Once again, economists are attempting to talk out of both sides of their mouths and hope no one is paying attention to the smoke and mirrors behind the curtain.

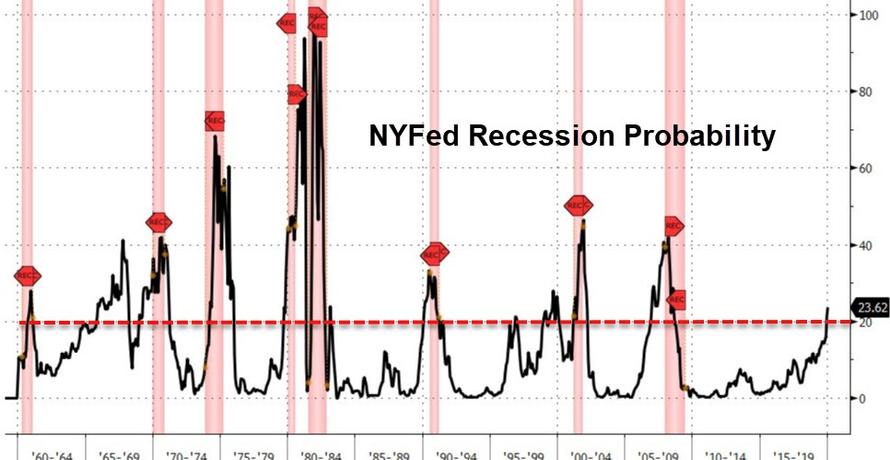

Bloomberg reports that more than three-quarters of business economists expect the U.S. to enter a recession by the end of 2021. This confirms the surging probability of recession implied by none other than the NY Fed’s model…

Ten percent saw a recession beginning this year, 42 percent project one next year, while 25 percent expect a contraction starting in 2021, according to a semiannual National Association for Business Economics survey released Monday. The rest expect a recession later than 2021 or expressed no opinion, the Jan. 30-Feb. 8 poll of nearly 300 members showed.

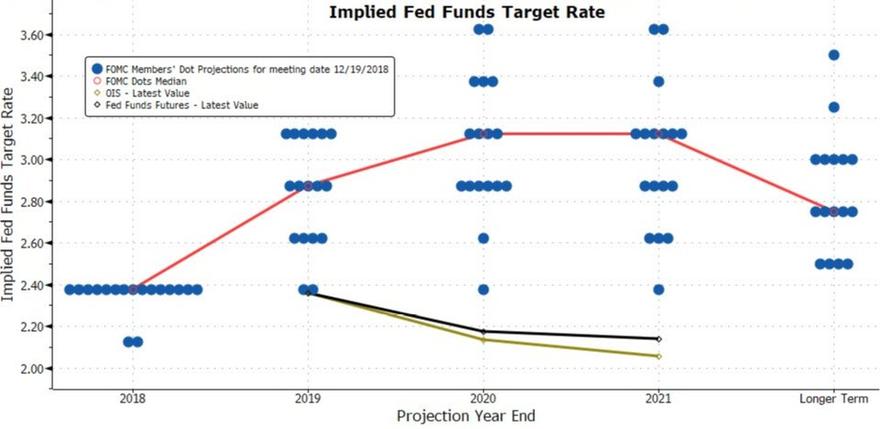

At the same time, a majority still estimate the Fed will continue raising interest rates this year (even if the market has entirely priced that out)…

The gap between forecasts and market-implied expectations is dramatic to say the least.

“There is a schism between what the NABE panel and the markets think about the Fed’s rate path and the shrinking of its balance sheet,” said Megan Greene, chief economist at Manulife Asset Management and chair of the survey.

“Markets are pricing in no more interest-rate hikes in 2019, whereas a majority of the NABE panel expects one or two rate hikes.”

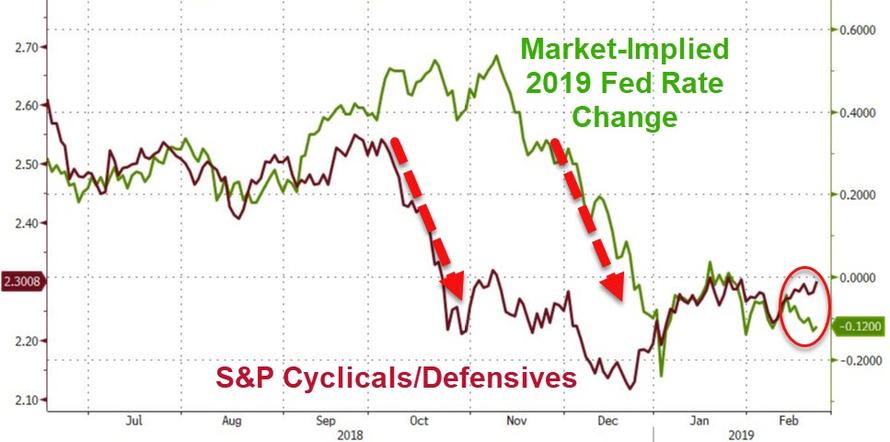

And it seems no one is paying attention to the fact that as cyclical growth hopes get priced back in to stocks…

…then that raises the probability that The Fed will indeed follow the economists’ forecast trajectory and bank a few more rate-hikes before the big one hits in 2020 or 2021. And no one is expecting that!

Of course, for now, stocks don’t care.

via ZeroHedge News https://ift.tt/2ICSVoP Tyler Durden