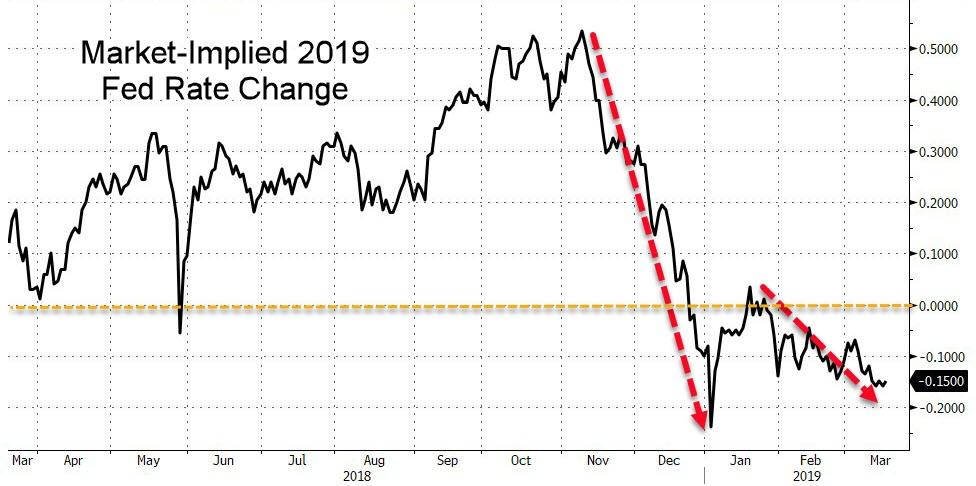

Short-term rate markets are priced for a 15bps rate-CUT in 2019 – which is the most dovishly priced since the crash at the start of 2019…

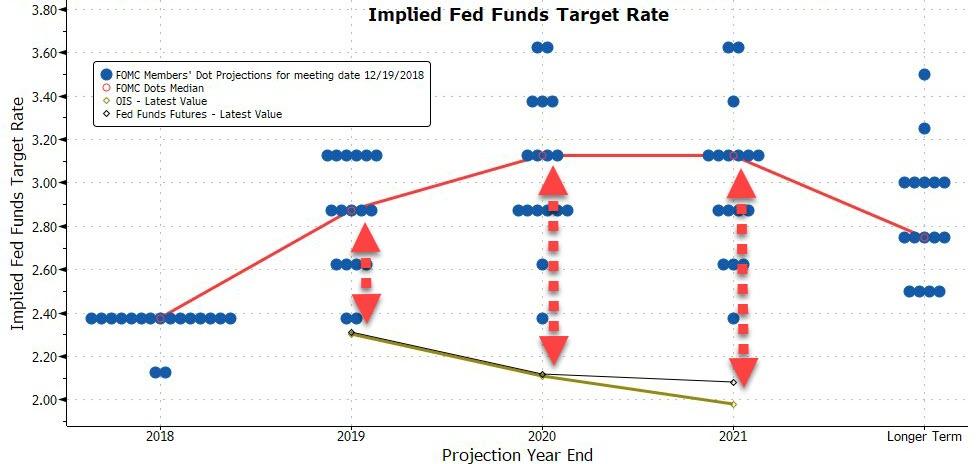

This is massively divergent from the views of The Fed‘s current hawkish dot-plot…

But, as former fund manager and FX trader Richard Breslow notes, it feels like the market is expecting an even more dovish outcome from the Fed this week than the forecasts already circulated.

Via Bloomberg,

Traders are using the word “expecting” as in “demanding” rather than “looking for.” It would appear that the Committee is likely to comply. And that would be a mistake.

They shouldn’t try to dress neutrality up in super-accommodative clothing to make asset prices bubbly. Especially when they are simultaneously hoping to retain the optionality they crave by keeping the dots above zero.

Policy makers have latched onto the word patience. It is time to pick another expression. They are no longer being patient, as in willing to pause. After the January meeting the hiking bias went away. Not only are they on hold, but they appear confused and timid. Using “patient” makes them feel comfortable even when they aren’t. And they are clearly unwilling to push back against market pricing and traders’ arguments. Even though they are meant to be thought leaders, not followers. Suddenly, discussing downside risks to inflation suits their mindset and allows them get on the firm academic ground of debating makeup strategies and letting the economy run hot. Which sounds good but is largely irrelevant.

And you can almost feel their faith in the policy toolkit to ward off a future recession slipping further away whenever an economic number misses estimate. Yet, when asked, they continue to argue that a recession is nowhere on the horizon. This makes the new economic projections the most valuable piece of information that will be offered. Much more so than usual. They may be the only true source of clarity. Even taking precedence over whatever will be in the much anticipated minutes.

Frankly, it just isn’t all that helpful to keep hearing that, “the economy is running just fine”, but “basic principles of risk management would suggest that the increase in downside risks warrant a modest downward revision to the modal path for policy.”

And warning of global headwinds has become more of a throwaway line than careful analysis. Especially as private economists keep telling us to sell dollars because green shoots are breaking out overseas. Of course, these are the same people who assured us before the weekend that the protests in France were losing their intensity, thereby bolstering consumer confidence. The ECB’s own staff forecasts are quickly becoming a distant memory thanks to the euro failing to fall below support.

Expect a fair amount of discussion of the balance sheet, reserve levels and dot plots. It will sound very carefully thought out and planned. But, I suspect, at the end of the day, we won’t know a great deal more than we do now. No matter how viscerally asset prices choose to react, or not, in the short-term.

In the meantime, keep a close eye on the relative behavior of the S&P 500 and the Russell 2000. They haven’t remained in lock-step. Only one of them is likely to be right.

Global bond yields really do need to hold very close to current levels. They should be a source of concern.

And the dollar is out of favor by everyone other than the traders who actually have positions.

via ZeroHedge News https://ift.tt/2Tft4TV Tyler Durden