Signa Holding, Austria’s largest privately owned real estate company, has reached an agreement to purchase the iconic Chrysler Building in New York City in partnership with property firm RFR Holding for about $150 million, according to Reuters.

The price is at a steep discount compared to the $800 million the Abu Dhabi Investment Council paid for a 90% stake in the building right before the 2008 financial crisis. Shortly after the investment arm of the Government of Abu Dhabi bought the property, commercial real estate prices crashed.

Sources told Reuters that the deal includes both the office building and the pyramid-topped Trylons on the land between the tower and 666 Third Avenue.

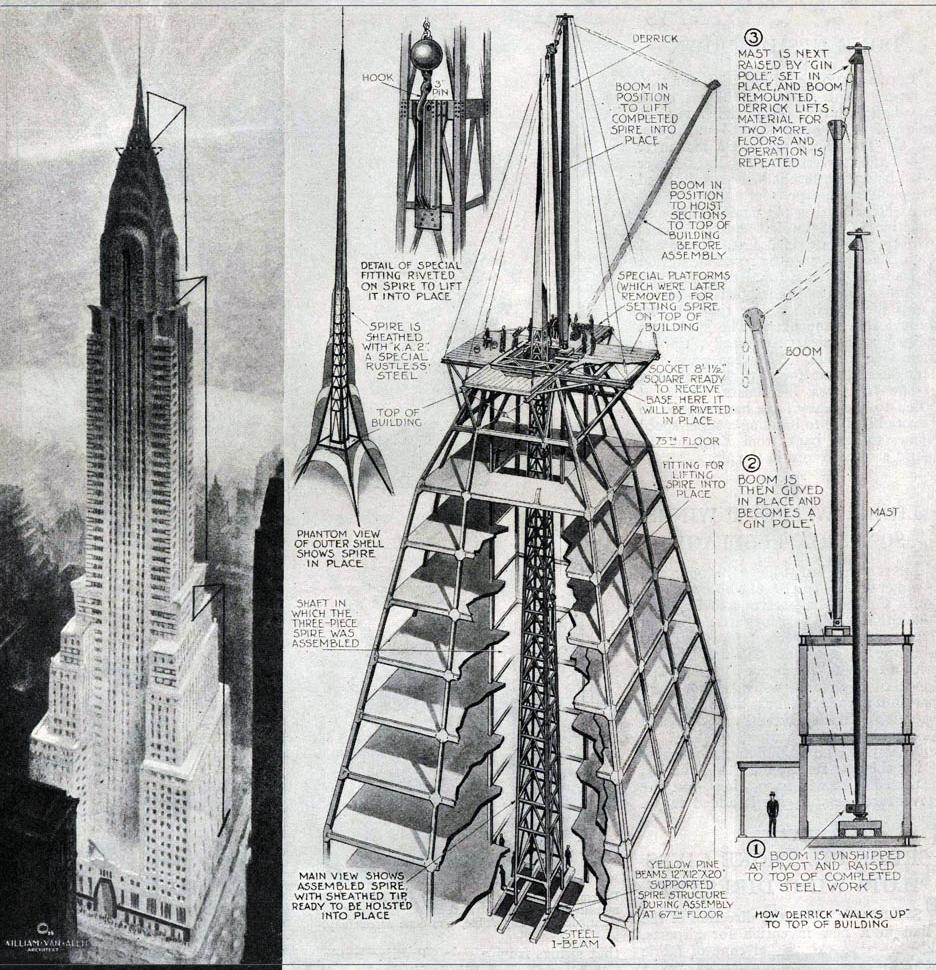

The Art Deco–style skyscraper, was completed in 1930 on the East Side of Midtown Manhattan in New York City. It is a recognizable symbol of Manhattan’s skyline, was for a short time in the early 1930s the tallest building in the world, only to be surpassed by the Empire State Building.

The most significant factor weighing on the price is out of control expenses tied to the building’s ground lease. The land under the tower is owned by the Cooper Union school, which raised the rent to $32.5 million last year from $7.75 million in 2017.

“The ground lease is a glaringly obvious negative,” Adelaide Polsinelli, a broker at New York City-based Compass, told Bloomberg. “The other negatives are that the space is not new and it is landmarked, therefore it’s twice as hard to get anything done.”

Tishman Speyer Properties and the Travelers Insurance Group bought the Chrysler Building in 1998 for about $230 million. In 2001, a 75% stake in the building was sold, for $300 million to TMW, the German arm of an Atlanta-based investment fund. Abu Dhabi bought the German fund’s share as well as part of Tishman’s in June 2008. Reuters said Signa and RFR were extremely close to a deal to purchase the tower.

Signa has an extensive portfolio of landmark buildings in prime locations. Its holdings include KaDeWe and the Upper West Tower in Berlin, Goldenes Quarter with the Park Hyatt Hotel in Vienna, Alte Akademie in Munich, and Alsterhaus and Alsterarkaden in Hamburg.

RFR has also made a name for itself in commercial real estate by owning and managing some of Manhattan’s most prestigious commercial properties, including the Seagram Building and Lever House, which are located on Park Avenue.

Signa and RFR had completed several deals together in the past, including in 2017, when Signa bought five landmark properties from RFR in Berlin, Hamburg, Frankfurt, and Munich for about 1.5 billion euros.

via ZeroHedge News https://ift.tt/2H9lxED Tyler Durden