While president Trump may have postponed one of the two major events scheduled to hit this Friday, March 1, the second one is still set to proceed as scheduled: that’s when the US debt limit suspension expires and the US debt ceiling will again return (incidentally the current debt ceiling was suspended when total debt was $1.5 trillion lower!), prompting Treasury Secretary Steven Mnuchin to draw upon extraordinary measures to keep the government within its statutory borrowing capacity for some time beyond March 1.

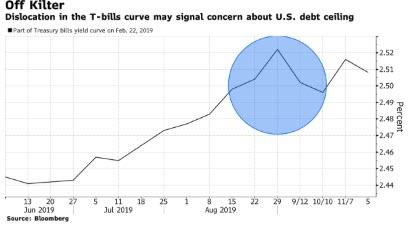

Which means that rates traders are wearily looking at the T-Bill curve to determine when analysts expect the Treasury to exhaust its extraordinary measures, at which point another debt ceiling crisis will become a very hot topic. And as the following chart of the infamous “kink” in bill yields shows, where the curve dislocation approximate the timing of the D-Date, the market believes that the US will run out of extenuating measures some time in the last week of August.

Making an accurate D-Date forecast problematic, this year the changes to the Treasury’s tax code has created additional uncertainty around IRS tax receipts.

That said, with at least six months to go until politicians once again repeat the debt ceiling charade, there has already been soft demand for six-month bill auctions in recent weeks.

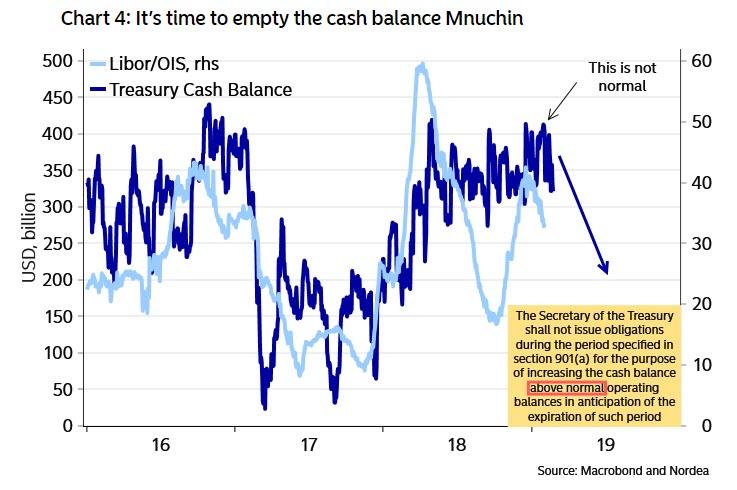

There are other ways this Friday’s debt ceiling return will impact markets, most notably with a sharp decline in the Treasury’s cash balance which currently stands at $331 billion, and is set to plunge as low as $200 billion over the next few days, as by Friday the cash balance should be at or below the level it was at when the current suspension went into effect in February 2018. And since the commercial banking system will be on the receiving end of that liquidity, this development should lead to sharp drop in Libor/OIS…

… while also work potentially serving to depress the USD over the next 60-90 trading days (due to the excess USD liquidity which will be released by the Treasury.)

But a bigger question is how will negotiations between Trump and the democrats play out heading into the August D-Date. Should trump fold in the current negotiations with China just to see his precious stock market gain another several hundred points, his core constituency – some of whom are already fuming over his border wall concession, when Trump decided to fund government and keep it open – will demand that Trump hold tough on this last point of leverage with the Democrat-controlled House. Should Trump fold here too, he will burn through much of his remaining political capital. On the other hand, the alternative is a US technical default. Which is why we urge traders not to rush to schedule their summer vacation plans: if the past is any indication, late August will be anything but a peaceful time.

via ZeroHedge News https://ift.tt/2IxRR5o Tyler Durden