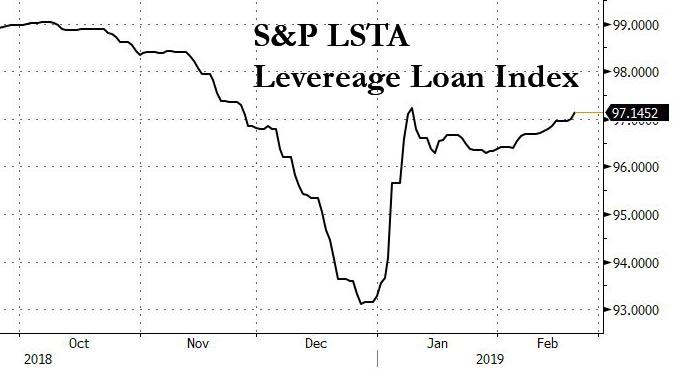

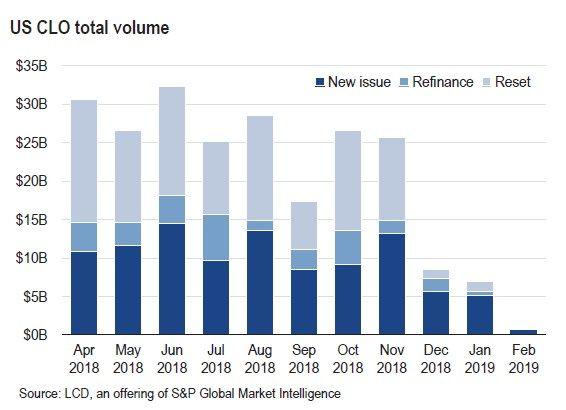

The last time we discussed trends in the US CLOs market – so critical for leveraged loan demand as CLOs account for 60% of the US leveraged loan market – we observed the sudden freeze in new issuance, which was a function of the lockup in the leveraged loan market itself a function of the sharp drop in loan prices in late 2018. Oddly, despite a sharp rebound in loan prices in the 2019…

… the CLO market remains effectively frozen, with new issuance in 2019 at roughly half its 2018 run-rate.

And, according to Fitch, the collapse in CLO volumes may be set to get far worse: the reason is that with U.S. life insurers loading up on collateralized loan obligations since the financial crisis, those CLOs might prove troublesome in the next recession according to Fitch.

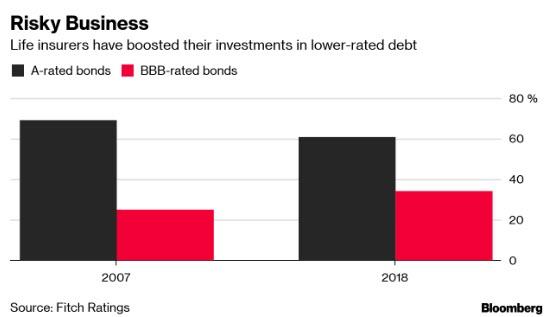

In a Thursday report, the rating agency warned that Insurers’ portfolios have become more risky since 2007 as corporate bonds were downgraded, highly rated bonds became scarcer and investors sought higher yields to counter low interest rates. None of this is new and is merely the scramble for new paper – any paper – which always comes alongside FOMO. And while most insurers have enough cushion to deal with a moderate economic slowdown, a more severe slump could drag credit ratings down, Fitch said.

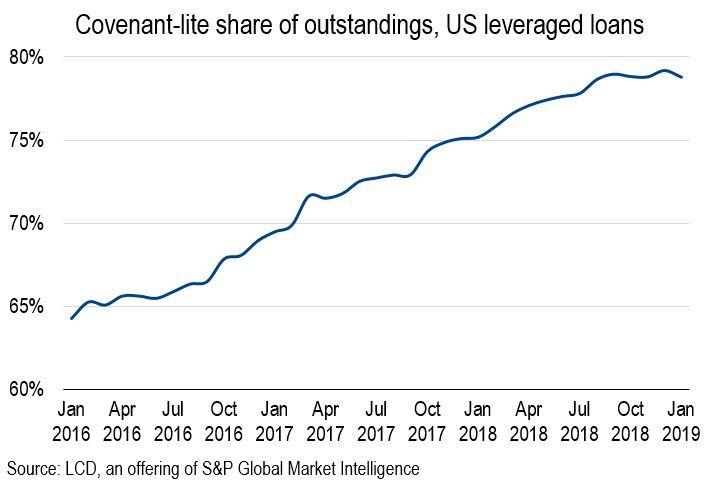

As reported first by Bloomberg, in a report titled descriptively enough “The Coming Storm: How U.S. Life Insurers Are Positioned for a Downturn” Fitch warned that “investments in collateralized loan obligations increased markedly in recent years and could pose a significant risk if investor protections weaken late in the credit cycle,” which as most know by now, they have as a result of a near uniformity of covenant line loan issuance.

In fact, according to LCDNews, covenant lite loans now constitute just under 80% of all outstanding paper, which means that during the next recession, “secured” recoveries will be negligible at best, and far below the 80% or so that “secured” investors are used to.

Meanwhile, Bloomberg notes that A or higher-rated bonds accounted for 61% of insurer investment portfolios in the third quarter of 2018, down from 69% at the end of 2007, while holdings of BBB-rated bonds, meanwhile, rose to 34% from 25% in the same period.

“We’ve been in a period of historically low interest rates and investment yields,” Mark Rouck, group credit officer for insurance at Fitch, said in a phone interview from Chicago. “That’s put a squeeze on life insurers’ profitability. As a result, they’ve gone a little further down the credit spectrum.”

* * *

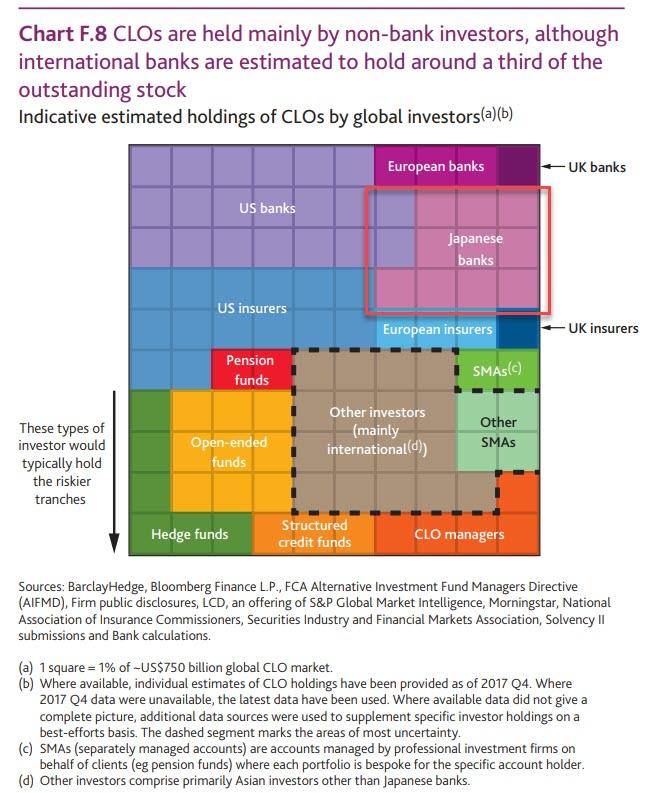

And while Fitch is worried about the “coming storm” for US insurance companies, don’t forget to spare a thought for the Japanese banks which have become some of the most aggressive buyers of CLOs in recent years, with UBS and the Bank of England estimating that these bank have been buying between 50-75% of AAA-rated CLO tranches and a third of the total market.

Japanese banks have been buying the top-rated AAA pieces of CLOs because they have higher yields than like-rated sovereign debt, according to UBS, with the lenders making up about 33% of total inflows into the asset class in the past several years. Additionally, as noted above, Japanese banks may be buying between half and three-quarters of AAA rated CLO tranches, UBS said, citing evidence from clients and analysis of the market for cross currency basis swaps. Without the Japanese bid for AAA rated CLO paper, top-rated CLO spreads would likely widen back to at least 2014 levels, or 50 basis points wider, the bank estimated.

“The Japanese bid for U.S. loans will not be easily broken,” analysts led by Stephen Caprio wrote in research published last December and first noted by Bloomberg. “Most Japanese banks are buy-and-hold investors; outright selling will be fairly limited unless the prospect of outright credit losses becomes likely, necessitating much higher recession risk than today.”

Furthermore, despite recent record outflows, Japanese banks should in theory continue to anchor the market as long as government yields stay low and the Bank of Japan clings to its ultra-easy monetary policies, UBS said quoted by Bloomberg.

And while Japanese demand is vulnerable to a pullback, it should help provide stability to the market in the face of a recent sell-off, UBS said. Unless of course, an unexpected regulatory intervention emerges making it far more cumbersome and complicated for Japanese banks to invest in US CLOs.

And yet, that’s precisely what may soon happen because as Bloomberg reported, citing law firms, a proposal is being floated by a Japanese regulator which could bait some U.S. CLO managers to readopt risk retention.

Specifically, the proposal floated by the Japanese Financial Services Agency (JFSA) would allow certain types of Japanese investors to buy only securitizations where the originator retains a 5% piece, according to a client note sent by legal practices Anderson Mori & Tomotsune and Milbank Tweed. The Japanese Financial Services Agency (JFSA) recently proposed the risk retention rule, which appears to be a carbon copy of the Frank-Dodd rule that was scrapped last year in the US, and which had held back demand from local buyers of CLOs.

Investors governed by the rule would include banks such as Norinchukin Bank, credit unions, and credit cooperatives, among other entities. If investors don’t adhere to new rule, they would be subject to a much higher capital charge, with a maximum weighting of up to 1,250%, the law firms said.

Commenting on potential impact of this proposal, should it be implemented, the law firms said that “any regulatory change that impacts investment in CLOs could have a dramatic effect on the market,” and added that “the imposition of the Japanese Retention Requirement may therefore see a return to retention-compliant U.S. CLO structures to the extent that such transactions are to be marketed in Japan.”

That said, this arguably huge development for one of the biggest sources of demand in the CLO, and thus loan market, is still one “potentially big news” because as Bloomberg’s Sebastian Boyd notes, we don’t know whether this is going to happen or whether it will include an exemption for “open market” CLOs. Only “open-market” CLOs, those in which loans are bought on the open market, are free from risk retention. The April ruling didn’t apply to private credit funds that set up CLOs.

Commenting on the “open market” CLO exemption, the law firms notes that this “has been raised as a possibility and is under consideration by the JFSA.” In February 2018, a U.S. appeals court decided that risk retention rules don’t apply to U.S. “open market” CLOs, and by April U.S. CLO managers were officially released from risk-retention rules.

Still, in a world where volatility has risen sharply recently, and where macroprudential policies are encouraging regulators to become far more critical of bank balance sheets especially after the worst year for global capital market since the financial crisis, it is a distinct possibility that Japan’s regulator will implement such a buffer. After all, European CLOs are already structured to include risk retention and disclosure obligations which are more far-reaching than the Japanese proposal, so European CLOs should generally meet the Japanese retention requirement.

While it is impossible to handicap the odds of a regulatory intervention, if law firms have already been engaged to lobby against the passage of this proposal, they are certainly non-trivial. Yet one thing is certain: should the proposal be enacted, and Japanese buying collapse due to risk-retention demands, then up to a third of demand for CLOs could be eliminated overnight. In that case watch out below as loan yields soars, price tumble, and the leverage loan market is rocked to its core with the potential aftershocks stretching first to junk, then to investment grade, and ultimately the entire credit space.

Certainly, it would be ironic if in their attempt to make the overall loan market safer, Japanese regulators end up triggering the avalanche that finally bursts the credit market bubble, potentially concluding in the next financial crisis.

via ZeroHedge News https://ift.tt/2E5O7Ts Tyler Durden