According to some, America’s bailout culture started long before the 2008 global financial crisis, with Wall Street’s bailout of Long-Term Capital Management, an iconic hedge fund whose employee rosters included a “who is who” of Nobel prize winners and financial luminaries, whose core business model was, for lack of a better word, collecting pennies in front of a steamroller: one of the fund’s most popular trades was in the arena of fixed-income arbitrage, where the fund would take advantage of tiny mispricing between more expensive “on the run” treauries and cheaper “old benchmark” notes, capitalizing on a tiny spread which was at most a few basis points, betting that over the long run this spread would collapse. To make this trade economic, the fund employed massive leverage: at the beginning of 1998, the firm had equity of only $4.72 billion against which it had borrowed over $124.5 billion resulting in “regulatory assets” of around $129 billion, for a debt-to-equity ratio of over 25 to 1 (the fund also had off-balance sheet interest rate derivatives with a notional value of approximately $1.25 trillion).

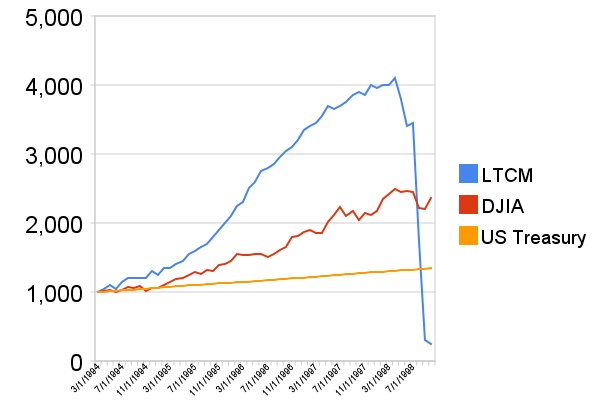

For a while, the fund’s massively leverage trades worked as expected, with the fund returning 21%, 43% and 41% in its first three years, respectively, however in year four things turned ugly when first the Asian Financial Crisis struck in 1997 followed by the 1998 Russian Financial Crisis. At that point the fund lost $4.6 billion in just weeks, wiping out its entire equity stack, and prompting the first official “intervention” by the Federal Reserve alongside a consortium of 16 banks, which stepped in to help an orderly unwind of the fund whose implosion was rocking the market.

We bring this iconic hedge fund blow up – which was entirely due to far too much leverage – because it appears that we may be returning to the good old days of stratospherically insane hedge fund leverage. Case in point, Michael Gelband’s new hedge – just a few months old – which may not have quite the leverage of LTCM just yet, appears to be giving it the old college try; in fact, as Bloomberg notes, Gelband is already already using more leverage than his former boss, Israel Englander.

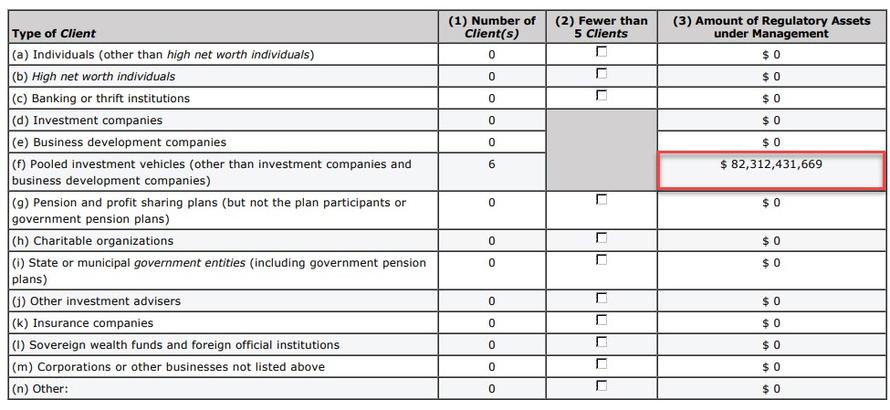

ExodusPoint Capital Management, one of the industry’s highest-profile launches in recent history, had $82.3 billion of regulatory assets as of Dec. 31, or almost 10 times the $8.4 billion of investor capital the firm had under management, resulting in roughly 10x leverage according to a the fund’s Form ADV.

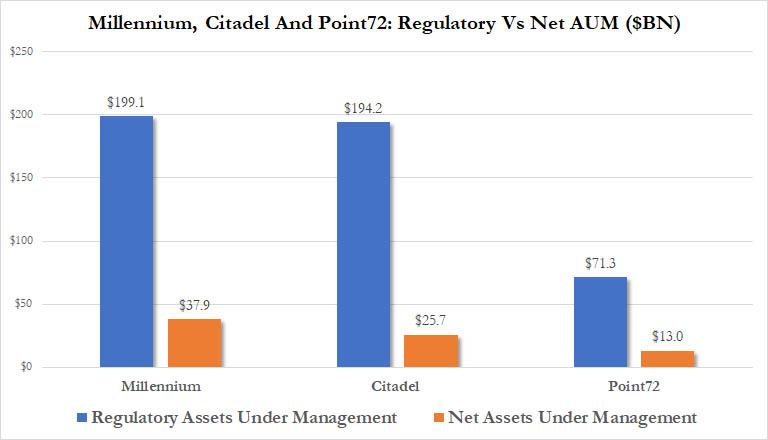

While not yet LTCM level leverage, it’s quickly getting there. By comparison, Izzy Englander’s Millennium, which Gelband quit in 2017 after realizing he would not take over for Englander any time soon, had regulatory leverage of “only” 5.85x net assets according to SEC filings.

As we have discussed before…

… and as Bloomberg reminds us today, multi-strat funds like ExodusPoint, which frequently include various HFT strategies among their various “pods”, use massive leverage to boost returns on tiny arbs while using risk controls to limit losses. Ken Griffin’s Citadel, another behemoth among multi-manager firms which extensively uses HFT trading strategies to scalp traders and front-run retail orderflow, had average leverage of over 7 times capital last year.

This was s the first time ExodusPoint has disclosed its regulatory assets which includes investments made through the use of borrowed money, repos, derivatives and other synthetic leverage instruments. Net assets, roughly equivalent to investor capital, omit leverage.

Amusingly even Bloomberg here admits that “funds have generally taken on more leverage since the 2008 financial crisis as efforts by central bankers to prop up markets depress the premiums investors receive to assume risk.”

Translation: it’s only a matter of time before we get another headline such as this: “Multistrat Massacre: Steve Cohen, Millennium, Citadel Suffer “One Of Worst Months Ever” and we have the Fed again to thank for it.

“We have been in an environment where risk premiums are narrowing, so people have had to embrace more risk,” said Eric Petroff, a former institutional consultant and research director who now provides money managers with research and marketing services.

ExodusPoint began trading last June as the industry’s largest startup after receiving some $8 billion in capital commitments, though about half of the money didn’t arrive until October, according to filings. The firm generated a 0.6% return over the ensuing seven months of 2018, despite suffering a sharp hit in December alongside most of its multi-strat peers.

So is ExodusPoint’s 10x leverage a harbinger of an LTCM-type blow up? Without knowing the fund’s full portfolio – something which Gelfand will guard with his life – it is impossible to know, however it is safe to speculate that 10x leverage on most ordinary positions would be sufficient to wipe out the fund overnight during even a modest market hiccup, which is why it is most likely that like Citadel and Millennium, Exodus point is applying this leverage to capture tiny arbitrage in the market microstructure, i.e., using HFTs to scalp micropennies. As to whether or not we experience another December-type “steamroller” event, it’s not a question of if but when. And when that happens, the only Exodus will be that of the fund’s investors, assuming of course that the fund won’t need another Fed-mediated bailout, just like its far more infamous, and levered, 4-letter acronymed ancestor.

via ZeroHedge News https://ift.tt/2NzWCKR Tyler Durden