Confusion continues to paralyze even the market’s best strategists.

One day after BMO’s rates team lead by Ian Lyngen and Jon Hil admitted that they “have been struggling with the question of how long risk assets can continue to perform so well”, the duo writes that “if asked to sum up our recent client meetings into a single word, it would be “uncertainty” – more than just our baseline market-call anxiety, but rather a growing sense that something paradigm shifting is on the horizon.”

What do they mean? As they state “at the risk of oversimplifying an extremely complex and nuanced debate”, the underlying question remains whether this is a 2016-style pause or has the Fed reached the end of hiking cycle and should prepare the market for rate cuts in the event of a deeper slowdown. As far as BMO is concerned, it continues to err on the side of the latter with 2.40% as the cycle peak for funds and the bank’s rates team is “actively stockpiling recession provisions, along with reading material for our economic bunker (The MMT Handbook, QE for Dummies, and Price-Level Targeting).”

To be sure, with uncertainty being the keyword, there are compelling arguments on both sides of the essential question for 2019; those less concerned that the proverbial sky is falling invariably point to the strong labor market, accelerating wage pressures, equity rebound, and Powell’s willingness to quickly pause at the first sign of trouble.

The next question is did Powell move too late? While a more dovish Fed earlier in the slowdown cycle is a very positive development and, frankly, a good argument that Jerome might still be able to orchestrate the ever-elusive ‘soft-landing’, BMO writes that even as its sympathies toward the central bankers’ lament persist, “the damage done to business confidence seems unlikely to fully recover – particularly as the Trump-Xi meeting gets further delayed as a trade deal proves astonishingly difficult to achieve.”

Who was it that said “Trade wars are good, and easy to win”? Alas, we digress.

As BMO notes next, as of right now there has been only scant evidence that the trade war has materially undermined the domestic labor market “however, this risk occupies the top spot in our checklist of worries.”

By way of what can perhaps be characterized as a coalmine canary, German automotive suppliers are now announcing layoffs (Leoni AG overnight) as the engine of European growth continues to sputter. Combine this with disappointing Japanese exports data and it becomes easier to identify who is currently losing the first trade battles, although a true winner seems increasingly unlikely to emerge.

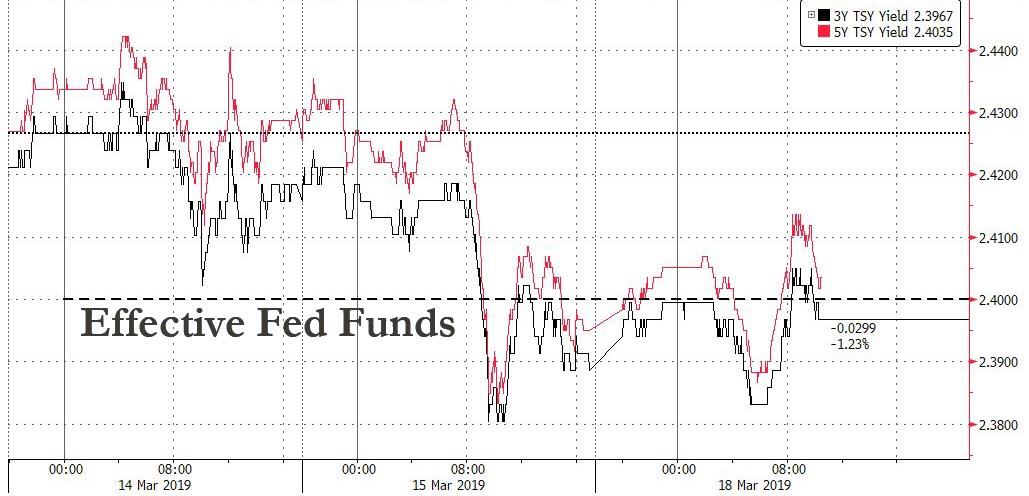

Confusion is also pervasive within the world’s deepest bond market as Treasuries have trended back to the bottom of the yield range and in doing so created a meaningful litmus test for investors’ commitment to the rate-cut narrative. As noted on Friday, the curve remains inverted with 3s and 5s repeatedly dipping below the effective Fed funds (2.40%)…

… “implying that either rate cuts are assumed within the next few years or term premium just extended further into negative territory.”

Regardless of one’s read on this issue, the implications for rates (lower) and the curve (flatter until the Fed signals a cut is on the table) are relatively straightforward. 240 is shocking… a little home improvement humor.

Meanwhile, the recent price action has extended momentum decidedly in favor of lower yields, so much so that the ‘overbought’ warning lights are flashing, the rates strategists warn, further adding that “while this concern is technical in nature, it nonetheless presents a near-term hurdle to Treasuries rallying further without a more concrete impetus.” As a result, those buying 5s at 2.386% are presumably betting such a driver will emerge from Wednesday’s FOMC meeting.

Which brings us to what the Fed will say on Wednesday, because while it’s tempting to employ the time-tested adage ‘buy the rumor, sell the fact’ as it pertains to the Fed, given that the Committee’s incentive is to layout the case for ending the balance sheet run-off and holding rates steady, erring on the side of unmistakable dovishness strikes us as a tangible risk.

The other obvious question from Wednesday is what guidance Powell provides on the end of balance sheet runoff. At this point, BMO writes that it’s very consensus that the process terminates at some point in 2019, but details such as timing and mechanics remain vague.

This means that in order for the recent economic stumbles to give way to a continued expansion BMO thinks that the communication on both rates and balance sheet will need to be far more about the Fed’s willingness to be accommodative when needed.

That, in a nuthsell and as noted above, is this moment’s biggest question – “whether or not the Fed shifted to an on hold stance of policy quickly enough to avert a more material slowdown.” BMO’s answer:

Given the way that GDP appears to be shaping up for Q1, it’s not entirely clear as of yet that they have been successful, though additional data going into Q2 will be required to confirm or deny this thesis. While it’s unclear if the Fed is able/willing to deliver a more dovish statement/dot plot than the market is expecting, the obvious risk is that they out dove the doves, as it were.

Furthermore, too accommodative of communication runs the risk of undesirable implications as investors would begin to wonder ‘what does the Fed know?’ about a potential impending global synchronized downturn.

Which bring us to the two key conclusion: as Lyngen and Hill write, they have been asked several times recently what the next big trade is in the Treasury market, “and still see 10-year yields ending the year somewhere in the 2.50% to 2.75% range. We’ll be the first to admit that cyclical resteepening of the curve is really not that exciting, so will also offer that there remains a significant subset of the market looking for another buying opportunity in the front-end, though a push back to that 2.60% to 2.70% range in 2s would be predicated on some more hawkish rhetoric. Is that this week’s story? It seems unlikely that Powell will try to jawbone the market pricing toward an upward sloping fed funds futures curve, at least not just yet.“

Finally, as we highlighted last week, BMO repeats that it “has been struggling with the question of how long risk assets can continue to perform so well” and observes that the rally to start the year is a function of the shift in Fed policy, i.e. not data which continues to come in below expectations (the economic surprise index remains near 12 month lows).

Moreover, we remain leery of the corporate sector as a result of the shape of the curve. Although the flattening really occurred last year, the implications of the move come with a 12 to 18 month lag, so this will be the year in which profit compression will become far more thematic.

Considering that a sharp slide in profits has already been observedm it’s the extent to which that trend is going to extend that leaves BMO increasingly cautious of risk assets.

via ZeroHedge News https://ift.tt/2HKZ6Vs Tyler Durden