It has been one week since the US Treasury revealed that the national debt had topped $22 trillion (only 11 months after it had topped the $21 trillion threshold). And as the US budget deficit shows no signs of shrinking thanks to the Trump tax cuts and the death of the Obama-era budget sequester that has allowed for an expansion of federal spending (with more presumably on the way once the Trump infrastructure plan comes into focus), S&P warned on Thursday that worldwide sovereign debt could reach $50 trillion this year.

According to Reuters, S&P predicted that governments will borrow some $7.78 trillion this year, up 3.2% since 2018 (the US will constitute more than $1 trillion of that all by itself). That’s a 6% increase in the total debt pile from the year before.

Most of this borrowing will be rolling over long-term debt.

“Some 70 percent, or $5.5 trillion, of sovereigns’ gross borrowing will be to refinance maturing long-term debt, resulting in an estimated net borrowing requirement of about $2.3 trillion, or 2.6 percent of the GDP of rated sovereigns,” said S&P Global Ratings credit analyst Karen Vartapetov.

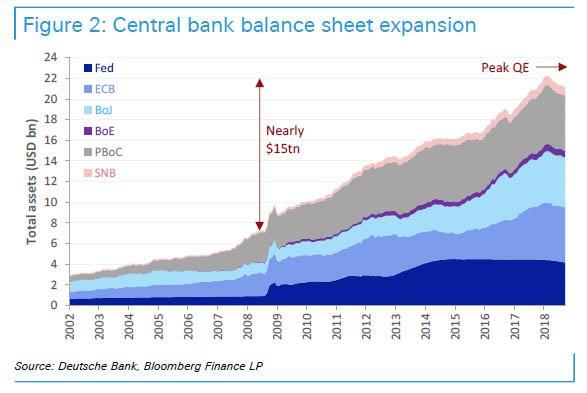

Governments, like corporations and individuals, took advantage of low interest rates around the world to step up borrowing in the wake of the financial crisis. Now, with borrowing costs expected to rise, these long-term burdens will become more burdensome to service. And with central banks slowly beginning to allow their inflated balance sheets to run off…

…investors will be watching to see if more central banks follow the Fed’s lead in pausing its balance sheet runoff, or possibly even take it one step further and return to the expansionist glory days of global QE. Who knows? As the global debt pile appears increasingly intractable, more economic officials might seriously consider Alexandria Ocasio-Cortez’s Modern Monetary Theory.

via ZeroHedge News https://ift.tt/2SSQkvw Tyler Durden