Another strong overnight market rally, built on the back of – what else – trade deal optimism, fizzled with US futures paring gains, European stocks edging lower and Asian shares rising as initial optimism was dented following more revelations that for all pompous talk, and now multiple MoUs, the trade war is actually escalating behind the scenes.

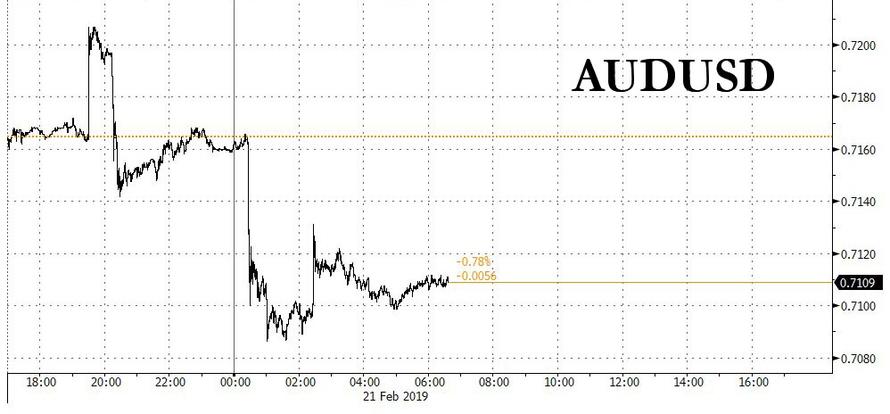

Europe’s Stoxx 600 Index drifted lower, weighed down by bank shares as individual companies including Centrica and shipping giant Maersk also underperformed after disappointing earnings. Over in the US, futures on all three main indexes levitated higher following Fed minutes that merely added to dovish sentiment, after a late Wednesday report that negotiators are working on multiple memorandums of understanding that would form the basis of a final trade deal; however the latest trade deal optimism – which has now become a daily joke as the market now prices in a successful outcome to the trade war every single day – faded, Chinese stocks dropped the yuan pared an advance and the Aussie plunged after a report that China’s Dalian port banned coal imports from Australia while Westpac, called for two RBA rate cuts this year.

The Aussie was last trading at $0.7105, down 0.8 percent on the day but it was not the only one struggling. The Kiwi dollar got bundled down 0.5 percent and the euro had given back its early gains to stand at $1.1320. The slide in the Aussie dollar had helped its share market close at a six-month high. Japan’s Nikkei had ended 0.1% stronger too and though Chinese shares sagged, the “offshore” yuan firmed to its strongest level since July on the trade hopes.

MSCI’s main Asia-Pacific index rose to a 4-1/2 month high, lifted by the initial, more optimistic trade reports, while generally ignoring the new trade war between Australia and China.

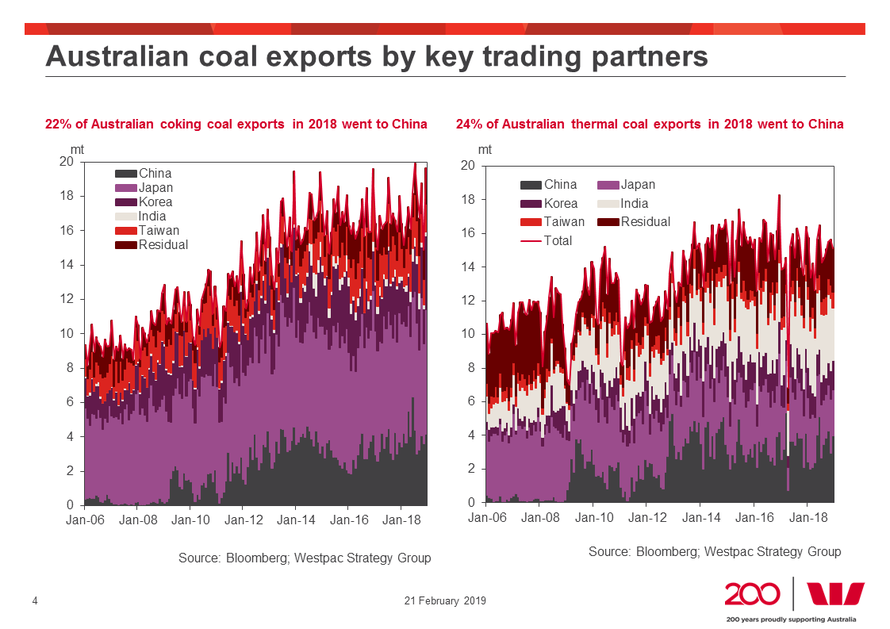

As noted earlier, the reported banning of Australian coal imports at the Chinese port of Dalian is seen as a sign that Beijing is flexing its economic muscles and warning nations not to bar its next-generation, 5G wireless technology or Huawei for that matter. The indefinite coal restrictions started this month and are part of an overall plan to cap imports into the customs region this year, Reuters reported, citing an unnamed Dalian Port official.

How China blocking Australian exports is conducive to a trade deal is beyond any rational thinking person, however, since algos are neither, they merely digested the “optimistic” headlines and futures are still higher, but fading gains fast.

In any case, the “steady” progress toward a trade agreement between the world’s biggest economies – one which could take years sending the S&P above 3,000 on “optimism” a deal is coming any moment, could give further impetus to a risk rally with the MSCI world index up about 15 percent since Christmas Day. But the new front in the global spat, this time between China and Australia, risks denting investor sentiment before concrete progress is seen in Washington.

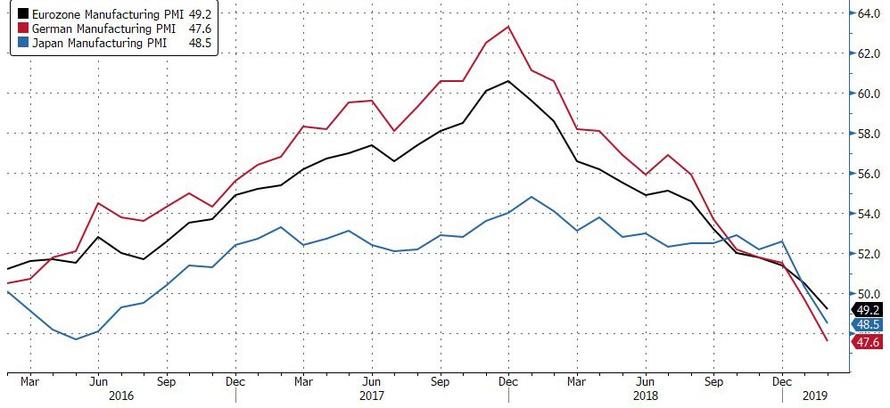

Meanwhile, the global economic picture is going from bad to abysmal, with manufacturing PMIs in Germany, Japan and the Eurozone all now officially in contraction, i.e. recession, territory.

“The euro zone economy remained close to stagnation in February. The general picture remained one of a more subdued business environment than seen throughout much of last year,” Chris Williamson, IHS Markit’s chief business economist said. Williamson said the results pointed to first-quarter euro zone growth of just 0.1 percent, below the latest Reuters poll estimate for 0.4 percent. They come soon after the European Central Bank ended its more than 2.6 trillion euro asset purchase stimulus program.

Elsewhere, Treasuries drifted lower with the 10Y yield rising 3bps to 2.67% while European bonds were mixed and the euro fluctuated.

Today’s trading session follows a muted day in the markets yesterday, following a FOMC Minutes release that had something in it for everyone: the overall tone of Fed rhetoric should “help to keep financial markets relatively steady as we head toward the weekend, all in the context of the recent risk asset roller coaster that has resulted from overly hawkish miscommunication from the Fed late last year, followed in January by an apparent overly-dovish policy U-turn,” Simon Ballard, a macro strategist at First Abu Dhabi Bank, wrote in a note.

In other FX, the dollar relinquished an Asia-session advance as the pound reversed losses amid growing Brexit optimism, only to tumble after an official said a deal was not coming. Sterling also shrugged off Fitch putting its UK credit rating on a formal downgrade warning amid uncertainty about whether the country’s parliament will be able to agree a transition deal before next month’s planned Brexit date.

Europe’s common currency swung between gains and losses and euro-area bonds traded mixed amid concerns over a slump in manufacturing in the region. Treasuries traded in the red, while European stocks were mixed and U.S. futures pointed to a higher open.

In the commodity market, crude prices rose more than 1 percent on Wednesday to their highest in 2019 on hopes that oil markets will balance later this year. U.S. crude was last up 0.3 percent, or 17 cents, at $57.33 per barrel. Brent was 0.1 percent, or 5 cents, higher at $67.13.

Initial jobless claims, durable goods orders and Markit PMI data are due. Scheduled earnings include Intuit and Hormel Foods

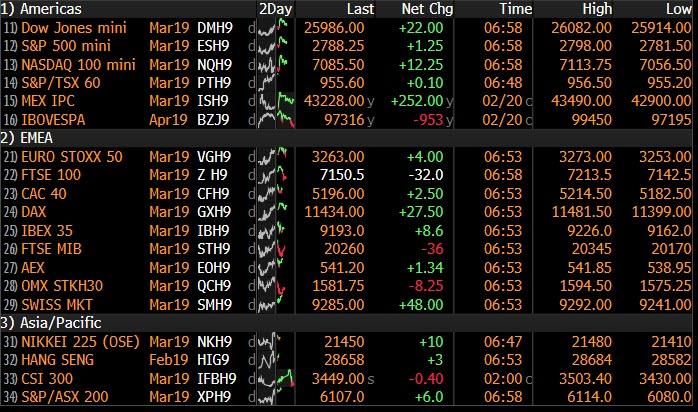

Market Snapshot

- S&P 500 futures up 0.1% to 2,790.25

- STOXX Europe 600 down 0.06% to 371.23

- MXAP up 0.2% to 159.07

- MXAPJ up 0.3% to 521.17

- Nikkei up 0.2% to 21,464.23

- Topix unchanged at 1,613.50

- Hang Seng Index up 0.4% to 28,629.92

- Shanghai Composite down 0.3% to 2,751.80

- Sensex up 0.4% to 35,908.47

- Australia S&P/ASX 200 up 0.7% to 6,139.25

- Kospi down 0.05% to 2,228.66

- German 10Y yield rose 1.0 bps to 0.11%

- Euro down 0.04% to $1.1333

- Brent Futures down 0.09% to $67.02/bbl

- Italian 10Y yield rose 7.0 bps to 2.499%

- Spanish 10Y yield fell 1.5 bps to 1.185%

- Gold spot down 0.3% to $1,334.15

- U.S. Dollar Index up 0.1% to 96.56

Top Overnight News

- The reported banning of Australian coal imports at the Chinese port of Dalian is maybe a sign that Beijing is flexing its economic muscles and warning nations not to bar its next- generation wireless technology. The indefinite coal restrictions started this month and are part of an overall plan to cap imports into the customs region this year, Reuters reported, citing an unnamed Dalian Port official.

- U.S. and Chinese negotiators are working on multiple memorandums of understanding that would form the basis of a final trade deal, according to a person briefed on the talks. The MoUs would cover areas including agriculture, non-tariff barriers, services, technology transfer and intellectual property, said the person, who asked not to be identified because the discussions are private

- U.K.’s Hammond said deadline pressure in the Brexit talks was helping officials to make progress and British lawmakers could vote on a revised deal next week. He said there were positive signs coming from Brussels that the EU is moving its position and giving ground on the Irish border backstop, and it was “significant” that the EU is now promising “guarantees” that the contentious backstop will be temporary

- In a sign of the challenge that U.K. Prime Minister Theresa May faces next week, as many as 15 government ministers are debating voting against her Brexit strategy and then challenging her to fire them in next week’s planned ballots, three people familiar with the matter said. The senior officials want to back a cross- party effort to stop Britain crashing out of the EU without a deal

Asian equity markets eventually traded mostly higher with the region supported by US-China trade hopes after reports that negotiators were drafting MOUs on key structural issues and are looking at a list of measures to address the trade imbalance. This helped the region shake off the early cautious tone brought on by another marginal performance of their US counterparts and a mixed-perceived FOMC minutes. ASX 200 (+0.7%) was underpinned by strength in Financials as well as outperformance in Consumer Discretionary after Wesfarmers shares rallied post-earnings, while the trade hopes inspired a turnaround for the Nikkei 225 (+0.2%) which was initially dampened by currency effects and after Nikkei Manufacturing PMI data slipped into contraction territory for the 1st time since August 2016. Elsewhere, the KOSPI (+0.1%) lagged with index heavyweight Samsung Electronics lacklustre after it unveiled its ground-breaking foldable smartphone which comes with an eye-watering price of nearly USD 2000, while Hang Seng (+0.4%) and Shanghai Comp. (-0.3%) were also initially choppy before the trade-related optimism provided a rising tide across the region. Finally, 10yr JGBs found support from the early cautious tone and after disappointing Nikkei Manufacturing PMI data, but then reversed course as risk sentiment improved and after weaker results in the enhanced liquidity auction for longer-dated bonds.

Top Asian News

- Top PC Maker Lenovo Gains Most in a Decade as Turnaround Sticks

- Goldman Says Asian Funds Positioned All Wrong for 2019’s Rally

- Hong Kong Monetary Authority Chief Norman Chan to Retire Oct. 1

Major European indices are mixed [Euro Stoxx 50 +0.1%] in spite of the firmer trade seen in Asia following reports that negotiators are drafting MOU’s. The FTSE 100 (-0.6%) is underperforming its peers, weighed on by BAE Systems (-7.0%) and Centrica (-11.8%) following earnings for both Co’s; additional downward pressure is applied by Anglo American (-0.1%) after earnings and Glencore (-1.5%) who are in the red following a tax demand and mine production cut. Sectors are mixed, with some mild outperformance in consumer discretionaries. Other notable movers include Bouygues (+3.4%) near the top of the Stoxx 600 as their FY profit came in above the prior. Also performing well after earnings are Barclays (+0.2%), with the Co. stating they are considering additional returns which include buybacks. Of note are Maersk (-9.6%) in the red after stating that 2019 guidance is subject to considerable uncertainty from trade risks, also the Co. and Maersk Drilling are to trade separately from April 4th.

Top European News

- Telecoms Trail in Europe as Results From Heavyweights Fall Flat

- European Banks Caught Between Nordic Contagion and Barclays Joy

- Just Eat Drops on Report Uber Eats Eyes U.K. Marketplace Service

In FX, it was a really rough night for the Antipodean Dollars, and especially the Aud that failed to glean any lasting benefit from a robust if not stellar January jobs report, as Westpac delivered an extremely dovish RBA outlook with not just one, but two rate cuts pencilled in for this year (August and November). Aud/Usd recoiled from just over 0.7200 in response and then reversed even more sharply on headlines reporting that China was blocking coal imports as several ports including the main Dalian hub, hitting lows under 0.7100. Meanwhile, Aud/Nzd fell from around 1.0490 to circa 1.0400, but is holding above the base as Nzd/Usd suffers knock-on losses towards 0.6800 vs 0.6875 at one stage.

- CAD/CHF/EUR – All on a softer footing vs the Greenback, as the DXY recovers from its post-FOMC minutes lows and with the overall take from the release not as dovish as many anticipated or were positioned for (end of balance sheet reduction by end 2019 favoured by most, but prospect of further rate normalisation this year left on the table) – index straddling 96.500 vs 96.390 at one stage. The Loonie is close to the bottom of a 1.3207-1.3163 range, while the Franc is back below parity, albeit just, and the single currency is pivoting 1.1350 amidst mixed Eurozone flash PMIs, volatile trade on stops and near term technical with some hefty option expiries also thrown in for good measure. Specifically, 1.1365, 1.1371-73 represent resistance, with the latter zone incorporating Wednesday’s high and the 30 DMA, while 1.2 bn rolls off at the 1.1300 strike and almost 3 bn at 1.1400.

- GBP/JPY – Relative G10 outperformers as Cable holds firmly above 1.3000, after a few wobbles, and not far from overnight peaks just over 1.3100 following a record UK public finance haul in January, a well received 2057 Gilt auction and comments from Chancellor Hammond suggesting the EU is showing some willingness to budge on the Irish backstop. Meanwhile, the Jpy has pared some losses within a 110.60-87 range in wake of another drop in the PBoC’s mid-point Usd/Cny fixing rate.

- NOK/SEK – The Scandi Crowns are both back under pressure, with Eur/Nok nudging above 9.7900 against the backdrop of stagnating oil prices and a somewhat disappointing Norwegian energy investment report, while Eur/Sek has rebounded to 10.6000+ from around 10.5600 following the IMF’s annual report that revealed a downward revision to Sweden’s 2019 GDP forecast and urged the Riksbank to hold off from another repo rate hike.

In commodities, Brent (+0.1%) and WTI (+0.5%) prices are largely unchanged after a mixed overnight session, with both Brent and WTI trading within a narrow USD 1/bbl range. Yesterday’s delayed API release showed a crude oil inventories build of 1.26mln barrels, although this was less than the expectation for a 3.1mln barrel build. EIA’s delayed weekly report is to be published later today where expectations are for a crude stock build of 3.1mln, which would make it the fifth consecutive week of builds. Elsewhere, reports show that Venezuela are paying large premiums for Russian and European fuel imports due to a limited number of available sellers, following US sanctions against PDVSA. Gold (-0.2%) is weaker after trading largely sideways overnight, with the yellow metal approaching the bottom of its USD 10/oz range. Elsewhere, Barrick Gold have outlined a deal reached with the Tanzania government, which features a USD 300mln payment, regarding disputes with Acacia Mining. Separately, China’s northern Dalian port bans imports of Australian coal and are to cap overall imports for the year at 12mln tonnes; this ban follows other Chinese ports taking 40 days to clear Australian coal. China’s Dalian customs bans Australian coal imports indefinitely and sets 12mln tons overall coal import quota for this year, according to sources.

Looking at the day ahead, we get the delayed December durable and capital goods orders data which should help to further sharpen Q4 GDP expectations. The consensus expects a +0.3% mom pickup in core durable goods orders and +0.2% mom core capex orders reading. Also due out is the October Philly Fed survey which will be worth watching for a mid-quarter update on the factor sector. The consensus expects a 3pt decline to +14.0. Away from that we’ll also get the latest weekly initial jobless claims print – where the four-week moving average has ticked up in recent weeks – the flash February PMIs, January leading index and January existing home sales. Other than data, we’ll also hear from more central bank speakers with the ECB’s Praet due to speak this morning and afternoon, and the Fed’s Bostic this afternoon. The ECB is also due to publish the accounts of the January meeting while EU trade ministers are due to meet. Today also see’s China’s Vice Premier Liu He join trade talks in Washington with Lighthizer and Mnuchin.

US Event Calendar

- 8:30am: Philadelphia Fed Business Outlook, est. 14, prior 17

- 8:30am: Initial Jobless Claims, est. 228,235, prior 239,000; Continuing Claims, est. 1.74m, prior 1.77m

- 8:30am: Durable Goods Orders, est. 1.7%, prior 0.7%; Durables Ex Transportation, est. 0.25%, prior -0.4%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. 0.2%, prior -0.6%; Cap Goods Ship Nondef Ex Air, est. 0.0%, prior -0.2%

- 9:45am: Markit US Manufacturing PMI, est. 54.8, prior 54.9; Markit US Services PMI, est. 54.3, prior 54.2

- 10am: Existing Home Sales, est. 5m, prior 4.99m; Existing Home Sales MoM, est. 0.2%, prior -6.4%

DB’s Jim Reid concludes the overnight wrap

Ahead of today’s important flash PMIs (preview later), I was in Frankfurt last night for a macro dinner and it’s fair to say that whilst nervous, most investors thought the pain trade was a further tightening of spreads and higher equity markets – in-line with my thought. In a show of hands no-one thought we’d get a hard Brexit and the vast majority thought we’d get some kind of supportive US-China trade deal in the coming weeks. So that’s the bias of views. There was less certainty beyond the next few months but some who previously were worried about the US cycle, like me, were a little less pessimistic about 2020 now due to the Fed 180 degree pivot in 2019. A lot of the conversation was taken up by the bubbling momentum of socialism in US politics. I think this could be a huge topic as we hit the primaries ahead of the 2020 election. So it’s something I’m going to write about in more depth soon.

Politics remains highly changeable at a global level and in an otherwise quiet week it’s the reshuffling of UK political lines which is proving to be the most interesting story at the moment. Yesterday’s news that three Conservative MPs had quit to join a new Independent Parliamentary Group might not have an immediate direct Brexit read-through but it does mean that May is becoming perilously close to losing her majority, especially with one of the defectors – Heidi Allen – saying that she expects more Tories to quit. This means the medium term risk of a new election is surely rising even if the gang of three made it clear that they would likely support the government outside of Brexit votes. Yesterday’s YouGov poll – while a little less meaningful at this stage and covering Feb 18-19 just before the Tory defections – put support for the Tories at 38% versus 26% for Labour. This is a remarkable collapse for the opposition party and only a small decline for the Tories. Whatever you think of Tory party tactics and handling of Brexit there is only one party that is pursuing Brexit as per the voter mandate and I think they are keeping support for them high because of this. Back to the poll and the new Independent Group scored 14%, followed by the Lib Dems at 7%. Could this be the start of a significant change in UK politics like the en Marche movement in France? The problem for them is that the U.K. has a constituency system and is “first past the post”. Indeed in the UK, winning a vote share in the low-20s has not historically been high enough to make much progress in Parliament. In 2010 the Lib Dems got 23% of the vote but fewer than 10% of the seats in Parliament. In 1983 the SDP-Liberal Alliance got 25% of the vote but didn’t even manage 5% of the seats. Indeed at a general election people usually vote tactically and unless a party can win, voters will often vote for one of the two main parties to ensure the one they don’t want to win has a better chance of losing. So a long road ahead for a centrist movement but unusual things are happening all over the world.

The pound took a roundtrip yesterday, initially depreciating -0.38% versus the dollar on the above resignations, before reversing to trade +0.36% stronger on possibly positive Brexit stories. Spain’s Foreign Minister Josep Borrell told reporters that “I think the accord is being hammered out now,” helping the pound to jump higher. His office subsequently walked back those comments, and the currency ultimately ended the session close to flat. There were also reports that the EU would want the UK Parliament to formally vote on any new agreement before the EU leaders considered it themselves. This would be new sequencing, which could indicate a subtle shift in positions that might allow a breakthrough, though it’s also an indictment of May’s inability to make promises given her fractured caucus. Elsewhere, the UK PM May and the EU President Juncker released a joint statement post their meeting saying that they discussed which guarantees could be given to underline once more the “temporary nature” of the Irish border backstop while adding that they have tasked chief Brexit negotiators of both sides – EU’s Michel Barnier and UK’s Stephen Barclay – with considering role for “alternative arrangements” in replacing backstop in future. They also discussed on any amendments that could be made to the political declaration consistent with their respective positions. In the meantime, yesterday Fitch placed the UK’s AA long term rating on a negative watch citing the “heightened uncertainty over the outcome of the Brexit process.”

Markets are a lot less complicated than Brexit at the moment with incremental positive returns the name of the game for now. That was the case last night even after the FOMC minutes with the S&P 500, DOW and NASDAQ turning in gains of +0.19%, +0.24% and +0.03% respectively. Treasuries closed around +1bp higher across maturities and the 2s10s yield curve remains steady at 14bps. HY spreads were -4bps in the US and the dollar also closed flat on the session.

Just on the minutes, the main highlights were confirmation that the FOMC is likely to end its balance sheet runoff later this year and a reaffirmation that rate hikes remain on hold for now. Due to a snow storm in Washington, DC, reporters did not receive embargoed access to the minutes before the official release, so the details trickled out as everyone read through the details. The market reaction was somewhat more muddled than usual, with the S&P 500 dropping -0.38% in the 20 minutes after the release but subsequently fully retracing. Perhaps investors initially focused on hawkish excerpts like “participants continued to view a sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective as the most likely outcomes over the next few years.” However, the minutes also said that “maintaining the current target range for the federal funds rate for a time posed few risks at this point” which suggests no imminent change in policy and “almost all participants thought that it would be desirable to announce before too long a plan to stop reducing the Federal Reserve’s asset holdings later this year.” That’s a very clear confirmation that we should expect a formal announcement and an end to the balance sheet runoff by year-end.

Meanwhile, overnight Bloomberg reported that the US and Chinese negotiators are working on multiple memorandums (6 in total as per Reuters) of understanding that would form the basis of a final trade deal and the MoUs are likely to cover areas including agriculture, non-tariff barriers, services, technology transfer and intellectual property. The report also added that the enforcement mechanism for the MoUs remains unclear as of now, but would likely be a threat of re-imposition of tariffs if conditions aren’t met and also indicated that China’s Vice Premier Liu He is likely to meet with President Trump on Friday. As a reminder China Vice Premier Liu He is set to meet Lighthizer and Mnuchin today. Elsewhere, President Trump reiterated his threat to impose tariffs on cars imported from the EU if the US can’t reach a trade deal with the EU. He said that “If we don’t make the deal we’ll do the tariffs. We’re trying to make a deal. They’re very tough to make a deal with, the EU.”

Asian markets pared losses on the above positive US-China trade headlines and are heading higher. The Nikkei (+0.49%), Hang Seng (+0.53%) and Shanghai Comp (+0.36%) are all up while the Kospi (-0.06%) is trading flattish. China’s onshore yuan also rose (+0.39%) on positive trade headlines to 6.6950, highest since July 2018. Elsewhere, futures on the S&P 500 are up +0.31% while 10y treasury yields are up +1.9bps this morning. In terms of overnight data releases, and a bit worrying ahead of today’s other flash numbers, Japan’s preliminary February manufacturing PMI was in contractionary territory at 48.5 (vs. 50.3 last month) for the first time since September 2016. The subindex for production fell to 47.0 (vs. 49.4 last month), indicating that actual output declined further. Joe Hayes, an economist at IHS Markit, said that “unless service sector activity can offset manufacturing weakness, the chance of Japan entering a recession in 2019 looks set to rise.”

In Europe, the STOXX 600 rallied +0.67% yesterday, closing above its 200-day moving average for the first time since September. Bunds were little changed and BTPs weakened a further +7.1bps after the ECB’s Praet confirmed that while the ECB will discuss a new TLTRO, it’s unclear that a decision will actually be made. Along with Lane and Rehn, that is 3 senior figures who have suggested that a new TLTRO might not come as soon as the next ECB meeting on March 7.

In other news from yesterday , the US Trade Representative Lighthizer is to testify about China trade matters before the House Ways and Means Committee on February 27th according to CNBC. As for the S232 report, it was interesting to note yesterday’s Politico report which suggested that there are rising calls for the White House to release the report with a source suggesting that it does find a threat and recommends tariffs of up to 25%. Despite those rumours, automaker stocks rallied +2.30% and +1.08% in Europe and the US, respectively.

Moving on. While it’s not been the most exciting of weeks in markets this week we do have the flash February PMIs to look forward to today in Europe. A reminder that we’ve seen the composite Euro Area PMI decline in 10 of the last 12 months to a five-and-a-half year low of 51.0 in January. The consensus is for a very modest pick-up to 51.1 this month. The services reading is expected to rise to 51.3 (from 51.2) however the manufacturing reading is expected to slide a little further, to 50.3 from 50.5 in January. That print has fallen in 12 of the last 13 months and last month hit the lowest since November 2014. As for the country level data, there will be plenty of focus on the data out of France given the recent slide with only a modest pick-up in the composite to 48.9 expected (from 48.2 in January). Germany’s composite reading is expected to nudge down slightly to 52.0 from 52.1.

Back to yesterday, where in EM land it was a bit of a roundabout session for South African assets following the release of the latest budget deficit forecasts. The Rand weakened as much as -2.28% at one stage and bonds blew wider with the National Treasury forecasting a budget deficit of 4.5% for the year starting April 1 which would be the widest since 2010. Growth rates were also cut, however the announcement of an operational overhaul of Eskom and discussions about privatising part of the transmission business helped assets to pretty much fully recover by the end of play. Wider EM FX was flat yesterday while the MSCI EM index finished +0.57%.

Looking at the day ahead, this morning we’ll get the final January CPI revisions in Germany and France, as well as February confidence indicators in the latter. The PMIs are out just after that before we can get a look at January public finances data in the UK. Over in the US this afternoon we’re due to get the delayed December durable and capital goods orders data which should help to further sharpen Q4 GDP expectations. The consensus expects a +0.3% mom pickup in core durable goods orders and +0.2% mom core capex orders reading. Also due out is the October Philly Fed survey which will be worth watching for a mid-quarter update on the factor sector. The consensus expects a 3pt decline to +14.0. Away from that we’ll also get the latest weekly initial jobless claims print – where the four-week moving average has ticked up in recent weeks – the flash February PMIs, January leading index and January existing home sales. Other than data, we’ll also hear from more central bank speakers with the ECB’s Praet due to speak this morning and afternoon, and the Fed’s Bostic this afternoon. The ECB is also due to publish the accounts of the January meeting while EU trade ministers are due to meet. Today also see’s China’s Vice Premier Liu He join trade talks in Washington with Lighthizer and Mnuchin.

via ZeroHedge News https://ift.tt/2NjQGFp Tyler Durden