After a seemingly endless series of trading days in which the market would spike higher as either the US or China would release some “trade deal optimism“, today was a stark disappointment for the bulls because while the latest round of trade talks started in DC between the US and Chinese delegations, there were no “optimistic” leaks or Trump tweets. Instead, overnight in a surprising twist, reports hit that China had “indefinitely” banned Australian coal imports, a report which send AUD traders in for a rollercoaster of a day, stopping out both longs and short, with the currency first jumping on good economic data, then sliding on a bank’s forecast for an RBA rate cut, then tumbling on the China export halt, and sliding for the rest of the day.

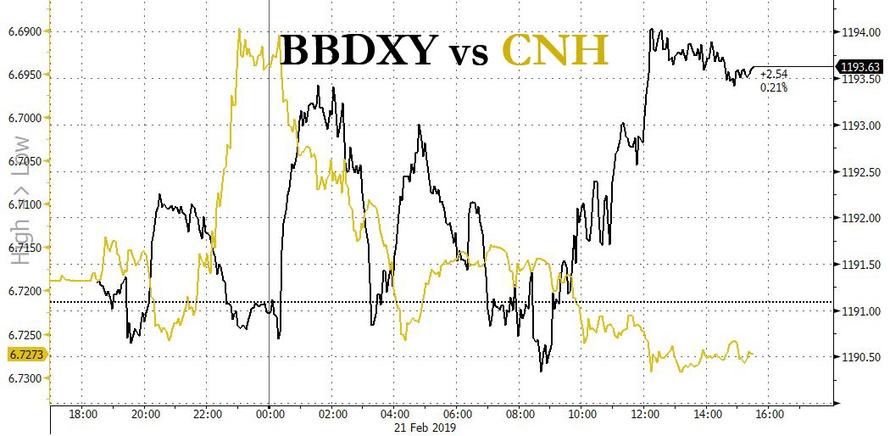

The news also hit the Chinese Yuan, which first jumped to a seven month high against the dollar, only to sink subsequently, ending the day at the lows, while the Bloomberg dollar index predictably rose for much of the day, reversing all of yesterday’s losses.

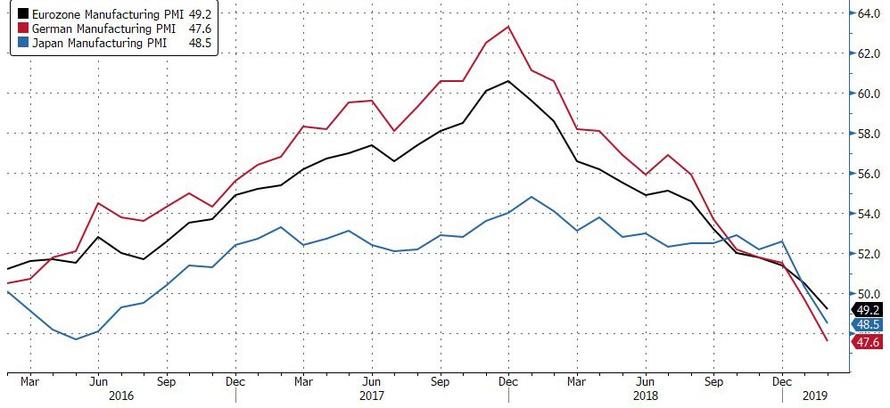

It wasn’t just the latest developments in the trade war saga that hit investor sentiment: the latest economic data also hurt, with PMIs out of Japan, Germany and the Eurozone, all sliding into contraction territory…

… and while the US manufacturing PMI remained above 50, it printed at a fresh 17 month low today, sparking more fears about a manufacturing contraction.

The fears only rose after the Philadelphia Fed tumbled by the most since the August 2011 US sovereign rating downgrade…

… ominously led by the biggest drop in the New Orders index since the Lehman bankruptcy.

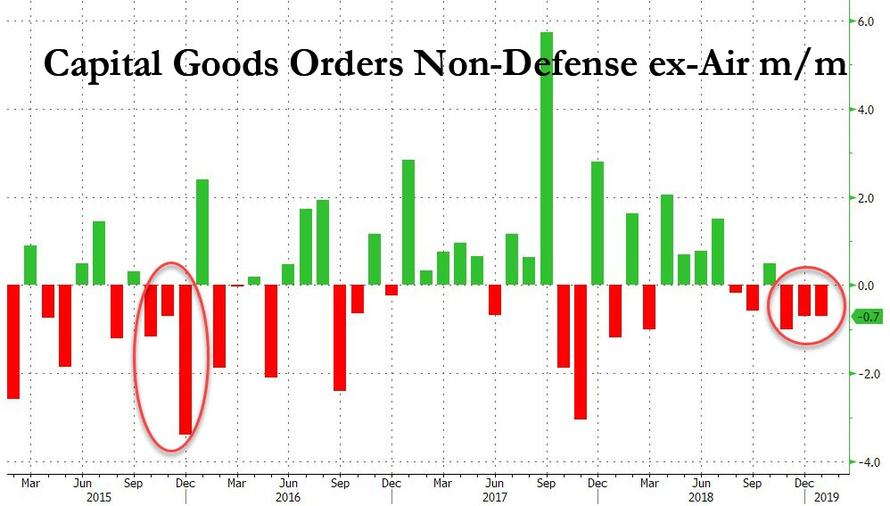

There was more bad economic news out of the US which saw core capex in the form of Capital Goods Orders non-def ex. Air unexpectedly declining for a third consecutive month, the longest stretch in the red since late 2015.

Meanwhile, the latest existing housing data also confirmed that the US economy is broadly slowing, with the first sub-5 million (annualized) housing print since 2015 as increasingly more potential homebuyers find themselves priced out of the market.

And with no “trade optimism” to fall back on, bad news was for once bad news, which meant that stocks sold off for much of the day, and after rising briefly into the green in the morning session, drifted lower in a subdued manner, with today’s best and worst sectors a mirror image of yesterday, as homebuilders were in the green while energy and tech in the red.

Meanwhile, Treasurys sold off across the curve as yields rose in a parallel curve shift.

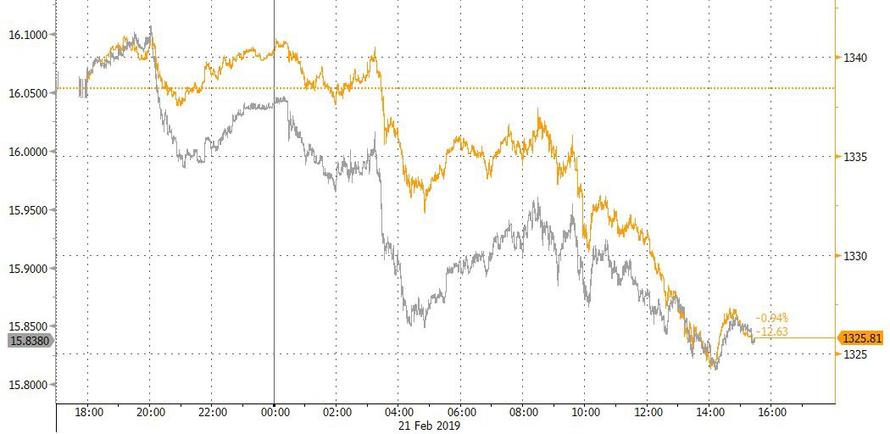

And while there was little to write home about, precious metals which had posted impressive gains in recent days, tumbled today, with gold tumbling 1.1%, its biggest drop since early November.

So with earnings season almost done and no economic news tomorrow, can traders relax for a bit? Hardly: expect headlines from the ongoing US China trade talks to start leaking over the next few hours, while tomorrow’s barrage of Fed speakers virtually assures that the market will be talked higher come hell or high water:

- 08:15 AM Atlanta Fed President Bostic (FOMC non-voter) speaks

- 10:15 AM New York Fed President Williams (FOMC voter) and San Francisco Fed President Daly (FOMC non-voter) speak

- 12:00 PM Fed Vice Chairman Clarida (FOMC voter) speaks

- 12:30 PM New York Fed Executive Vice President Potter speaks

- 01:30 PM Vice Chairman for Supervision Quarles (FOMC voter) speaks

- 01:30 PM St. Louis Fed President Bullard (FOMC voter) speaks

- 01:30 PM Philadelphia Fed President Harker (FOMC non-voter) speaks

- 05:30 PM New York Fed President Williams (FOMC voter) speaks

via ZeroHedge News https://ift.tt/2GFR1BK Tyler Durden