Authored by Frank Shostak via The Mises Institute,

In a free, unhampered market, we could envisage that the economy would be subject to various shocks but it is difficult to envisage a phenomenon of recurrent boom-bust cycles.

Before the Industrial Revolution in approximately the late 18th century, there were no regularly recurring booms and depressions. There would be a sudden economic crisis whenever some king made war or confiscated the property of his subjects; but there was no sign of the peculiarly modern phenomena of general and fairly regular swings in business fortunes, of expansions and contractions.

The boom-bust cycle phenomenon is somehow linked to the modern world. But what is the link? The source of the recurring boom-bust cycles turns out to be the alleged “protector” of the economy — the central banks themselves.

A loose central bank monetary policy, which results in an expansion of money out of “thin air” sets in motion an exchange of nothing for something, which amounts to a diversion of real wealth from wealth-generating activities to non-wealth-generating activities.

In the process, this diversion weakens wealth generators, and this in turn weakens their ability to grow the overall pool of real wealth.

The expansion in activities that are based on loose monetary policy is what an economic “boom” (or false economic prosperity) is all about. Note that once the central bank’s pace of monetary expansion has strengthened the pace of the diversion of real wealth is also going to strengthen.

Once however, the central bank tightens its monetary stance, this slows down the diversion of real wealth from wealth producers to non-wealth producers. Activities that sprang up on the back of the previous loose monetary policy are now getting less support from the money supply; they fall into trouble — an economic bust or recession emerges.

Irrespective of how big and strong an economy is, a tighter monetary stance is going to undermine various non-productive or bubble activities that sprang up on the back of the previous loose monetary policy.

This means that recessions or economic busts have nothing to do with the so-called strength of an economy, improved productivity, or better inventory management by companies.

For instance, because of a loose monetary stance on the part of the Fed, various activities emerge to accommodate the demand for goods and services of the first receivers of newly injected money.

Now, even if these activities are well managed, and maintain very efficient inventory control, this fact cannot be of much help once the central bank reverses its loose monetary stance. Again, these activities are the product of the loose monetary stance of the central bank.

Once the stance is reversed, regardless of efficient inventory management, these activities will come under pressure and run the risk of being liquidated.

The central bank is the key factor behind recurrent boom-bust cycles

The central bank’s ongoing policies that are aimed at fixing the unintended consequences that arise from its earlier attempts at stabilizing the so-called economy are key factors behind the repetitive boom-bust cycles.

Because of the difference in the time lags from changes in money to changes in prices and real economic activity data, Fed policy makers are confronted with economic data that could be in conflict with the Fed’s targets. (Also, note that the time lags are variable).

The time lag from changes in money and changes in price inflation tends to be much longer than the time lag between changes in money and changes in real economic activity. For instance, as a result of the previous loose monetary policy, price inflation begins to strengthen. To counter this strengthening the Fed decides to tighten its stance. However due to the differences in the time lags, the real economy is likely to weaken rather quickly in response to the recent tighter monetary stance while price inflation is still gaining strength on account of the longer lag effects of past loose monetary policies. To counter the rising price inflation the Fed tightens further. Hence, what we have here is a situation whereby central bank officials responding to the effects of their own previous monetary policies.

Fed policy makers regard themselves as being the responsible entity authorized to bring the so-called economy onto the path of stable economic growth and stable price inflation. Consequently, any deviation from the growth path sets the Fed’s response in terms of either a tighter or a looser stance. These responses to the effects of previous policies on economic data give rise to the fluctuations in the growth rate of the money supply and in turn to the recurrent boom-bust cycles.

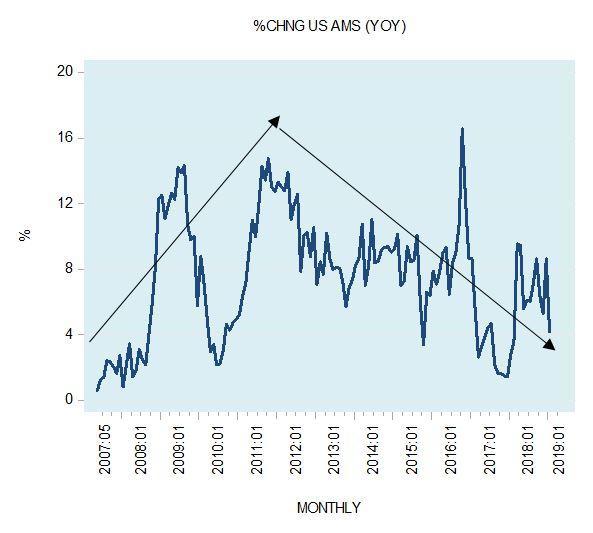

The uptrend in the yearly growth rate in the adjusted money supply (AMS) between May 2007 and October 2011 is still dominating the US economic scene. However, a declining trend in the yearly growth rate of AMS between October 2011 and January 2019 is starting to gain strength (see chart). Consequently, we suggest that in the months ahead the influence of the declining trend in the growth rate of AMS is going to assert its dominance on economic activity, all other things being equal.

What will determine the severity of the downturn is the state of the pool of real wealth. Prolonged reckless monetary and fiscal policies have likely severely undermined the real wealth generation process.

This in turn raises the likelihood that the pool of real wealth is hardly growing.

via ZeroHedge News https://ift.tt/2Hge9GM Tyler Durden