Canadian GDP just contracted for the second month in a row, leaving the headline Canada GDP up just 0.4% SAAR in 4Q, according to Statistics Canada (dramatically below the estimate of +1.0%). The headline quarterly change misses even lowest of economist estimates.

Under the hood it was just as ugly, with household consumption growth slowing further to 0.7% QoQ (weakest since 2015), investment and housing declining sharply, and helped only by an inventories accumulation (inventories added 1.53 percentage points to growth in 4Q).

Business gross fixed capital formation dropped 9.6% in 4Q, from -8.4% in previous quarter:

-

Non-residential investment falls 10.9%, largest decline since 2016

-

Residential structures fall 14.7%, biggest decline since 2009

Final domestic demand tumbled 1.5% in 4Q, from -0.5% in previous quarter

Worse still, first half of 2018 growth revised down to 2.0% from 2.3%.

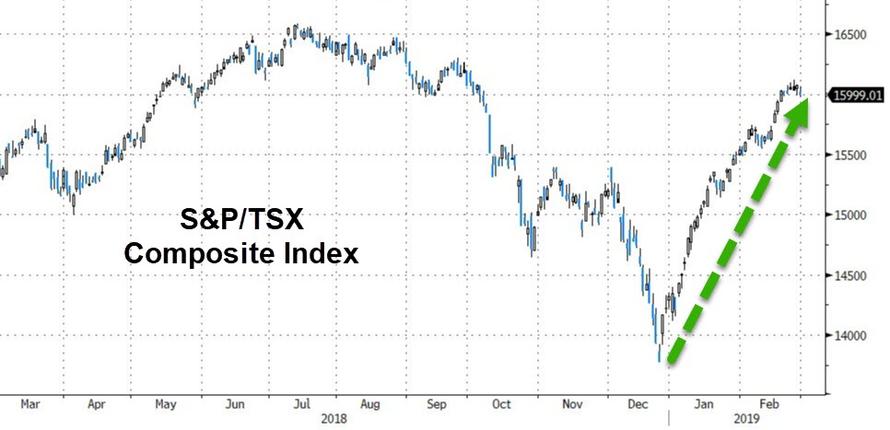

But apart from that – everything is awesome and you should be buying Canadian stocks!!

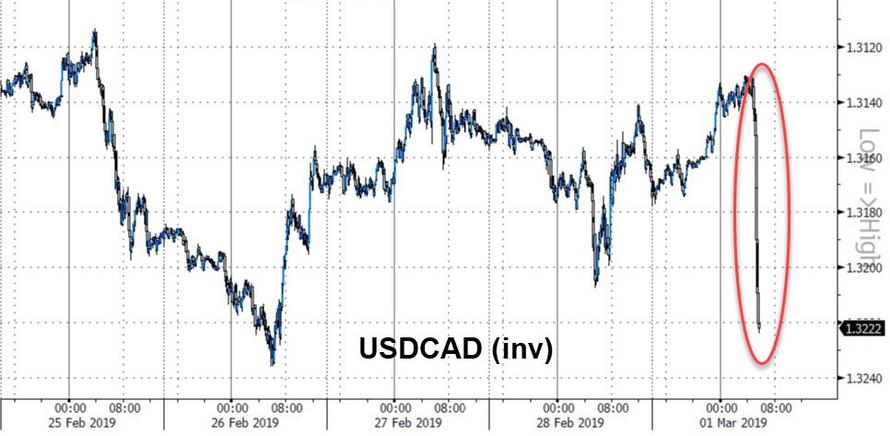

The result – as Poloz et al. are about to reverse all hawkishness even further – a tumble in the loonie…

via ZeroHedge News https://ift.tt/2GPoMRe Tyler Durden