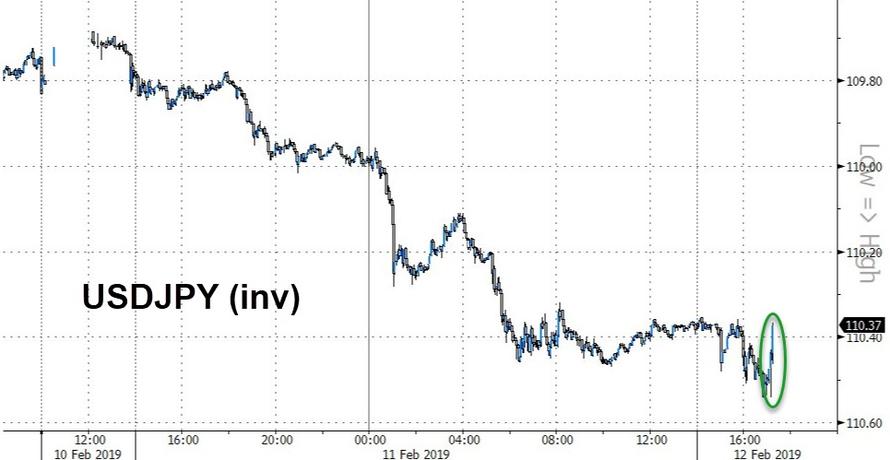

The kneejerk reaction was yen buying (after being dumped against the dollar all day long)…

The message is loud and clear – The Bank of Japan is running out of ‘assets’ to monetize.

via ZeroHedge News http://bit.ly/2THmq9S Tyler Durden