Authored by Mike Shedlock via MishTalk,

St. Louis Fed president James Bullard discusses Quantitative Tightening (QT). As usual, he makes little sense.

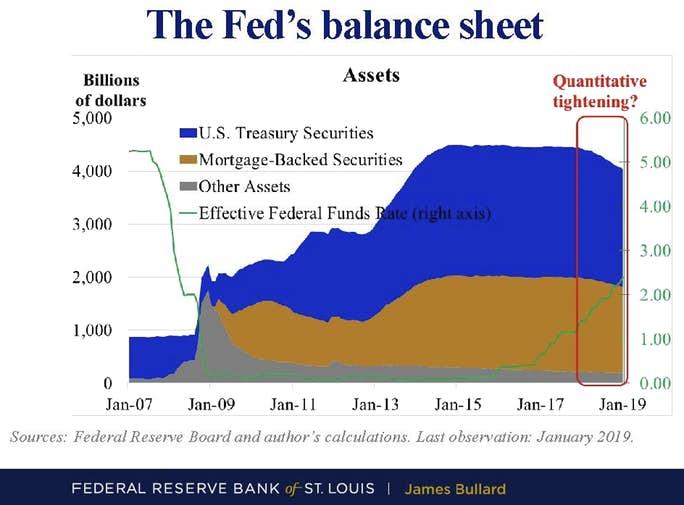

James Bullard explains: When Quantitative Tightening Is Not Quantitative Tightening.

The actual effects of QE appear to be far from neutral. There are many ideas about why this may be so. One leading candidate theory is that QE did not have direct effects but did send a credible signal about how long the FOMC intended to keep the policy rate near zero.

The signaling argument seems to work reasonably well if the policy rate is near zero. In that situation, the FOMC may wish to signal convincingly that it will keep the policy rate near zero “for longer”—i.e., beyond the time that an ordinary approach to monetary policy would call for rising rates. QE may have been a good approach to accomplish this objective.

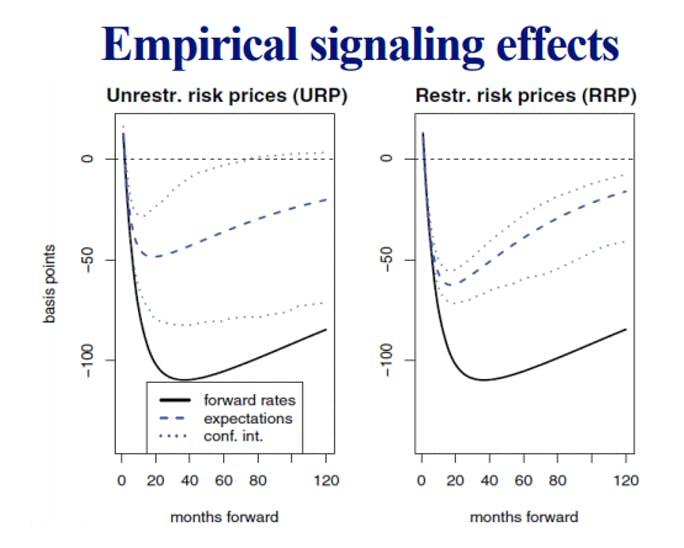

The figure illustrates the effect of QE announcements on forward rates. A sizable part of the effect is due to expectations for future policy. Imposing no-arbitrage restrictions (right panel) delivers more precise estimates.

Asymmetric Effects

With the policy rate near zero, the effects of QE may have been substantial due to signaling effects.

Now, with the policy rate well above zero, any signaling effects from balance sheet changes have dissipated.

This means balance sheet shrinkage—“QT”—does not have equal and opposite effects from QE. Indeed, one may view the effects of unwinding the balance sheet as relatively minor.

Making Stuff Up As We Go Along

Supposedly QE had no direct effect. Rather it had an indirect one. This is the hindsight given today.

The next time, when something different happens, the Fed will give different hindsight, always with the implied message it did the right thing.

Questions for Bullard

-

Why didn’t QE work very well for the EU? Japan?

-

Was the goal of QE to raise inflation as the BLS measures it, or raise asset prices and create bubbles?

-

If QT doesn’t matter, then why the hell did the Fed abandon it, a week or so after announcing QT was on auto-pilot?

-

If it doesn’t matter, why not just undo all of it right now?

Of Ivory Towers and Wizards

In regards to question number two, the Fed surely succeeded at blowing bubbles.

These wizards sit in their ivory tower group-think boxes and spout complete nonsense about the Phillips Curve, inflation expectations and the meaning of inflation itself while ignoring the massive bubbles they blow while doing so.

Stupidity Well-Anchored

Two days ago NY Fed President John Williams reiterated complete nonsense on the Phillips Curve and inflation expectations.

Bullard offered further evidence that Economic Stupidity and Fed Groupthink Remain “Well-Anchored”

via ZeroHedge News https://ift.tt/2H0YAm8 Tyler Durden