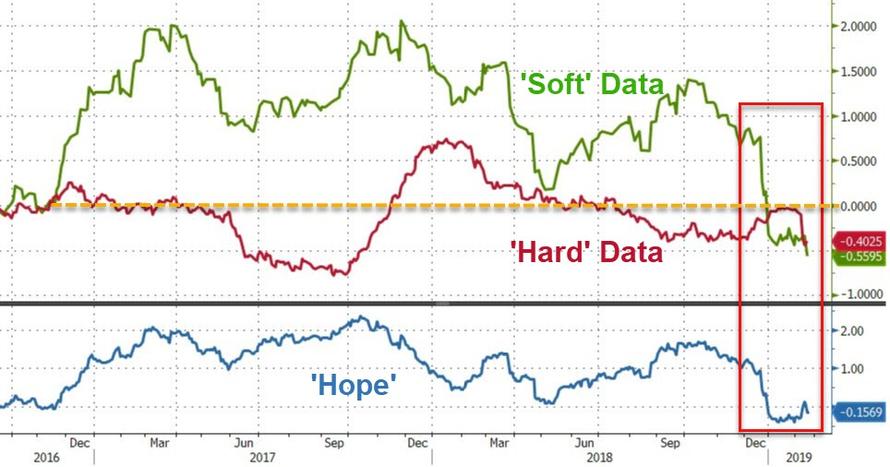

While ‘hope’ has collapsed in macro-economic data over the past few weeks:

Former fund manager and FX trader Richard Breslow notes that there has been plenty of hopeful news out the last few days.

Progress on trade. Loudly proclaimed, meaningful details to follow.

Brexit moves closer to being delayed. Posturing continues at peak tempo. Even the Church of England has gotten involved.

The Chinese government is stepping up its liquidity provisions with much optimistic discussion of the transmission mechanism to the real economy finally kicking in. Wholesale securities deregulation of rules previously implemented to curb bubbles is quickly being enacted and margin debt on stock purchases leap to a new high for the year.

Italy is saved as Fitch refrains from downgrading the country closer to junk. The governing coalition continues to fray, early elections loom and BTP buyers still keep close eye contact with the ECB.

Via Bloomberg,

Risk-related assets have taken their cue from the optimistic side of the coin and boomed. Equities are flying.

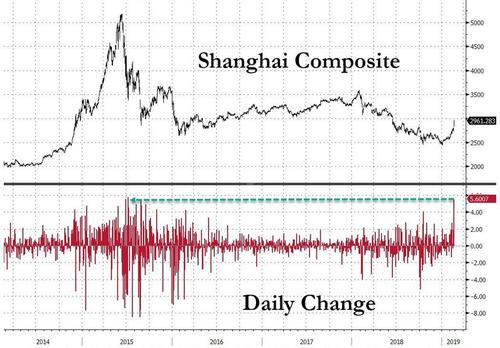

Chinese stocks didn’t merely have a good day. They gapped higher on the open and never once looked back. And they did so in volume not seen since 2015, when the market was busy exploding higher before promptly imploding lower, presaging a multi-year period of far lower volatility.

Two months does not prove any case, but I couldn’t help watching this market trade and think, here we go again. But that doesn’t at all mean that it can’t keep going a long way if it chooses. “Impulsive” is the word of the day.

Markets on the mainland have floated indexes globally. Emerging markets are darlings again. And they look great on the technical charts. Only the bravest of contrarians would be willing to walk in today and take the other side of this price action. But there is a big difference between going with the flow, which is what we are supposed to do after all, and realizing there is something wrong with the storyline.

I have yet to hear any of the analysts who have, correctly, been bullish on the market also come out with an argument for central banks pivoting once again to a more balanced, let alone hawkish, stance. The most we’ve gotten is that things are sure to start looking up at some point. Which seems to be the standard mantra for dollar bears and not many others. In fact, you are more likely to hear analysts cautioning rate-setting committees not to panic if they see good news.

BOJ Governor Haruhiko Kuroda was talking about “four options for extra easing” should prices lose impetus. Next week’s ECB meeting is expected to, once again, include lowered staff forecasts. There is no shortage of strategists recommending trades to position for even greater dovishness from the Governing Council than is currently priced. The Fed is feverishly trying to put their current “patient” stance back onto inflation lest they run out of other excuses. I was practically nauseated over the weekend to have to skim articles regurgitating the potential benefits of raising the inflation target. I could make this simple for them, measure inflation more realistically.

There is a lot of euphoria out there today. Concerns of earnings recessions and, indeed, the probability of outright recessions have abated. Rather, decision makers and traders are only too happy to dream of falling back on the policies that worked so well for them over the last decade.

In a Bloomberg survey of economists, most see a recession by sometime in 2021. They had better hope, in any case, it doesn’t come before the next set of global elections.

via ZeroHedge News https://ift.tt/2EtV020 Tyler Durden