Following a dismal Philly Fed print and disappointing Durable Goods, moments ago the Markit Manufacturing PMI made it a trifecta of trouble, when the closely watched index printed at 53.7, down from 54.9, and missing expectations of 54.3. This was the lowest Manufacturing index print in 17 months, since Sept 2017, and indicates that the recent rebound in the Manufacturing ISM, which rose to 56.6 last month, won’t last.

The output index fell to to 53.7 from 55.7 in Jan (also the lowest reading since Sept. 2017) while New Orders also fell.

While the Service PMI posted a modest rebound from 54.2 to 56.2, the latest manufacturing survey signalled a loss of momentum across the manufacturing sector. Anecdotal evidence from survey respondents cited a soft patch for client demand, partly linked to uncertainty across manufacturing supply chains and concerns about the global trade outlook. According to the report, there were also some reports that adverse weather conditions had disrupted production schedules in February.

Curiously, just like with the strong employment components in the Philly Fed, despite a slowdown in production and new order growth, the latest Markit data signalled another solid upturn in manufacturing employment. Moreover, input buying continued to rise at a relatively strong pace in February, which added to signs that manufacturers remain in expansion mode despite concerns about gathering storm clouds.

Meanwhile, and also like in the Philly Fed instance, input price inflation eased for the fourth month running and reached its lowest since August 2017. Survey respondents still noted that trade tariffs had pushed up the cost of imported materials, although there were some reports that prices charged by domestic steel producers had begun to moderate.

Commenting on the flash PMI data, Tim Moore, Associate Director at IHS Markit said: “The main worrying development was the loss of momentum reported by manufacturing companies in February. Businesses that experienced a soft patch for production cited a range of factors holding back growth, including adverse weather, worries about the global economic outlook and ongoing international supply chain uncertainty.

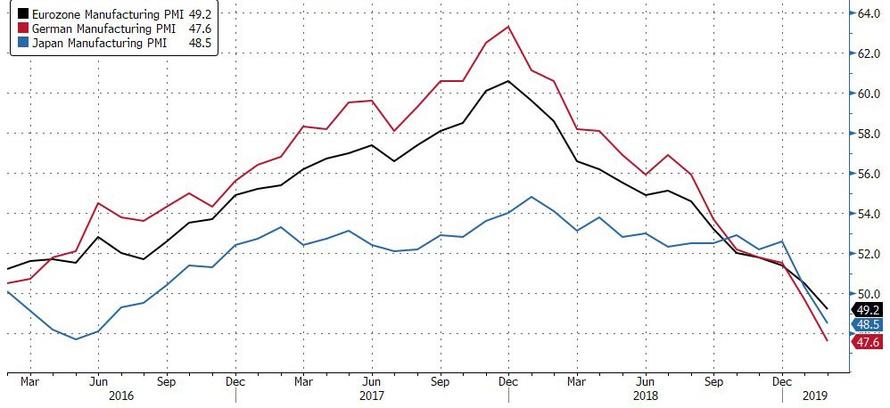

The silver lining: at least the US isn’t Europe or Asia. “Nonetheless, relatively strong domestic business conditions mean that US manufacturers remain on a much more positive trajectory than the recent downbeat production trends signalled by IHS Markit’s Manufacturing PMI surveys across Europe and Asia.”

via ZeroHedge News https://ift.tt/2IC178S Tyler Durden