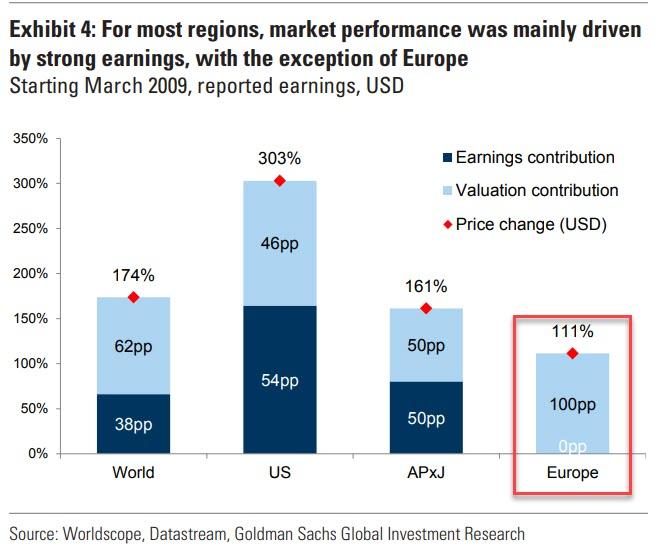

Two weeks ago, when discussing one of the more fascinating observations of the current market and business cycle, using Goldman data we showed that while in the US earnings have been responsible for roughly half of the 303% rise in stock prices, in Europe valuation expansion has been the sole driver of the 111% growth in equity prices. In other words, Europe has seen no earnings growth over the past decade!

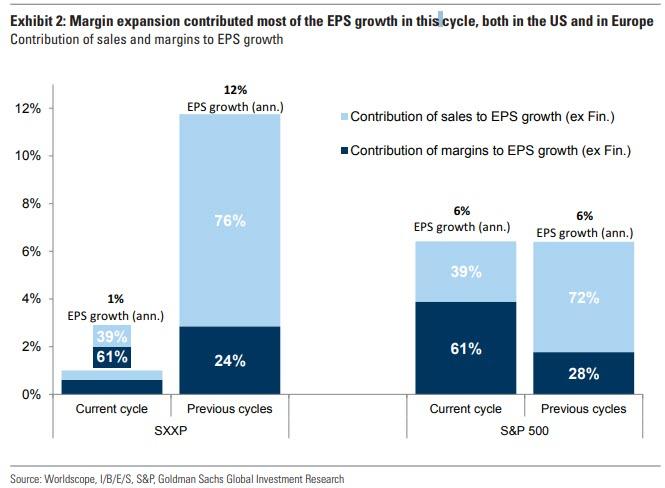

Now, in a follow up report, Goldman drills down on the components of earnings growth (or lack thereof in the case of Europe), which are two: either sales or margin growth. And here, too, there is a remarkable observation that makes the current business cycle unique: as Goldman’s Lilia Peytavin writes, this cycle has been unusual in that margin expansion has driven more than 60% of profit growth in both the US and Europe. This contrasts with previous cycles, where revenue growth, a function of the pace of nominal GDP growth, drove more than 70% of the rise in profits. The chart below shows the contribution of sales and margins to EPS growth (ex Financials) in the US and in Europe in the current cycle and in previous cycles.

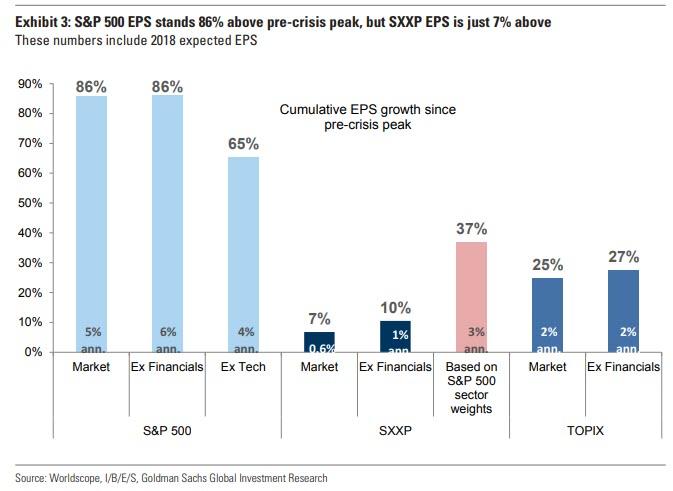

The stark contrast between the two regions is that US margins are about 280bp above their pre-crisis peak, compared with just 40bp for European margins. As a result, S&P 500 EPS stands 86% above its pre-crisis level, whereas SXXP EPS is just 7% above its pre-crisis peak, which goes back to what we disclosed two weeks ago, namely that Europe has had virtually no EPS growth.

The problem with European EPS relying entirely on margin expansion and not on sales growth is that margins – like in the US – are near all time high. According to Goldman, at the end of 2018, European margins stood at a record high level of 7.6% and as a result, Goldman does not expect them to rise further. Meanwhile, with economic growth slowing and wage growth picked up, it means that margins will most likely contract, and as a result Goldman cuts if 2019 European EPS forecast from 4% to 2%.

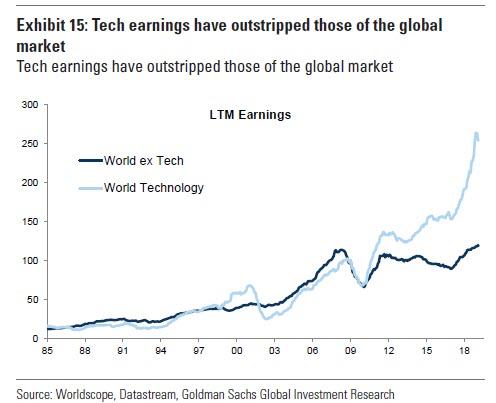

Which begs the question: why has earnings growth in the US been so much higher than in Europe. The answer is one word: technology. As we discussed most recently at the start of February, the US has been the outlier over recent years, as it has enjoyed strong profit growth. While a small part of this can be attributed to the boom in buybacks, more importantly, overall profit growth has been boosted by a boom in technology earnings.

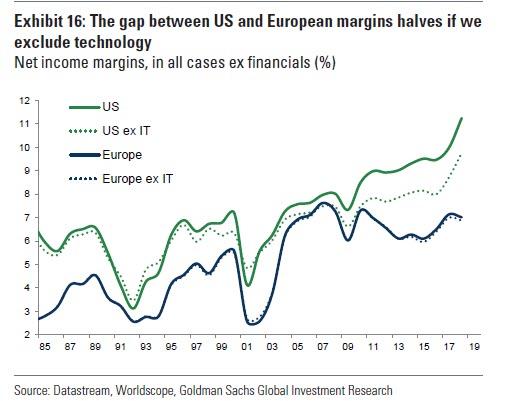

Indeed, if one excludes US tech names, global profits are only moderately higher than they were prior to the financial crisis, while technology profits have moved sharply upwards (mainly reflecting the impact of large US technology companies), driven by a combination of strong sales growth and sharply rising margins (Exhibit 16).

In its latest note, Goldman delves a little deeper on this topic, and first answers the following key question behind the divergence: what are the sectors with lower margins in Europe than in the US? Not surprisingly, it is once again all about tech. With net income margins of 10%, Europe Technology is far from being as profitable as US Tech, which generates margins of 18%. Europe Tech has fewer Internet companies and more traditional software businesses, while Telecoms and Utilities are considerably less profitable in Europe than in the US. These two sectors accounted for about 20% of the SXXP market cap at the beginning of the century and now make up just 7% of the index. Furthermore, pre-2000, Telecoms was in a strong ‘growth mode’, with mobile usage soaring, while the sector now struggles to generate any profitability, with regulation being one of the main drags.

By contrast, Personal & Household Goods and Healthcare generate margins largely above their US peers. Luxury stocks, which are to Europe what Tech is to the US, are classified in Personal & Household Goods. The US Healthcare sector is very different from Europe’s, as Equipment & Services make up about 45% of it (comprising hospitals with low profitability), compared with 13% in Europe.

Meanwhile the gap between Europe and the US has been wide during this cycle, also because Europe has more cyclical sectors, which have been hit by the unusually slow economic recovery. Oil prices have fallen 6% per annum during this cycle, while they had risen sharply in previous recoveries, and the lack of inflation has kept interest rates around the zero lower bound. This has sharply impaired commodity-related sectors and the profitability of Financials.

What about unleashing major tax reform like in the US? Here too, Goldman pours cold water, writing that with an average forecast GDP growth of 1% in the Euro area in 2019, European governments are unlikely to meaningfully lower corporate tax rates. By contrast, lower taxes have boosted US margins tremendously in 2018. Margins surprised to the upside during the 4Q US reporting season (+82bp yoy), partly due to lower tax rates. The realized tax rate of the median company is 19%, compared with a projection of 21% at the start of earnings season. And while effective tax rates were similar in the two regions previously, this will no longer be the case.

One final reason why both revenue and margin growth is doomed in Europe is a consequence of the continent’s regulatory (and often socialist) environment: as restructuring projects are often ambitious, they are blocked at the offset: cost-cutting programs are challenged in sectors with regulation, unionization and government influence; this is particularly the case with politicians under pressure from populist groups.

via ZeroHedge News https://ift.tt/2GSWPYI Tyler Durden